Intro

Streamline your business financing process with a professionally designed Business Credit Application Template in Word format. Easily customize and download the template to create a comprehensive application, including company profile, financial statements, and credit history, to present to lenders and secure funding for your business growth.

Establishing a solid business credit foundation is crucial for any entrepreneur or small business owner. A well-structured business credit application can help you secure the funding you need to grow your business. In this article, we will provide a comprehensive guide on how to create a business credit application template in Word format.

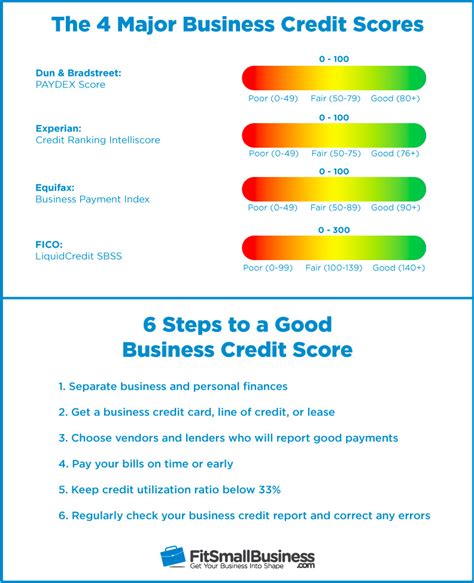

Understanding the Importance of Business Credit

Before we dive into the template, it's essential to understand the significance of business credit. Business credit refers to the ability of a business to borrow money or access credit from lenders, suppliers, or creditors. A good business credit score can help you:

- Secure lower interest rates on loans and credit cards

- Obtain better payment terms with suppliers

- Increase your chances of getting approved for business credit

- Build a strong business reputation

Creating a Business Credit Application Template in Word Format

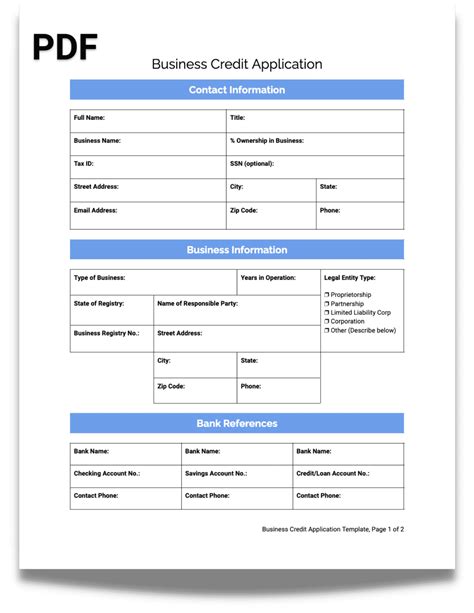

A business credit application template should include the following essential sections:

Business Information

This section should include your business's basic information, such as:

- Business name

- Business address

- Business phone number

- Business email

- Business type (sole proprietorship, partnership, corporation, etc.)

Business Owner Information

This section should include the business owner's personal information, such as:

- Name

- Address

- Phone number

- Social Security number or EIN (Employer Identification Number)

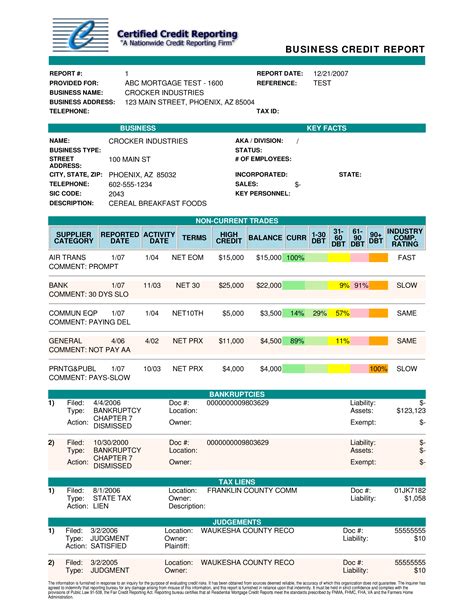

Business Credit History

This section should include information about your business's credit history, such as:

- Credit accounts ( loans, credit cards, etc.)

- Credit limits

- Payment history

- Any past due accounts or collections

Financial Information

This section should include your business's financial information, such as:

- Annual revenue

- Net income

- Total assets

- Total liabilities

Collateral Information

This section should include information about any collateral you are willing to pledge to secure the loan, such as:

- Property (real estate, equipment, etc.)

- Inventory

- Accounts receivable

Loan Information

This section should include information about the loan you are applying for, such as:

- Loan amount

- Loan term

- Interest rate

- Repayment schedule

Certifications and Authorizations

This section should include certifications and authorizations, such as:

- Certification that the information provided is accurate and complete

- Authorization to check credit reports

- Authorization to verify employment and income

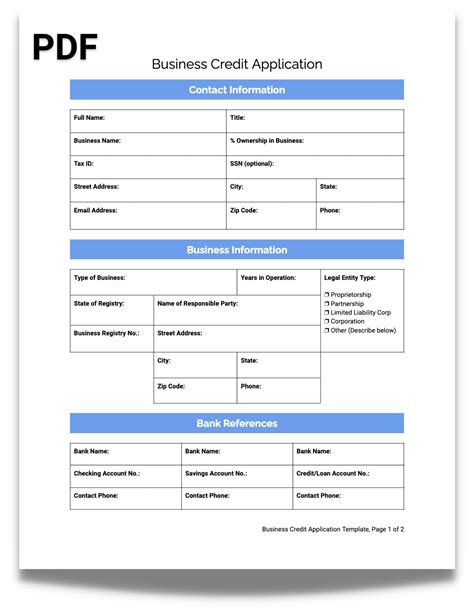

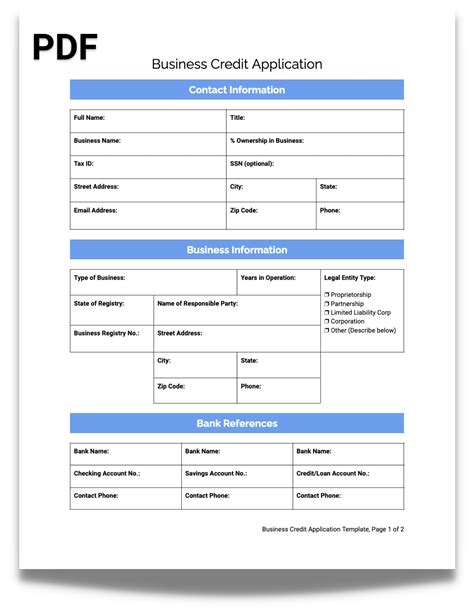

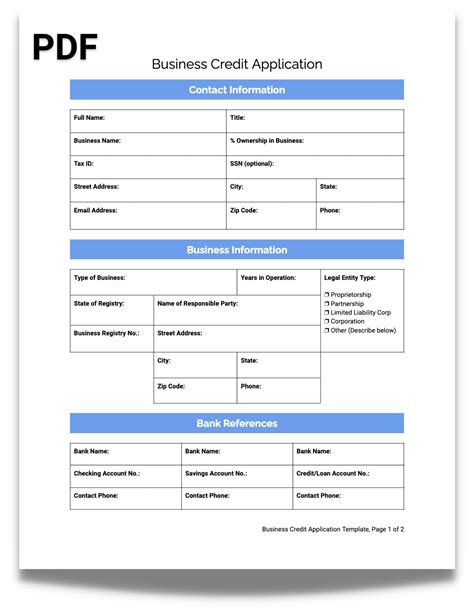

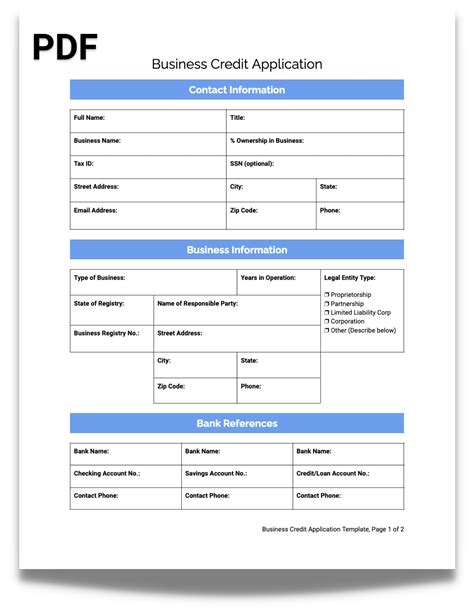

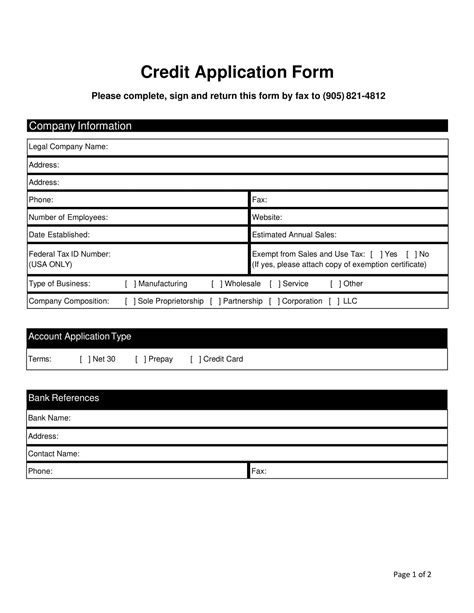

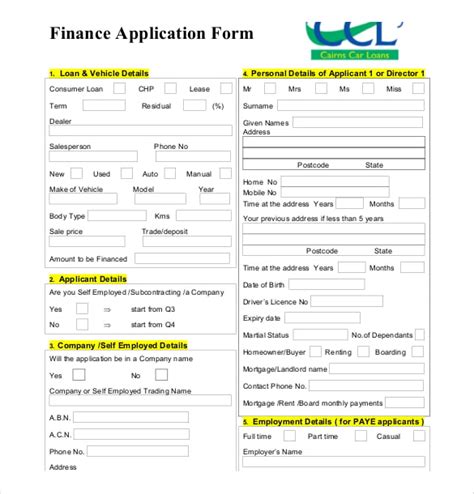

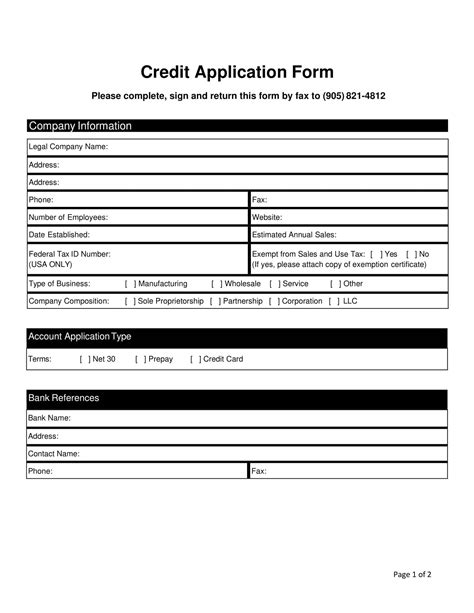

Sample Business Credit Application Template in Word Format

Here is a sample business credit application template in Word format:

Tips for Creating a Business Credit Application Template

Here are some tips to keep in mind when creating a business credit application template:

- Use a clear and concise format

- Use a standard font and font size

- Use headings and subheadings to organize the information

- Make sure to include all required information

- Proofread the template carefully to ensure accuracy

Best Practices for Business Credit Applications

Here are some best practices to keep in mind when completing a business credit application:

- Be honest and accurate when providing information

- Make sure to provide all required documentation

- Follow up with the lender to ensure the application is complete and being processed

- Consider working with a business credit expert to help with the application process

Gallery of Business Credit Application Templates

Business Credit Application Templates Gallery

We hope this article has provided you with a comprehensive guide on how to create a business credit application template in Word format. Remember to follow the tips and best practices outlined above to increase your chances of getting approved for business credit. If you have any questions or need further assistance, please don't hesitate to comment below.