Intro

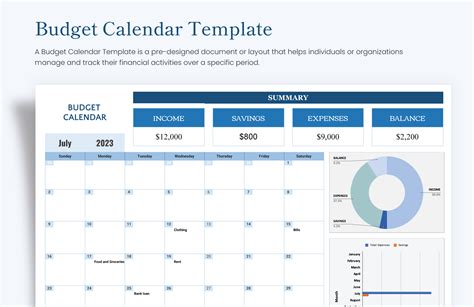

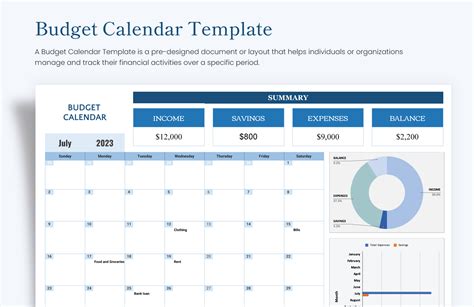

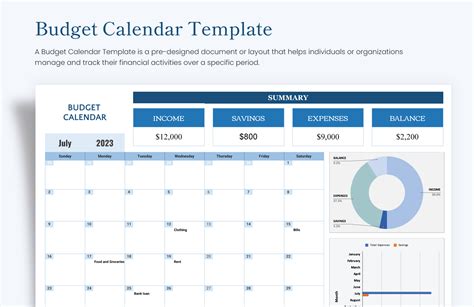

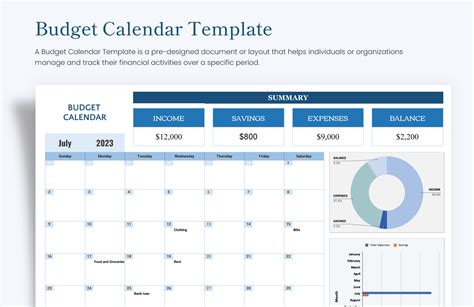

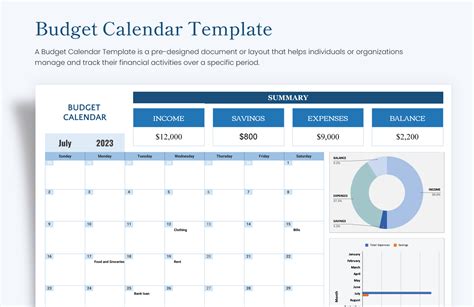

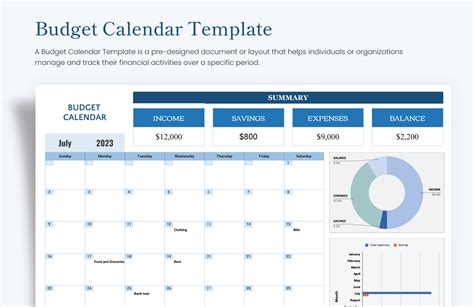

Create a personalized budget plan with our free budget calendar template for Excel. Easily track income and expenses, set financial goals, and stay organized with a customizable calendar. Download now and start managing your finances effectively with a clear and concise budgeting tool, ideal for personal or business use.

Effective financial management is crucial for individuals, businesses, and organizations to achieve their goals and maintain stability. One essential tool for managing finances is a budget calendar. A budget calendar helps track income and expenses, identify areas for cost-cutting, and make informed financial decisions. In this article, we will discuss the importance of using a budget calendar, its benefits, and provide a free budget calendar template in Excel for download.

Importance of Using a Budget Calendar

A budget calendar is a powerful tool for managing finances, and its importance cannot be overstated. Here are some reasons why using a budget calendar is crucial:

- Tracks income and expenses: A budget calendar helps you track your income and expenses, making it easier to identify areas where you can cut costs and allocate resources more efficiently.

- Improves financial planning: By using a budget calendar, you can plan your finances more effectively, make informed decisions, and achieve your financial goals.

- Enhances financial discipline: A budget calendar helps you stay disciplined and committed to your financial goals, ensuring that you stick to your budget and avoid unnecessary expenses.

- Reduces financial stress: By having a clear picture of your finances, a budget calendar can help reduce financial stress and anxiety, allowing you to focus on other aspects of your life.

Benefits of Using a Budget Calendar

Using a budget calendar offers numerous benefits, including:

- Improved financial management: A budget calendar helps you manage your finances more effectively, ensuring that you stay on top of your income and expenses.

- Increased savings: By identifying areas for cost-cutting and allocating resources more efficiently, a budget calendar can help you save money and achieve your financial goals.

- Better financial decision-making: A budget calendar provides a clear picture of your finances, enabling you to make informed decisions and avoid financial pitfalls.

- Reduced debt: By tracking your income and expenses, a budget calendar can help you identify areas where you can reduce debt and improve your financial stability.

Free Budget Calendar Template Excel Download

To help you get started with managing your finances, we are offering a free budget calendar template in Excel for download. This template is easy to use, customizable, and provides a comprehensive framework for tracking your income and expenses.

Features of the Template

- Monthly budget calendar: The template provides a monthly budget calendar that allows you to track your income and expenses for each month.

- Income and expense tracking: The template includes separate sections for tracking income and expenses, making it easier to identify areas for cost-cutting.

- Budgeting categories: The template includes budgeting categories, such as housing, transportation, and food, to help you allocate resources more efficiently.

- Formula-driven calculations: The template includes formula-driven calculations that automatically calculate your total income, total expenses, and net income.

How to Use the Budget Calendar Template

Using the budget calendar template is easy and straightforward. Here are the steps to follow:

- Download the template: Download the free budget calendar template in Excel from our website.

- Customize the template: Customize the template to suit your financial needs and goals.

- Track your income and expenses: Use the template to track your income and expenses for each month.

- Review and adjust: Review your budget regularly and adjust as necessary to ensure that you are achieving your financial goals.

Tips for Effective Budgeting

Here are some tips for effective budgeting:

- Set clear financial goals: Set clear financial goals, such as saving for a down payment on a house or paying off debt.

- Track your expenses: Track your expenses to identify areas where you can cut costs and allocate resources more efficiently.

- Create a budget plan: Create a budget plan that outlines projected income and expenses for each month.

- Review and adjust: Review your budget regularly and adjust as necessary to ensure that you are achieving your financial goals.

Common Budgeting Mistakes to Avoid

Here are some common budgeting mistakes to avoid:

- Not tracking expenses: Not tracking expenses can lead to overspending and financial instability.

- Not creating a budget plan: Not creating a budget plan can lead to financial chaos and make it difficult to achieve financial goals.

- Not reviewing and adjusting: Not reviewing and adjusting your budget regularly can lead to financial stagnation and make it difficult to achieve financial goals.

Budget Calendar Template Excel Download FAQs

Here are some frequently asked questions about the budget calendar template Excel download:

- What is the budget calendar template?: The budget calendar template is a free Excel template that helps you track your income and expenses and manage your finances more effectively.

- How do I download the template?: You can download the template from our website by clicking on the download link.

- Is the template customizable?: Yes, the template is customizable, allowing you to tailor it to your financial needs and goals.

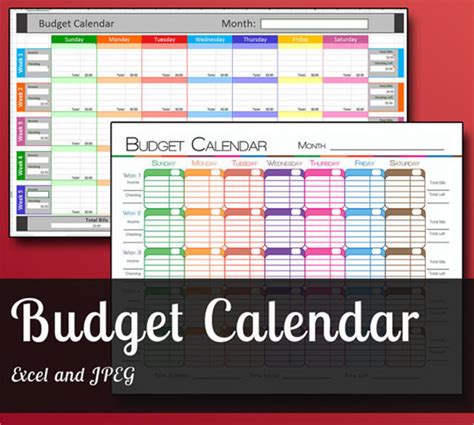

Gallery of Budget Calendar Template Excel Download

Conclusion

In conclusion, a budget calendar is a powerful tool for managing finances, and using a budget calendar template in Excel can help you track your income and expenses, identify areas for cost-cutting, and make informed financial decisions. By following the tips outlined in this article and avoiding common budgeting mistakes, you can use the budget calendar template to achieve financial stability and success.