Discover 5 ways Navy Federal Business Account boosts financial management, cash flow, and business growth with online banking, credit solutions, and investment services, tailored for entrepreneurs and small business owners.

In today's fast-paced business environment, managing finances effectively is crucial for the success and growth of any organization. One of the key components of financial management is selecting the right business account that meets the unique needs of your company. For businesses associated with the military, veterans, or the Department of Defense, Navy Federal Credit Union offers a range of business account solutions designed to provide flexibility, convenience, and cost savings. Understanding the benefits and features of these accounts can help business owners make informed decisions about their financial management strategies.

The importance of choosing the right business account cannot be overstated. It impacts everything from daily operations to long-term financial health. A well-suited business account can streamline financial tasks, reduce costs, and provide access to valuable resources and services that support business growth. Navy Federal Credit Union, with its member-centric approach and comprehensive suite of financial products, has become a preferred choice for many businesses within its field of membership. By exploring the features and benefits of Navy Federal business accounts, businesses can better navigate their financial options and find the account that best aligns with their goals and operations.

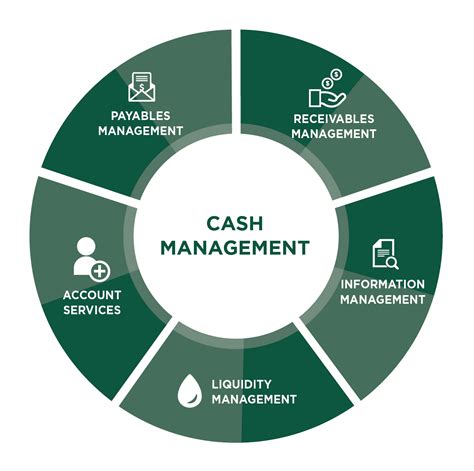

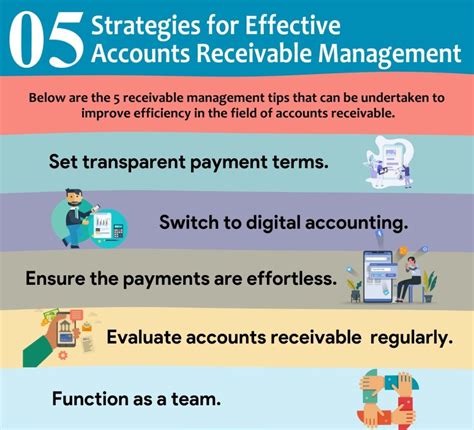

For businesses looking to optimize their financial management, Navy Federal Credit Union offers several business account options, each designed to cater to different business needs and sizes. From basic checking accounts for small businesses to more advanced cash management solutions for larger corporations, Navy Federal's range of business accounts is tailored to provide the flexibility and support that businesses need to thrive. Whether it's managing cash flow, facilitating payments, or accessing credit, Navy Federal's business accounts are equipped with features that can help businesses improve their financial efficiency and achieve their objectives.

Overview of Navy Federal Business Accounts

Benefits of Navy Federal Business Accounts

Types of Navy Federal Business Accounts

Features of Each Account Type

The features of each Navy Federal business account are designed to address the unique challenges and opportunities faced by businesses. For example: - Basic Business Checking: Suitable for small businesses, this account often comes with low or no monthly maintenance fees, unlimited transactions, and basic online banking services. - Premium Business Checking: Geared towards larger businesses, this account may offer advanced online banking features, higher limits on transactions, and dedicated customer support. - Business Savings and Money Market Accounts: These accounts are ideal for businesses looking to save for the future or earn interest on their cash reserves, providing a safe and stable way to grow their funds.How to Choose the Right Navy Federal Business Account

Opening a Navy Federal Business Account

Managing Your Navy Federal Business Account

Best Practices for Account Management

Some best practices for managing a Navy Federal business account include: - Regularly reviewing account statements to ensure accuracy and detect any suspicious activity. - Setting up account alerts to notify you of low balances, large transactions, or other significant events. - Utilizing online banking and mobile banking apps to manage your account remotely and efficiently. - Maintaining a cushion of funds in your account to avoid overdrafts and associated fees.Navy Federal Business Account Image Gallery

In conclusion, Navy Federal business accounts offer a comprehensive financial management solution for businesses associated with the military, veterans, or the Department of Defense. By understanding the benefits, features, and types of accounts available, businesses can make informed decisions about their financial strategies. Whether you're a small startup or a large corporation, Navy Federal Credit Union has the tools and resources to support your financial success. We invite you to explore the possibilities of Navy Federal business accounts and discover how they can help your business thrive. Share your thoughts on the importance of choosing the right business account, and let's discuss how Navy Federal can meet your business's unique financial needs.