Intro

Unlock the power of options pricing with Excel. Learn how to implement the Black Scholes model in 5 easy steps, utilizing Excel formulas and functions. Discover how to calculate call and put options prices, Greeks, and volatility. Improve your financial modeling skills with this practical guide, featuring examples and screenshots.

Introduction to Black Scholes in Excel

The Black Scholes model is a widely used financial model for pricing options, which was first introduced by Fischer Black and Myron Scholes in 1973. The model provides a theoretical estimate of the price of European-style options and shows the relationship between the option price and various factors such as the underlying stock price, strike price, time to expiration, risk-free interest rate, and volatility.

As a financial analyst or trader, being able to implement the Black Scholes model in Excel can be a valuable skill. In this article, we will explore five ways to implement the Black Scholes model in Excel.

What is the Black Scholes Model?

The Black Scholes model is a mathematical model that estimates the theoretical price of an option based on six inputs:

- Underlying stock price (S)

- Strike price (K)

- Time to expiration (T)

- Risk-free interest rate (r)

- Volatility (σ)

- Type of option (call or put)

The model assumes that the underlying stock price follows a geometric Brownian motion, and the option price is a function of the underlying stock price and the other inputs.

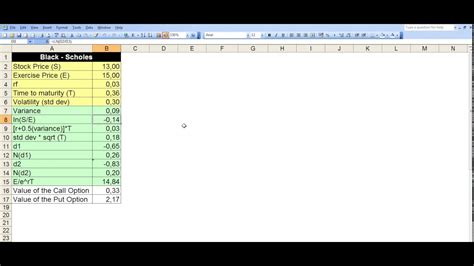

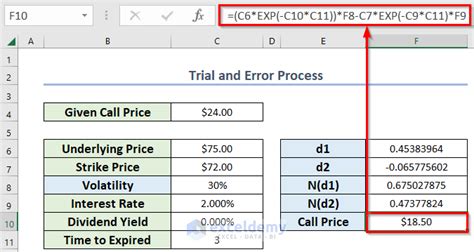

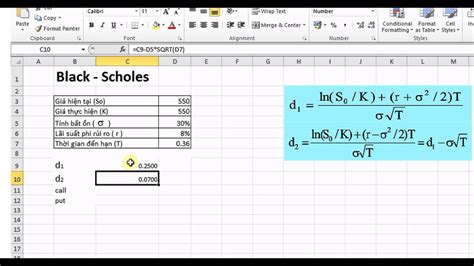

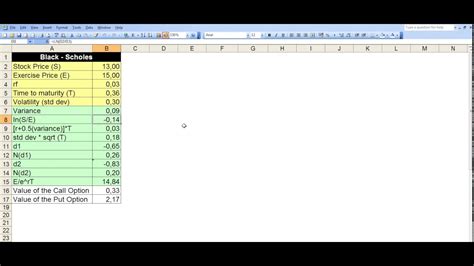

Method 1: Using the Black Scholes Formula

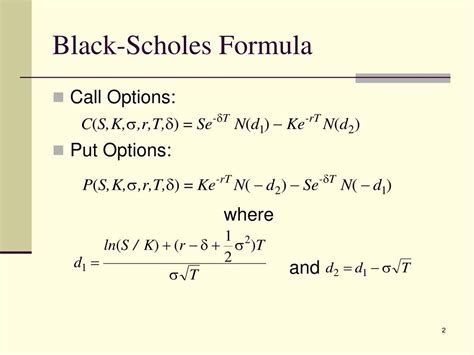

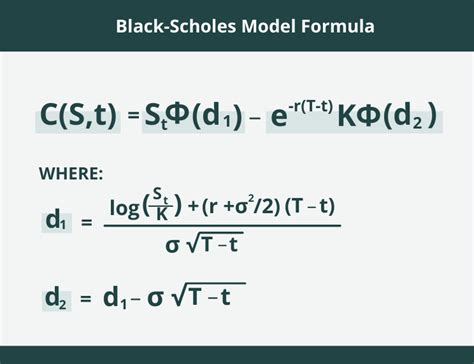

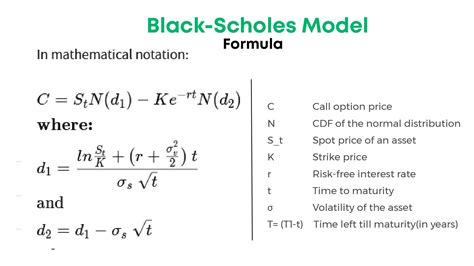

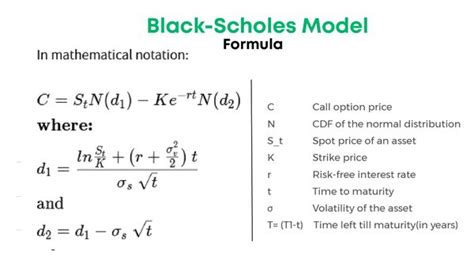

One way to implement the Black Scholes model in Excel is to use the formula directly. The formula for a call option is:

C = S * N(d1) - K * e^(-r*T) * N(d2)

Where:

- C = call option price

- S = underlying stock price

- K = strike price

- r = risk-free interest rate

- T = time to expiration

- σ = volatility

- N(d1) and N(d2) = cumulative distribution functions of the standard normal distribution

To implement this formula in Excel, you can use the following steps:

- Create a new spreadsheet with the following columns: S, K, r, T, σ, and C

- Enter the values for S, K, r, T, and σ in the respective columns

- Use the formula above to calculate the call option price, C

- Use the NORMSDIST function in Excel to calculate N(d1) and N(d2)

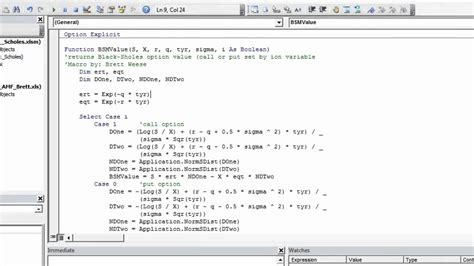

Method 2: Using VBA Macros

Another way to implement the Black Scholes model in Excel is to use VBA macros. VBA macros are a powerful tool for automating tasks in Excel, and can be used to create a custom Black Scholes calculator.

To create a VBA macro for the Black Scholes model, follow these steps:

- Open the Visual Basic Editor in Excel by pressing Alt+F11 or by navigating to Developer > Visual Basic

- Create a new module by clicking Insert > Module

- Paste the following code into the module:

Function BlackScholesCall(S As Double, K As Double, r As Double, T As Double, sigma As Double) As Double

Dim d1 As Double

Dim d2 As Double

d1 = (Log(S / K) + (r + 0.5 * sigma ^ 2) * T) / (sigma * Sqrt(T))

d2 = d1 - sigma * Sqrt(T)

BlackScholesCall = S * Application.WorksheetFunction.NormSDist(d1) - K * Exp(-r * T) * Application.WorksheetFunction.NormSDist(d2)

End Function

- Save the module and close the Visual Basic Editor

- Use the

BlackScholesCallfunction in your spreadsheet to calculate the call option price

Method 3: Using Excel Add-ins

There are several Excel add-ins available that can be used to implement the Black Scholes model. Some popular options include:

- Analysis ToolPak: This is a built-in add-in in Excel that provides a range of financial functions, including the Black Scholes model.

- FinCAD: This is a third-party add-in that provides a range of financial functions, including the Black Scholes model.

- Bloomberg Excel Add-in: This is a third-party add-in that provides a range of financial functions, including the Black Scholes model.

To use an Excel add-in to implement the Black Scholes model, follow these steps:

- Install the add-in and activate it in Excel

- Use the add-in's functions to calculate the call option price

- Refer to the add-in's documentation for more information on how to use the functions

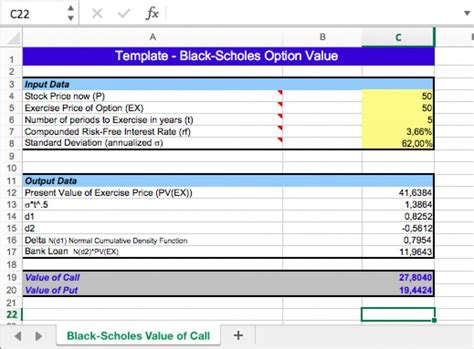

Method 4: Using Online Templates

There are several online templates available that can be used to implement the Black Scholes model in Excel. Some popular options include:

- Microsoft Office Templates: This website provides a range of free templates for Excel, including a Black Scholes template.

- Vertex42: This website provides a range of free templates for Excel, including a Black Scholes template.

- Template.net: This website provides a range of free templates for Excel, including a Black Scholes template.

To use an online template to implement the Black Scholes model, follow these steps:

- Download the template from the website

- Open the template in Excel

- Enter the values for S, K, r, T, and σ in the respective columns

- Use the template's functions to calculate the call option price

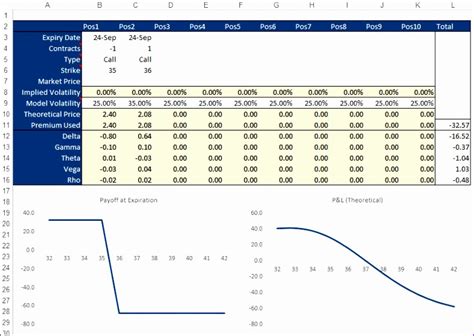

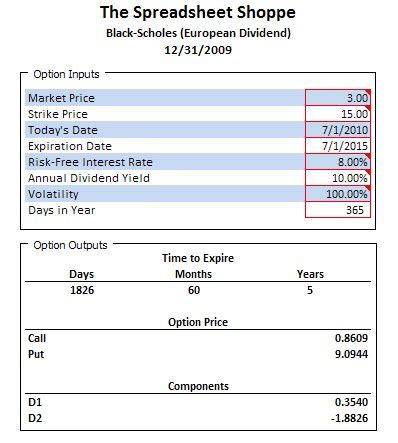

Method 5: Using a Custom Spreadsheet

The final method for implementing the Black Scholes model in Excel is to create a custom spreadsheet from scratch. This method requires a good understanding of the Black Scholes model and how to implement it in Excel.

To create a custom spreadsheet for the Black Scholes model, follow these steps:

- Create a new spreadsheet with the following columns: S, K, r, T, σ, and C

- Enter the values for S, K, r, T, and σ in the respective columns

- Use the formula above to calculate the call option price, C

- Use the NORMSDIST function in Excel to calculate N(d1) and N(d2)

- Format the spreadsheet to make it easy to use and understand

Conclusion

In this article, we have explored five ways to implement the Black Scholes model in Excel. Each method has its advantages and disadvantages, and the choice of method will depend on your specific needs and requirements.

Whether you use the Black Scholes formula directly, VBA macros, Excel add-ins, online templates, or a custom spreadsheet, implementing the Black Scholes model in Excel can be a valuable skill for any financial analyst or trader.

Black Scholes Model Image Gallery