Learn Bri calculation with our comprehensive guide, covering benefit-cost ratio analysis, investment appraisal, and financial metrics for informed decision-making.

The Bri Calculation Guide is an essential resource for businesses and individuals looking to understand the concept of Bri, also known as Benefit Ratio Index. The Bri is a statistical measure used to evaluate the effectiveness of a project or investment by comparing the benefits to the costs. In this article, we will delve into the world of Bri calculation, exploring its importance, benefits, and steps to calculate it.

The importance of Bri calculation cannot be overstated. It provides a clear and concise way to evaluate the viability of a project, helping decision-makers to make informed choices. By calculating the Bri, businesses can determine whether a project is likely to generate sufficient benefits to outweigh the costs, thereby minimizing the risk of investment. Furthermore, the Bri calculation guide can be applied to various fields, including finance, engineering, and economics, making it a versatile tool for professionals.

The benefits of using the Bri calculation guide are numerous. It enables businesses to prioritize projects based on their potential return on investment, allocate resources more efficiently, and identify areas for improvement. Additionally, the Bri calculation guide helps to reduce the risk of project failure by providing a clear understanding of the potential benefits and costs. With the Bri calculation guide, businesses can make data-driven decisions, rather than relying on intuition or guesswork.

Bri Calculation Basics

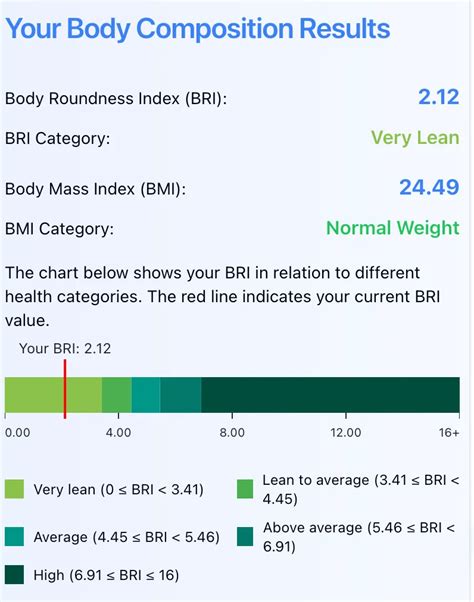

To calculate the Bri, it is essential to understand the basic concepts involved. The Bri is calculated by dividing the benefits of a project by the costs. The benefits can include revenue, cost savings, or other positive outcomes, while the costs include expenses, investments, or other negative outcomes. The Bri calculation guide provides a step-by-step approach to calculating the Bri, making it easy to follow and apply.

Benefits of Bri Calculation

The benefits of Bri calculation are numerous and can be summarized as follows: * Improved decision-making: The Bri calculation guide provides a clear and concise way to evaluate the viability of a project, enabling decision-makers to make informed choices. * Reduced risk: By calculating the Bri, businesses can minimize the risk of investment and identify areas for improvement. * Increased efficiency: The Bri calculation guide helps businesses to prioritize projects based on their potential return on investment, allocate resources more efficiently, and identify areas for improvement. * Data-driven decisions: The Bri calculation guide enables businesses to make data-driven decisions, rather than relying on intuition or guesswork.Bri Calculation Steps

To calculate the Bri, follow these steps:

- Identify the benefits: Determine the benefits of the project, including revenue, cost savings, or other positive outcomes.

- Identify the costs: Determine the costs of the project, including expenses, investments, or other negative outcomes.

- Calculate the Bri: Divide the benefits by the costs to calculate the Bri.

- Interpret the results: Interpret the results of the Bri calculation, taking into account the industry benchmarks and standards.

Bri Calculation Example

For example, let's say a business is considering investing in a new project that is expected to generate $100,000 in revenue and cost $50,000 to implement. To calculate the Bri, we would divide the benefits ($100,000) by the costs ($50,000), resulting in a Bri of 2. This means that for every dollar invested, the business can expect to generate two dollars in revenue.Bri Calculation Guide for Businesses

The Bri calculation guide is an essential resource for businesses looking to evaluate the viability of a project or investment. By following the steps outlined in the guide, businesses can make informed decisions, minimize the risk of investment, and maximize their return on investment. The Bri calculation guide can be applied to various fields, including finance, engineering, and economics, making it a versatile tool for professionals.

Bri Calculation Software

There are various software programs available that can help businesses to calculate the Bri, including spreadsheet software such as Microsoft Excel and Google Sheets. These programs provide a range of tools and features that can help businesses to calculate the Bri, including formulas, charts, and graphs.Bri Calculation Best Practices

To get the most out of the Bri calculation guide, it is essential to follow best practices, including:

- Using accurate and reliable data: The accuracy of the Bri calculation depends on the quality of the data used.

- Considering multiple scenarios: Businesses should consider multiple scenarios, including best-case, worst-case, and most-likely scenarios.

- Using industry benchmarks: Businesses should use industry benchmarks and standards to interpret the results of the Bri calculation.

- Reviewing and updating the calculation: Businesses should regularly review and update the Bri calculation to ensure that it remains accurate and relevant.

Bri Calculation Limitations

While the Bri calculation guide is a powerful tool for evaluating the viability of a project or investment, it has some limitations. These limitations include: * Simplistic approach: The Bri calculation guide uses a simplistic approach that may not capture the complexity of the project or investment. * Lack of consideration for external factors: The Bri calculation guide may not consider external factors, such as market trends and economic conditions. * Limited scope: The Bri calculation guide may have a limited scope, focusing only on the financial aspects of the project or investment.Bri Calculation Guide for Individuals

The Bri calculation guide is not only useful for businesses but also for individuals looking to evaluate the viability of a personal project or investment. By following the steps outlined in the guide, individuals can make informed decisions, minimize the risk of investment, and maximize their return on investment.

Bri Calculation for Personal Finance

For example, let's say an individual is considering investing in a new car that is expected to cost $20,000 and generate $5,000 in annual savings. To calculate the Bri, we would divide the benefits ($5,000) by the costs ($20,000), resulting in a Bri of 0.25. This means that for every dollar invested, the individual can expect to generate 25 cents in annual savings.Bri Calculation Image Gallery

In conclusion, the Bri calculation guide is a powerful tool for evaluating the viability of a project or investment. By following the steps outlined in the guide, businesses and individuals can make informed decisions, minimize the risk of investment, and maximize their return on investment. We encourage readers to share their experiences with Bri calculation in the comments section below and to explore the resources provided in this article to learn more about this essential tool.