Intro

Taking control of your finances can be a daunting task, but with the right tools and mindset, achieving financial freedom is within reach. One effective way to manage your money is by using a budget by paycheck printable. This simple yet powerful tool helps you track your income and expenses, making it easier to make informed financial decisions.

Living paycheck to paycheck can be stressful and unpredictable. You may feel like you're just scraping by, without any clear direction or control over your financial situation. However, by using a budget by paycheck printable, you can break free from this cycle and start building a more secure financial future.

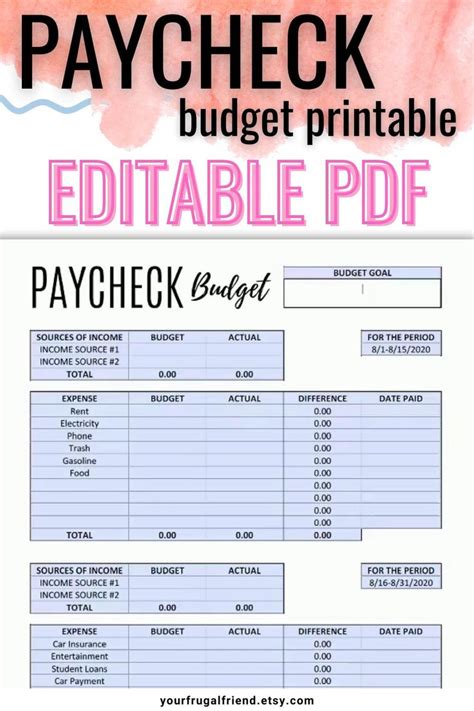

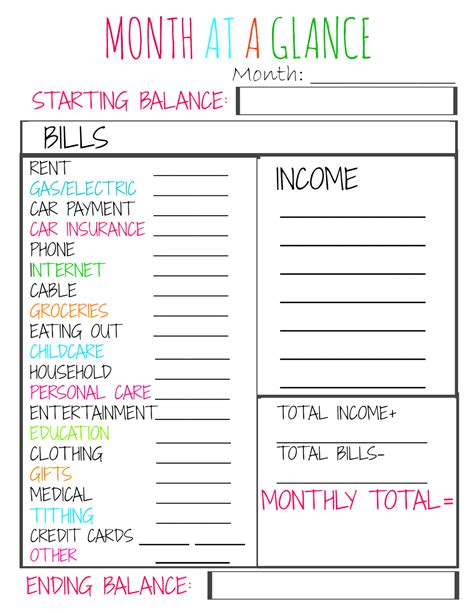

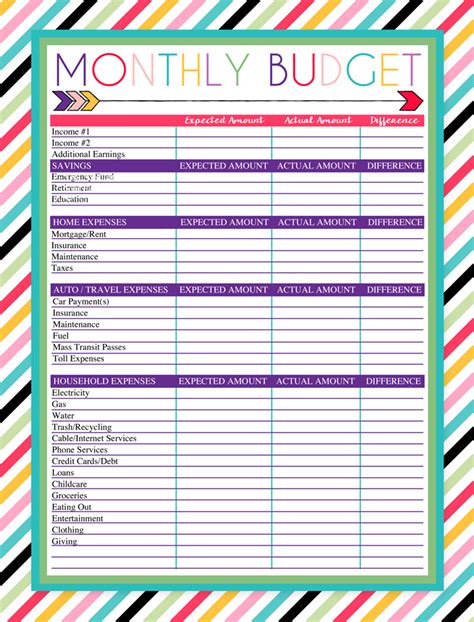

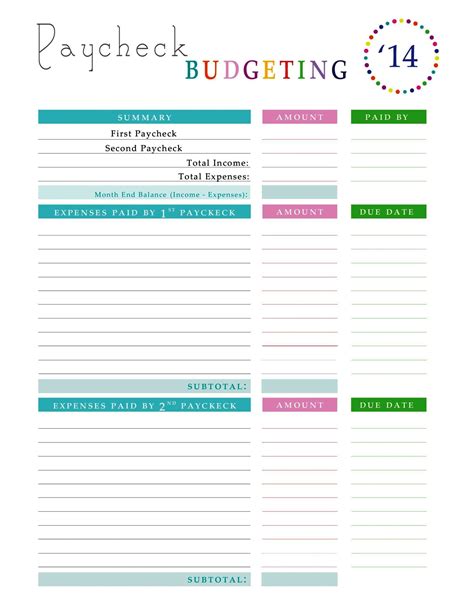

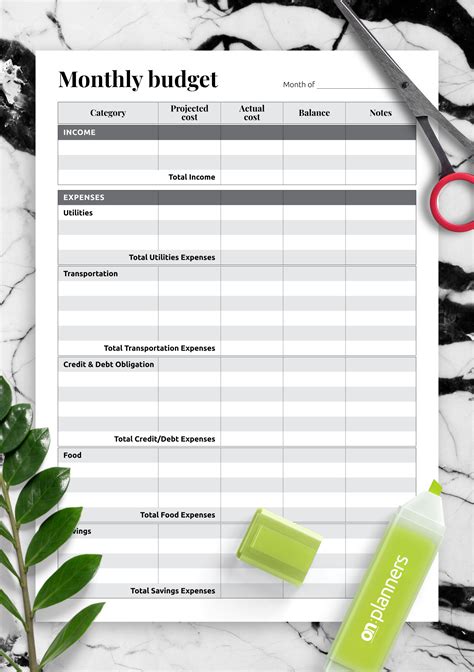

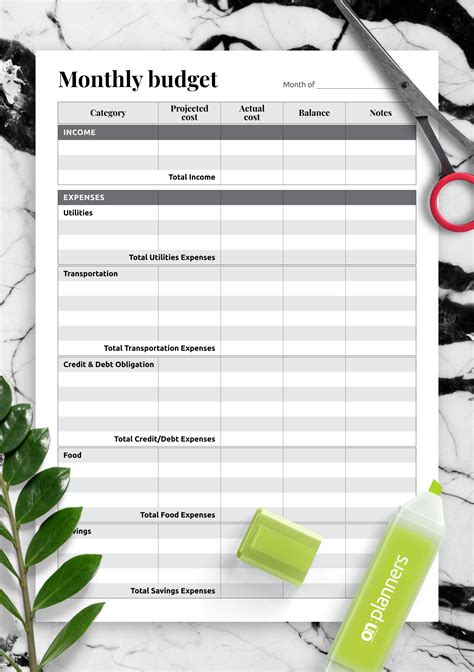

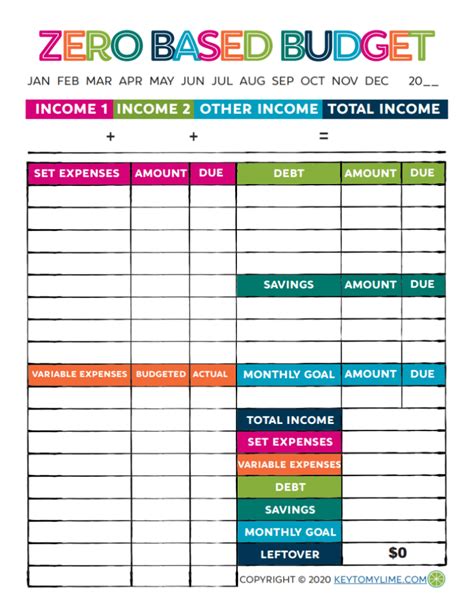

A budget by paycheck printable is a customizable template that allows you to track your income and expenses on a bi-weekly or weekly basis. By dividing your expenses into manageable chunks, you can better understand where your money is going and make adjustments as needed. This helps you prioritize your spending, ensure you're covering essential expenses, and make progress towards your long-term financial goals.

Benefits of Using a Budget by Paycheck Printable

Using a budget by paycheck printable offers numerous benefits, including:

- Improved financial organization: By tracking your income and expenses, you'll gain a clearer understanding of your financial situation and be able to make more informed decisions.

- Reduced stress: With a budget by paycheck printable, you'll feel more in control of your finances, reducing stress and anxiety.

- Increased savings: By prioritizing your spending and making adjustments as needed, you can start building a safety net and making progress towards your long-term financial goals.

- Better financial habits: Using a budget by paycheck printable helps you develop healthy financial habits, such as regularly tracking your expenses and making adjustments as needed.

How to Use a Budget by Paycheck Printable

Using a budget by paycheck printable is straightforward. Here's a step-by-step guide to get you started:

- Download and print the template: Find a budget by paycheck printable template online or create your own using a spreadsheet or word processing software.

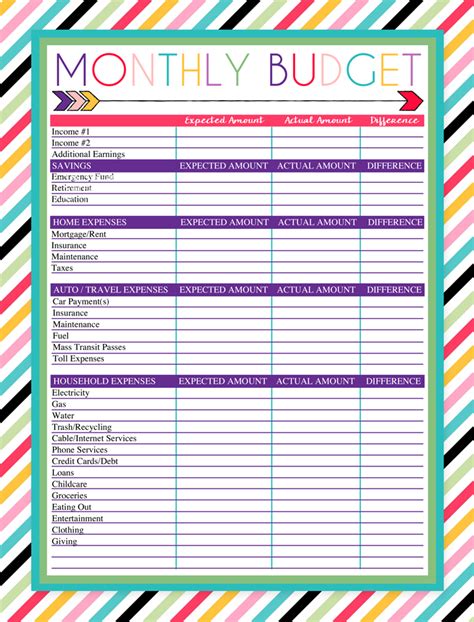

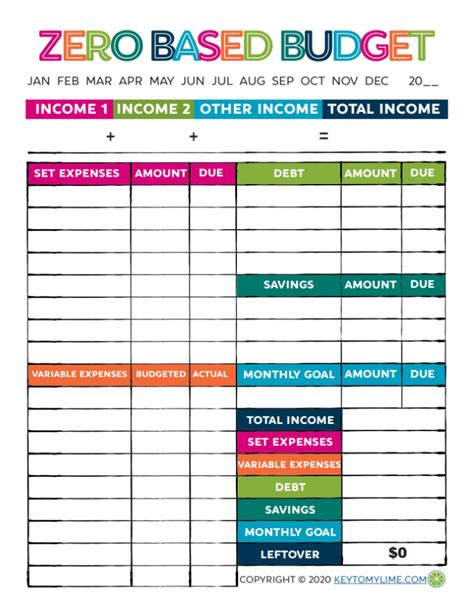

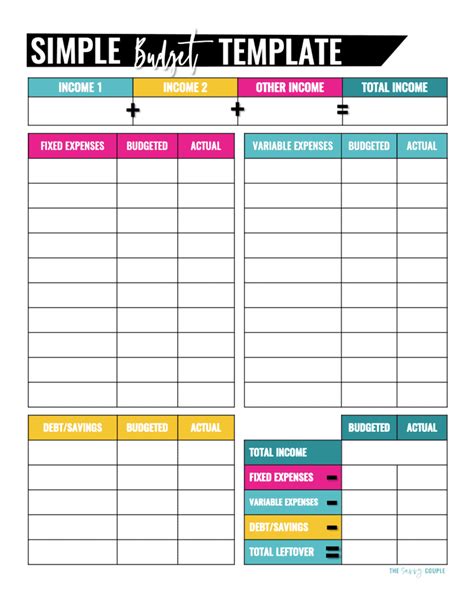

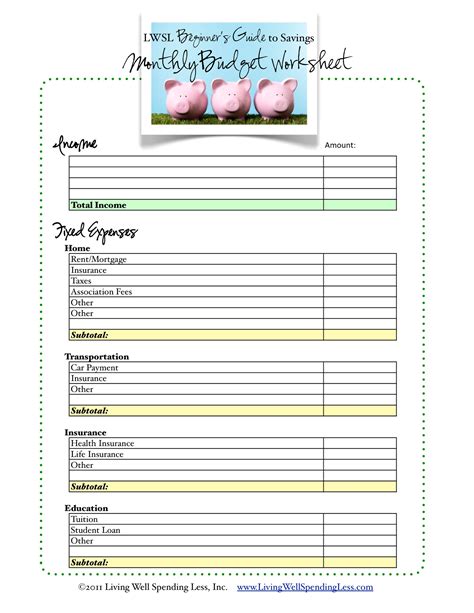

- Track your income: Start by tracking your income, including your regular paycheck, any side hustles, or other sources of income.

- List your expenses: Next, list your expenses, including essential expenses like rent/mortgage, utilities, and groceries, as well as non-essential expenses like entertainment and hobbies.

- Categorize your expenses: Categorize your expenses into groups, such as housing, transportation, and food.

- Set financial goals: Determine your short-term and long-term financial goals, such as paying off debt, building an emergency fund, or saving for a big purchase.

- Make adjustments: Regularly review your budget and make adjustments as needed to stay on track with your financial goals.

Customizing Your Budget by Paycheck Printable

To get the most out of your budget by paycheck printable, it's essential to customize it to your specific financial situation. Here are some tips to help you tailor your budget:

- Use different categories: Create categories that reflect your unique expenses, such as pet expenses, home maintenance, or education costs.

- Prioritize needs over wants: Be honest about what you need versus what you want, and prioritize your spending accordingly.

- Account for irregular expenses: Make sure to account for irregular expenses, such as car maintenance or property taxes, to avoid going over budget.

- Leave room for adjustments: Life is unpredictable, so leave some wiggle room in your budget for unexpected expenses or changes in income.

Common Mistakes to Avoid When Using a Budget by Paycheck Printable

While using a budget by paycheck printable can be an effective way to manage your finances, there are some common mistakes to avoid:

- Not tracking income accurately: Make sure to track all sources of income, including irregular or variable income.

- Underestimating expenses: Don't underestimate your expenses, especially for categories like groceries or entertainment.

- Not prioritizing needs: Prioritize essential expenses over non-essential expenses to ensure you're covering the basics.

- Not reviewing and adjusting regularly: Regularly review your budget and make adjustments as needed to stay on track with your financial goals.

Additional Tips for Achieving Financial Freedom

In addition to using a budget by paycheck printable, here are some additional tips to help you achieve financial freedom:

- Live below your means: Avoid overspending and live below your means to build wealth over time.

- Invest in yourself: Invest in your education, skills, and personal development to increase your earning potential.

- Avoid debt: Work to pay off high-interest debt and avoid taking on new debt to free up more money in your budget.

- Build an emergency fund: Build a safety net to cover unexpected expenses and avoid going into debt.

By following these tips and using a budget by paycheck printable, you can take control of your finances and achieve financial freedom.

Gallery of Budget by Paycheck Printables

Budget by Paycheck Printable Image Gallery

By implementing these strategies and using a budget by paycheck printable, you can take control of your finances and achieve financial freedom. Remember to stay flexible, prioritize your spending, and make adjustments as needed to stay on track with your financial goals.

Take action today and start building a more secure financial future. Share your experiences and tips for achieving financial freedom in the comments below!