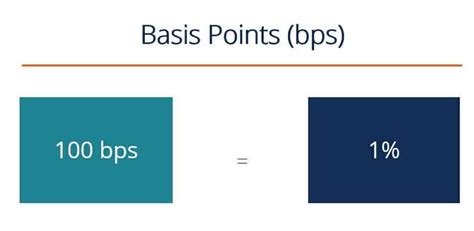

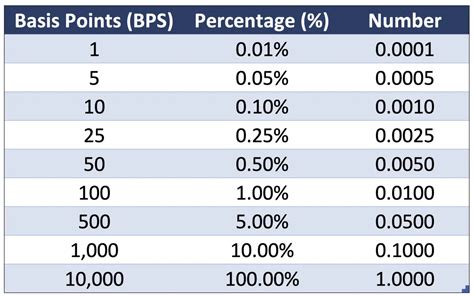

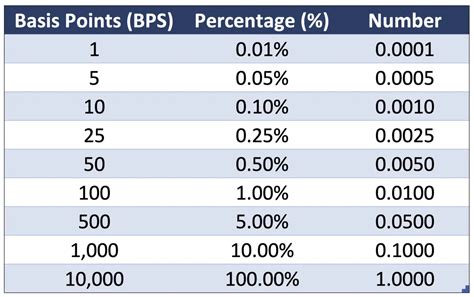

Basis points are a unit of measurement used to express the percentage change in a financial instrument's value or interest rate. One basis point is equivalent to 0.01% or 1/100th of a percent. In the financial industry, basis points are widely used to measure changes in interest rates, yields, and returns on investment. In this article, we will explore three ways to calculate basis points in Excel.

Calculating basis points is essential in finance, as it allows investors and analysts to understand the magnitude of changes in financial instruments' values. It's a crucial metric in various financial calculations, such as bond yields, interest rate swaps, and option pricing. Moreover, basis points are used to express the fees and commissions charged by financial institutions for various services.

In this article, we will delve into the world of basis points and explore three methods to calculate them in Excel. Whether you're a finance professional or an individual investor, mastering basis point calculations will help you make more informed decisions.

What are Basis Points?

Before we dive into the calculations, let's define what basis points are. Basis points are a unit of measurement used to express the percentage change in a financial instrument's value or interest rate. One basis point is equivalent to 0.01% or 1/100th of a percent.

For example, if the interest rate on a bond increases from 5% to 5.05%, the change is 5 basis points. Similarly, if the price of a stock increases from $100 to $100.05, the change is 5 basis points.

Why are Basis Points Important?

Basis points are essential in finance, as they provide a common language for expressing changes in financial instruments' values. They allow investors and analysts to compare the performance of different investments and make informed decisions.

Moreover, basis points are used to express the fees and commissions charged by financial institutions for various services. For instance, a mutual fund might charge a management fee of 50 basis points per year, which is equivalent to 0.5% of the fund's assets.

Method 1: Using the Formula

The first method to calculate basis points in Excel is by using a simple formula. The formula is:

=(New Value - Old Value) / Old Value * 100

Where:

- New Value is the new value of the financial instrument

- Old Value is the old value of the financial instrument

For example, if the interest rate on a bond increases from 5% to 5.05%, you can calculate the basis points as follows:

=(5.05 - 5) / 5 * 100 = 1%

This means the change is 1% or 100 basis points.

Using the Formula in Excel

To use the formula in Excel, follow these steps:

- Open a new Excel spreadsheet

- Enter the old value in cell A1

- Enter the new value in cell B1

- Enter the formula

=(B1-A1)/A1*100in cell C1 - Press Enter to calculate the result

The result will be displayed in cell C1, which represents the change in basis points.

Method 2: Using the Basis Point Function

The second method to calculate basis points in Excel is by using the basis point function. The basis point function is a built-in function in Excel that calculates the change in basis points between two values.

The formula is:

=BASIS_POINTS(old_value, new_value)

Where:

- old_value is the old value of the financial instrument

- new_value is the new value of the financial instrument

For example, if the interest rate on a bond increases from 5% to 5.05%, you can calculate the basis points as follows:

=BASIS_POINTS(5%, 5.05%)

This will return the result 1%, which represents the change in basis points.

Using the Basis Point Function in Excel

To use the basis point function in Excel, follow these steps:

- Open a new Excel spreadsheet

- Enter the old value in cell A1

- Enter the new value in cell B1

- Enter the formula

=BASIS_POINTS(A1, B1)in cell C1 - Press Enter to calculate the result

The result will be displayed in cell C1, which represents the change in basis points.

Method 3: Using a Basis Point Calculator

The third method to calculate basis points in Excel is by using a basis point calculator. A basis point calculator is a pre-built template in Excel that calculates the change in basis points between two values.

To use a basis point calculator, follow these steps:

- Download a basis point calculator template from the internet

- Open the template in Excel

- Enter the old value in the designated cell

- Enter the new value in the designated cell

- The calculator will automatically display the result in basis points

Using a basis point calculator is a quick and easy way to calculate basis points without having to create a formula or use a function.

Conclusion

Calculating basis points is an essential skill in finance, and Excel provides several methods to do so. In this article, we explored three methods to calculate basis points in Excel: using a formula, using the basis point function, and using a basis point calculator.

Whether you're a finance professional or an individual investor, mastering basis point calculations will help you make more informed decisions. By using one of these methods, you can quickly and easily calculate the change in basis points between two values.

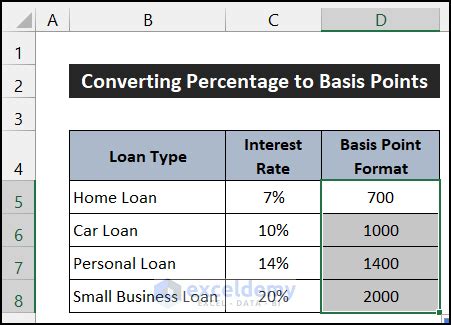

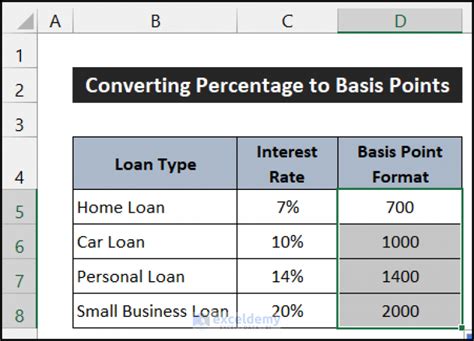

Gallery of Basis Points Images

Basis Points Image Gallery

We hope this article has helped you understand the concept of basis points and how to calculate them in Excel. If you have any questions or need further clarification, please don't hesitate to ask.