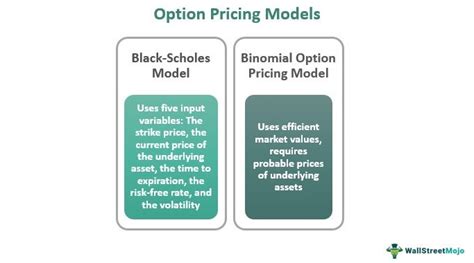

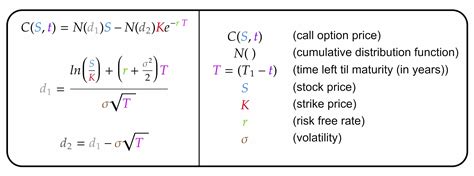

The Black-Scholes model is a widely used financial model that estimates the value of a call option or a put option. It is a complex mathematical formula that takes into account several variables, including the current stock price, strike price, time to expiration, risk-free interest rate, and volatility. While the formula can be calculated manually, it is often easier to use a calculator or a spreadsheet program like Excel to perform the calculations. In this article, we will discuss five ways to create a Black-Scholes calculator in Excel.

What is the Black-Scholes Model?

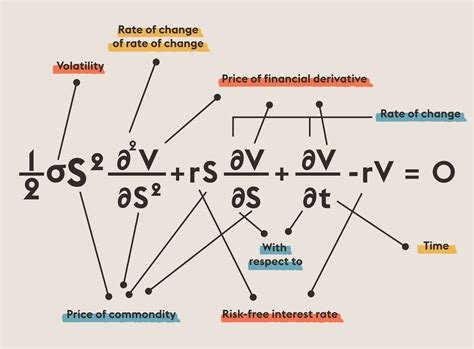

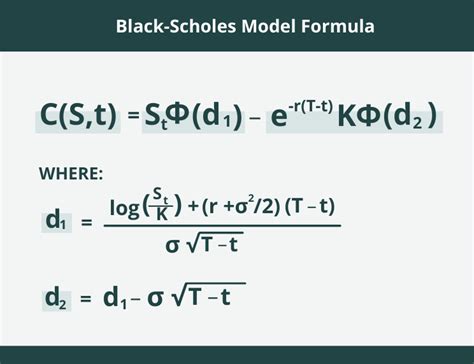

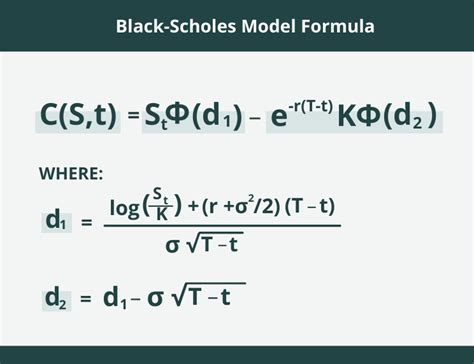

The Black-Scholes model is a financial model that was developed in the early 1970s by Fischer Black and Myron Scholes. It is a partial differential equation that estimates the value of a European call option or a European put option. The model assumes that the stock price follows a geometric Brownian motion and that the risk-free interest rate is constant.

Why Use a Black-Scholes Calculator in Excel?

Creating a Black-Scholes calculator in Excel can be useful for several reasons. Firstly, it allows you to easily calculate the value of a call option or a put option using different inputs. Secondly, it enables you to perform sensitivity analysis and see how changes in the inputs affect the option value. Finally, it can be used to compare the theoretical value of an option with its market price.

Method 1: Using a Pre-Built Formula

One way to create a Black-Scholes calculator in Excel is to use a pre-built formula. Excel has a built-in function called BLACKSCHOLES that can be used to calculate the value of a call option or a put option. To use this function, you need to enter the following inputs:

S: the current stock priceK: the strike priceT: the time to expiration (in years)R: the risk-free interest rate (in decimal form)V: the volatility (in decimal form)Type: a text string indicating whether the option is a call option ("C") or a put option ("P")

Here is an example of how to use the BLACKSCHOLES function in Excel:

Method 2: Using VBA

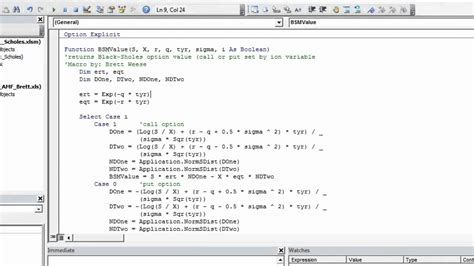

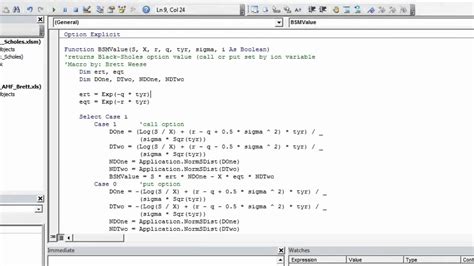

Another way to create a Black-Scholes calculator in Excel is to use VBA (Visual Basic for Applications) programming. You can create a custom function that takes the inputs and calculates the option value using the Black-Scholes formula.

To create a VBA function, you need to open the Visual Basic Editor in Excel by pressing Alt+F11 or by navigating to Developer > Visual Basic in the ribbon. Then, you can create a new module and paste the following code:

Function BlackScholes(S As Double, K As Double, T As Double, R As Double, V As Double, Type As String) As Double

' Calculate the option value using the Black-Scholes formula

Dim d1 As Double

Dim d2 As Double

Dim optionValue As Double

d1 = (Log(S / K) + (R + V ^ 2 / 2) * T) / (V * Sqrt(T))

d2 = d1 - V * Sqrt(T)

If Type = "C" Then

optionValue = S * NormSDist(d1) - K * Exp(-R * T) * NormSDist(d2)

ElseIf Type = "P" Then

optionValue = K * Exp(-R * T) * NormSDist(-d2) - S * NormSDist(-d1)

Else

optionValue = 0

End If

BlackScholes = optionValue

End Function

Method 3: Using a Spreadsheet Template

A third way to create a Black-Scholes calculator in Excel is to use a spreadsheet template. You can create a template with the inputs and the formulas to calculate the option value.

Here is an example of a spreadsheet template:

| Input | Value |

|---|---|

| S | 100 |

| K | 100 |

| T | 1 |

| R | 0.05 |

| V | 0.2 |

| Type | C |

| Formula | Value |

|---|---|

| d1 | =(LN(S/K)+(R+V^2/2)T)/(VSQRT(T)) |

| d2 | =d1-V*SQRT(T) |

| optionValue | =SNORMSDIST(d1)-KEXP(-R*T)*NORMSDIST(d2) |

Method 4: Using a Add-In

A fourth way to create a Black-Scholes calculator in Excel is to use an add-in. There are several add-ins available that provide Black-Scholes calculations, such as the XLSTAT add-in or the FINCAD add-in.

To use an add-in, you need to install it in Excel and then use the provided functions to calculate the option value.

Method 5: Using a Web Service

A fifth way to create a Black-Scholes calculator in Excel is to use a web service. There are several web services available that provide Black-Scholes calculations, such as the Yahoo Finance web service or the Google Finance web service.

To use a web service, you need to use the WEBSERVICE function in Excel to call the web service and retrieve the option value.

Gallery of Black-Scholes Calculators

Black-Scholes Calculator Gallery

Conclusion

In this article, we have discussed five ways to create a Black-Scholes calculator in Excel. We have shown how to use a pre-built formula, VBA programming, a spreadsheet template, an add-in, and a web service to calculate the value of a call option or a put option. We hope that this article has been helpful in providing you with a comprehensive understanding of the Black-Scholes model and how to use it in Excel.

What's Next?

If you have any questions or comments about this article, please feel free to leave a comment below. We would be happy to hear from you.

If you would like to learn more about the Black-Scholes model and how to use it in Excel, we recommend checking out some of the following resources:

- "The Black-Scholes Model" by Fischer Black and Myron Scholes

- "Options, Futures, and Other Derivatives" by John Hull

- "Excel for Finance" by Michael Alexander

We hope that this article has been helpful in providing you with a comprehensive understanding of the Black-Scholes model and how to use it in Excel. Happy calculating!