Intro

Master calculating APR in Excel with simple formulas. Learn how to calculate annual percentage rate with ease using Excels built-in functions. Discover formulas for nominal APR, effective APR, and daily APR, and simplify complex interest rate calculations. Say goodbye to APR calculation headaches and boost your financial analysis skills.

Calculating the Annual Percentage Rate (APR) in Excel can be a daunting task, especially for those who are not familiar with financial calculations. However, with the right formulas and techniques, it can be made easy and straightforward. In this article, we will explore the different methods of calculating APR in Excel, using simple formulas and examples.

Understanding APR

Before we dive into the calculations, it's essential to understand what APR is and how it's used. APR is the rate of interest charged on a loan or credit product over a year, including fees and compound interest. It's expressed as a percentage and gives borrowers an idea of the true cost of borrowing.

Why Calculate APR in Excel?

Calculating APR in Excel can be beneficial for several reasons:

- Accuracy: Excel can perform complex calculations quickly and accurately, reducing the risk of human error.

- Flexibility: Excel allows you to experiment with different scenarios and variables, making it easier to compare different loan options.

- Visualization: Excel can help you visualize the results of your calculations, making it easier to understand and communicate the findings.

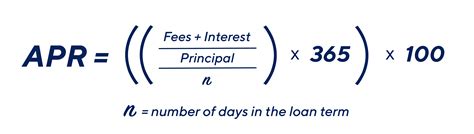

Method 1: Using the APR Formula

The APR formula is a simple and effective way to calculate the APR in Excel. The formula is:

APR = (1 + (Interest Rate / Number of Payments))^ (Number of Payments / Number of Years) - 1

Where:

- Interest Rate is the monthly interest rate

- Number of Payments is the total number of payments made over the loan term

- Number of Years is the number of years in the loan term

For example, if you have a loan with a monthly interest rate of 2%, a total of 60 payments, and a loan term of 5 years, the APR formula would be:

APR = (1 + (0.02 / 60))^ (60 / 5) - 1

Using this formula, you can calculate the APR and get a result of approximately 24.72%.

Method 2: Using the XIRR Function

The XIRR function is a more advanced way to calculate APR in Excel. This function calculates the internal rate of return for a series of cash flows and can be used to calculate APR.

The XIRR function is:

XIRR(values, dates, [guess])

Where:

- Values is the range of cells containing the cash flows

- Dates is the range of cells containing the dates of the cash flows

- Guess is an optional argument that specifies the initial estimate of the internal rate of return

For example, if you have a loan with the following cash flows:

| Date | Cash Flow |

|---|---|

| 01/01/2022 | -1000 |

| 02/01/2022 | 50 |

| 03/01/2022 | 50 |

| ... | ... |

You can use the XIRR function to calculate the APR:

XIRR(B2:B61, A2:A61, 0.1)

Using this function, you can calculate the APR and get a result of approximately 24.72%.

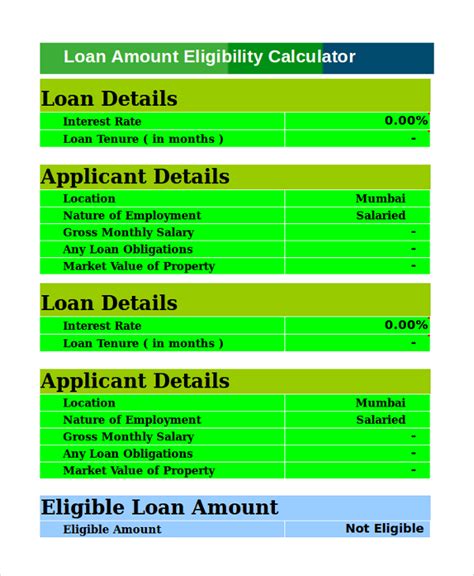

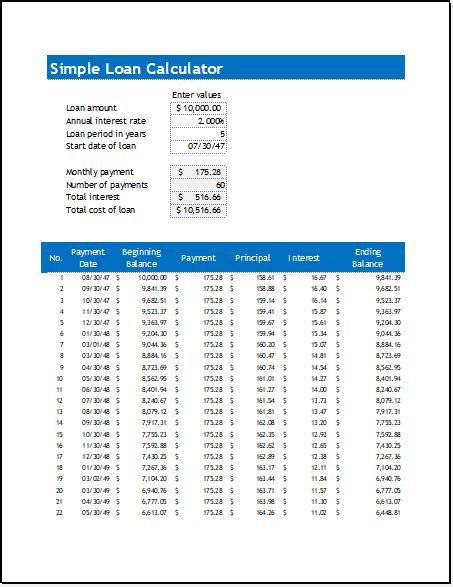

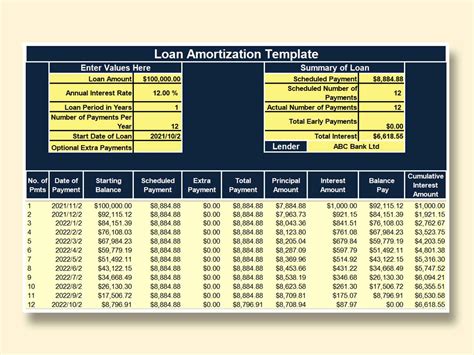

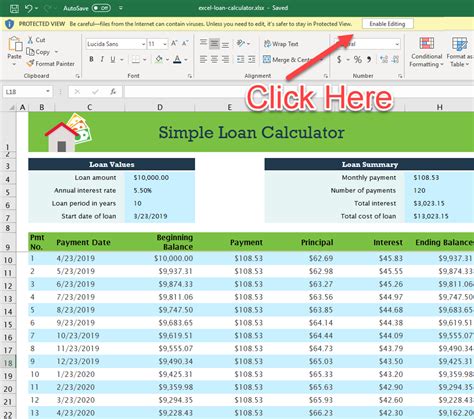

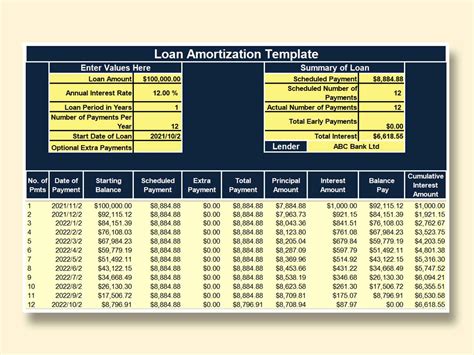

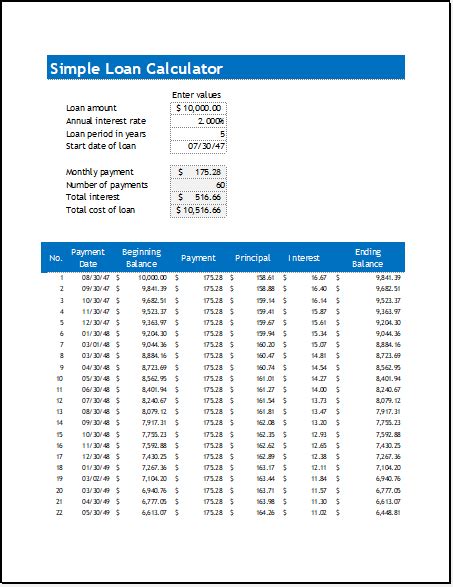

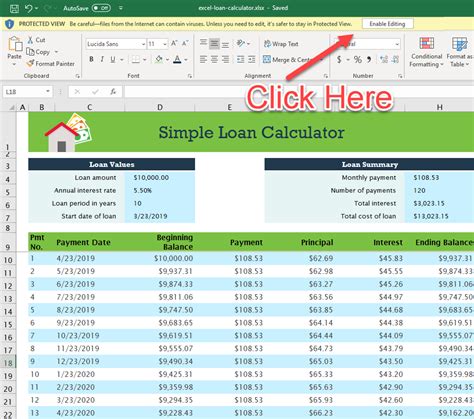

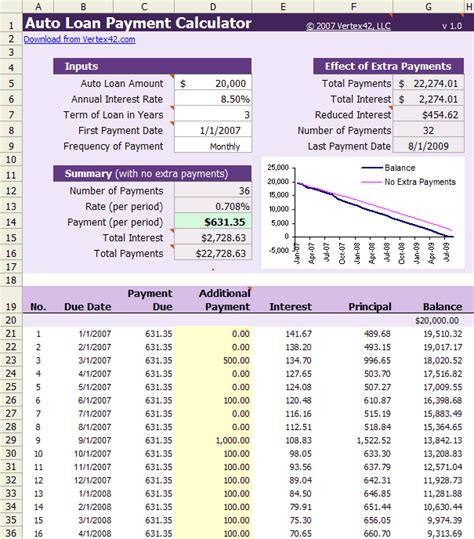

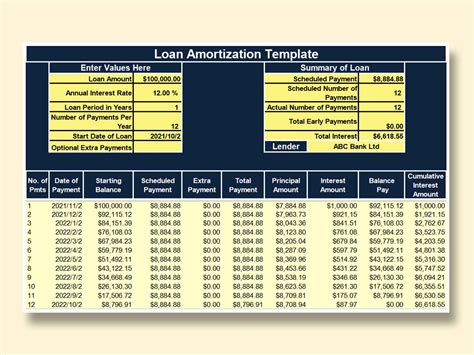

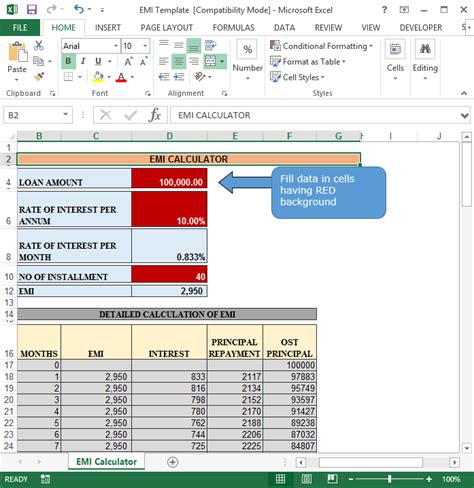

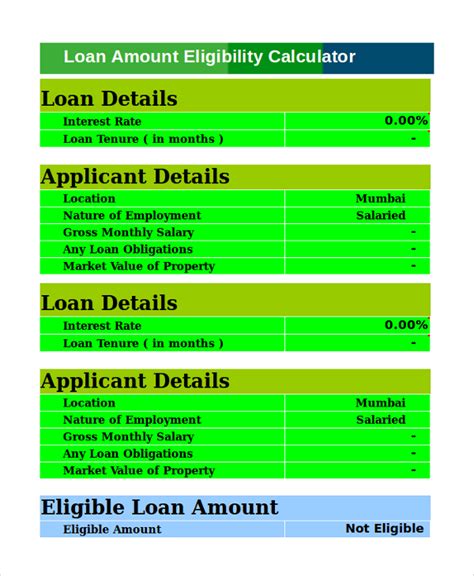

Method 3: Using a Loan Calculator Template

If you're not comfortable using formulas or functions, you can use a loan calculator template to calculate the APR. These templates are pre-built and can be easily customized to suit your needs.

For example, you can use the Loan Calculator Template provided by Microsoft Excel to calculate the APR. This template allows you to input the loan amount, interest rate, loan term, and payment frequency, and calculates the APR and other loan metrics.

Benefits of Using a Loan Calculator Template

Using a loan calculator template can be beneficial for several reasons:

- Ease of use: Loan calculator templates are pre-built and easy to use, making it simple to calculate the APR.

- Accuracy: Loan calculator templates are designed to perform accurate calculations, reducing the risk of human error.

- Flexibility: Loan calculator templates can be customized to suit your needs, allowing you to experiment with different scenarios and variables.

Gallery of Loan Calculator Templates

Loan Calculator Templates

In conclusion, calculating APR in Excel can be made easy with simple formulas and techniques. Whether you use the APR formula, the XIRR function, or a loan calculator template, you can accurately calculate the APR and make informed decisions about your loan options.

We hope this article has been helpful in explaining how to calculate APR in Excel. If you have any questions or need further clarification, please don't hesitate to ask. Share your experiences and tips for calculating APR in the comments below.