Intro

Master the art of Break Even Point Calculation in Excel with ease. Learn how to calculate BEP using simple formulas and charts, and discover the importance of contribution margin, fixed costs, and variable costs in determining profitability. Boost your business insights with this straightforward guide to break even analysis in Excel.

Breaking even is a crucial milestone for any business, as it marks the point where the company's revenues equal its costs, and it begins to generate profits. Calculating the break-even point (BEP) is essential to determine the viability of a business idea, set pricing strategies, and create sales forecasts. In this article, we will explore how to calculate the break-even point in Excel, making it easy to understand and apply in your business.

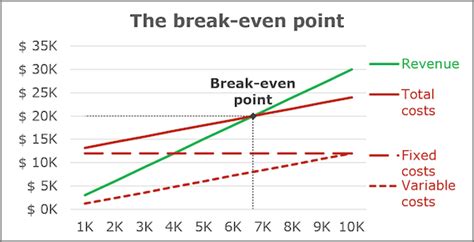

The break-even point is the point at which the total revenue equals the total fixed and variable costs. It is calculated by dividing the fixed costs by the contribution margin, which is the difference between the selling price and the variable cost per unit. The formula for the break-even point is:

BEP = Fixed Costs / (Selling Price - Variable Cost per Unit)

To illustrate this concept, let's consider a simple example. Suppose we have a company that sells widgets, and we want to calculate the break-even point. The fixed costs are $10,000 per month, the selling price is $100 per widget, and the variable cost per unit is $50.

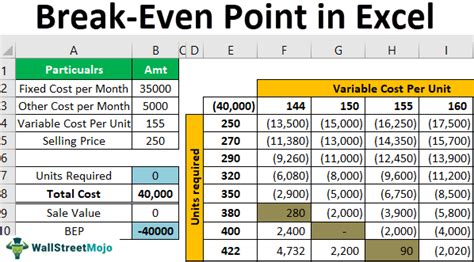

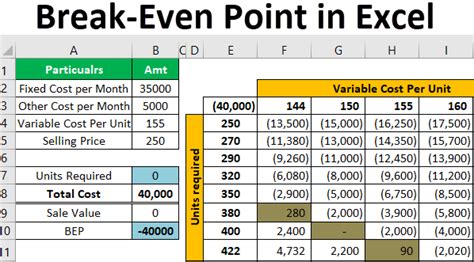

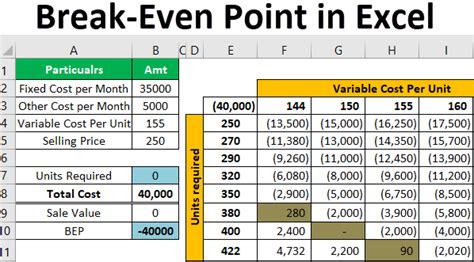

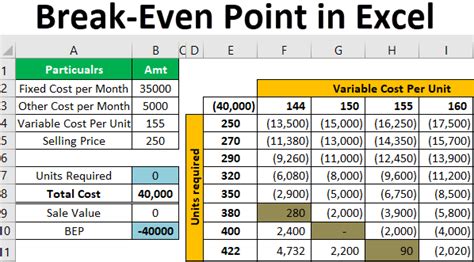

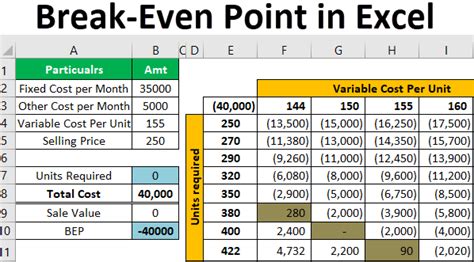

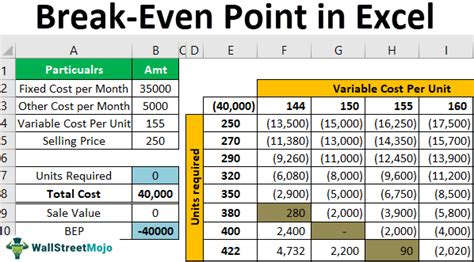

Break-Even Point Calculation in Excel

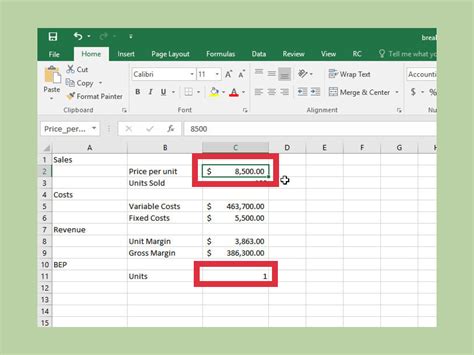

To calculate the break-even point in Excel, we can use a simple formula. Here's how:

- Open a new Excel spreadsheet and create a table with the following columns:

- Fixed Costs

- Selling Price

- Variable Cost per Unit

- Contribution Margin

- Break-Even Point

- Enter the values for the fixed costs, selling price, and variable cost per unit.

- Calculate the contribution margin by subtracting the variable cost per unit from the selling price.

- Calculate the break-even point by dividing the fixed costs by the contribution margin.

Here's the Excel formula:

=B2/(C2-D2)

Where:

- B2 is the fixed costs

- C2 is the selling price

- D2 is the variable cost per unit

Example Calculation

| Fixed Costs | Selling Price | Variable Cost per Unit | Contribution Margin | Break-Even Point |

|---|---|---|---|---|

| $10,000 | $100 | $50 | $50 | 200 |

In this example, the break-even point is 200 units, which means that the company needs to sell at least 200 widgets per month to break even.

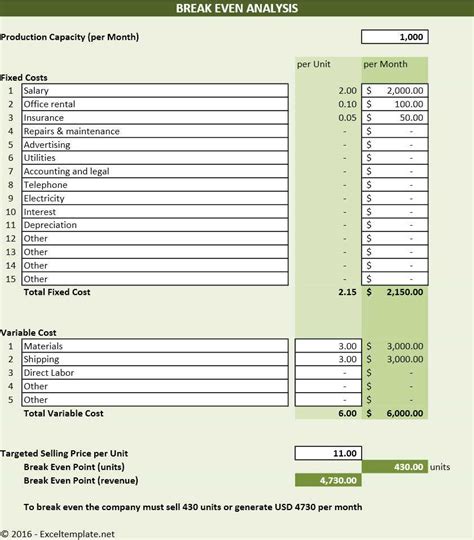

Using Excel Formulas for Break-Even Analysis

Excel provides several formulas that can be used for break-even analysis. Here are a few examples:

- Fixed Costs Formula

=SUM(Fixed Costs)

This formula calculates the total fixed costs.

- Contribution Margin Formula

=Selling Price - Variable Cost per Unit

This formula calculates the contribution margin.

- Break-Even Point Formula

=Fixed Costs / Contribution Margin

This formula calculates the break-even point.

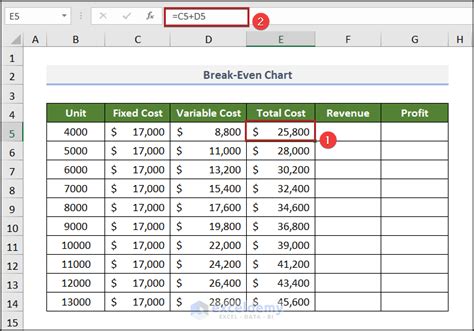

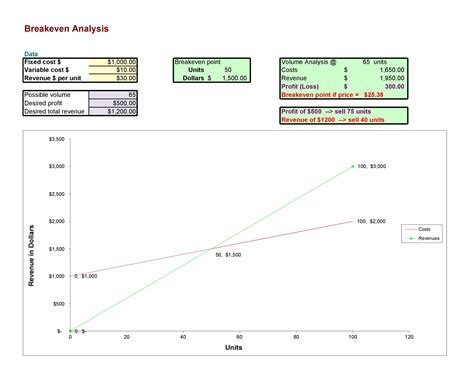

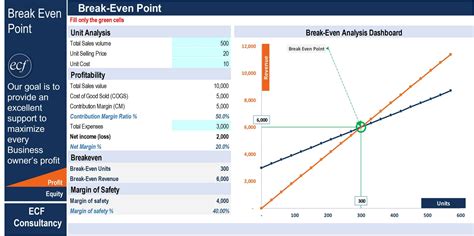

Break-Even Chart in Excel

A break-even chart is a graphical representation of the break-even point. It shows the relationship between the total revenue and the total costs. To create a break-even chart in Excel, follow these steps:

- Select the data range that includes the fixed costs, selling price, and variable cost per unit.

- Go to the "Insert" tab and click on "Chart".

- Select the "Line" chart type.

- Customize the chart as desired.

Interpreting the Break-Even Point

The break-even point has several implications for business decision-making. Here are a few:

- Pricing Strategy: The break-even point can be used to determine the minimum price at which a product should be sold to break even.

- Sales Forecasting: The break-even point can be used to estimate the sales required to break even.

- Cost Reduction: The break-even point can be used to identify areas where costs can be reduced to improve profitability.

Conclusion

Calculating the break-even point in Excel is a straightforward process that can be used to determine the viability of a business idea, set pricing strategies, and create sales forecasts. By using Excel formulas and charts, businesses can easily calculate and interpret the break-even point, making informed decisions to improve profitability.

Gallery of Break-Even Point Calculation in Excel

Break-Even Point Calculation in Excel Image Gallery

FAQ

-

What is the break-even point? The break-even point is the point at which the total revenue equals the total fixed and variable costs.

-

How do I calculate the break-even point in Excel? To calculate the break-even point in Excel, use the formula: BEP = Fixed Costs / (Selling Price - Variable Cost per Unit).

-

What is the contribution margin? The contribution margin is the difference between the selling price and the variable cost per unit.

-

How do I create a break-even chart in Excel? To create a break-even chart in Excel, select the data range, go to the "Insert" tab, click on "Chart", and select the "Line" chart type.

-

What is the break-even point used for? The break-even point is used to determine the viability of a business idea, set pricing strategies, and create sales forecasts.