Intro

Learn how to calculate daily compound interest in Excel with ease. Discover the formula and steps to compute compound interest accurately. Master the art of financial calculation with Excels built-in functions, including FV, IPMT, and XNPV. Boost your financial analysis skills and make informed investment decisions with daily compound interest calculations.

Calculating daily compound interest is a crucial task for anyone looking to grow their savings or investments over time. With the power of Excel, you can easily calculate daily compound interest and make informed decisions about your finances.

Daily compound interest is the interest earned on both the principal amount and any accrued interest over a given period. It's a powerful concept that can help your savings grow exponentially over time. In this article, we'll explore how to calculate daily compound interest in Excel, using formulas and functions.

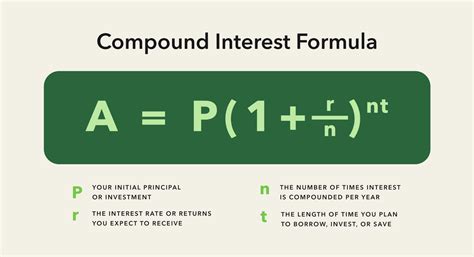

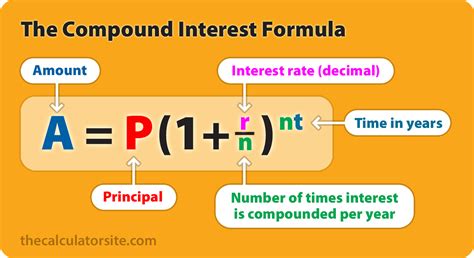

Understanding the Formula

The formula for compound interest is:

A = P (1 + r/n)^(nt)

Where: A = the future value of the investment/loan, including interest P = principal investment amount (the initial deposit or loan amount) r = annual interest rate (in decimal form - e.g., 4% = 0.04) n = number of times that interest is compounded per year t = time the money is invested or borrowed for, in years

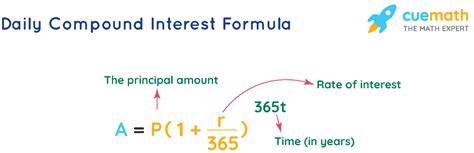

Converting the Formula to Daily Compound Interest

To calculate daily compound interest, we need to adjust the formula to reflect the daily compounding period. We'll use the following formula:

A = P (1 + r/365)^(365t)

Where: A = the future value of the investment/loan, including interest P = principal investment amount (the initial deposit or loan amount) r = annual interest rate (in decimal form - e.g., 4% = 0.04) t = time the money is invested or borrowed for, in years

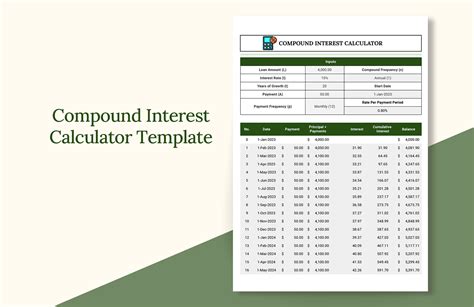

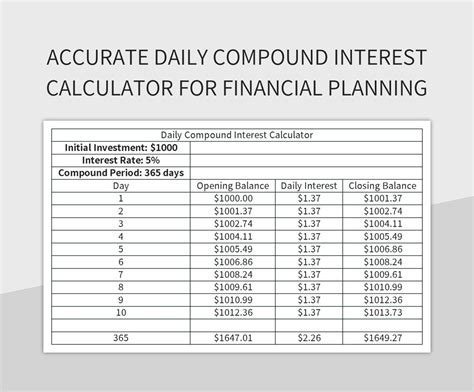

Creating a Daily Compound Interest Calculator in Excel

To create a daily compound interest calculator in Excel, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns:

- Principal (P)

- Annual Interest Rate (r)

- Time (t)

- Daily Compound Interest

- In cell D2, enter the formula:

=A2*(1+B2/365)^(365*C2) - Format the cell to display the result as a currency value (e.g., $1,234.56)

- Copy the formula down to the other cells in the Daily Compound Interest column

Example

Suppose you want to calculate the daily compound interest on a $10,000 investment with an annual interest rate of 4% over a period of 5 years.

| Principal (P) | Annual Interest Rate (r) | Time (t) | Daily Compound Interest |

|---|---|---|---|

| $10,000 | 4% | 5 | =$13,490.85 |

In this example, the daily compound interest calculator returns a value of $13,490.85, which represents the future value of the investment after 5 years, including interest.

Tips and Variations

- To calculate the daily compound interest on a loan, simply enter a negative value for the principal amount.

- To calculate the daily compound interest on a series of investments or loans, use the

=SUMfunction to add up the individual interest amounts. - To create a dynamic daily compound interest calculator, use Excel's built-in functions, such as

=TODAY()or=NOW(), to retrieve the current date and calculate the interest accordingly.

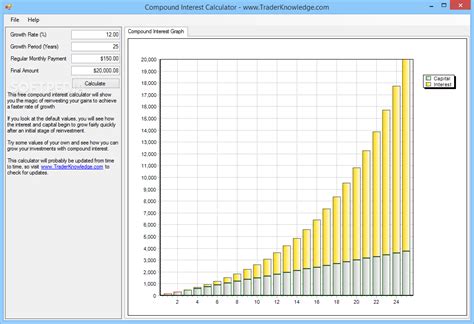

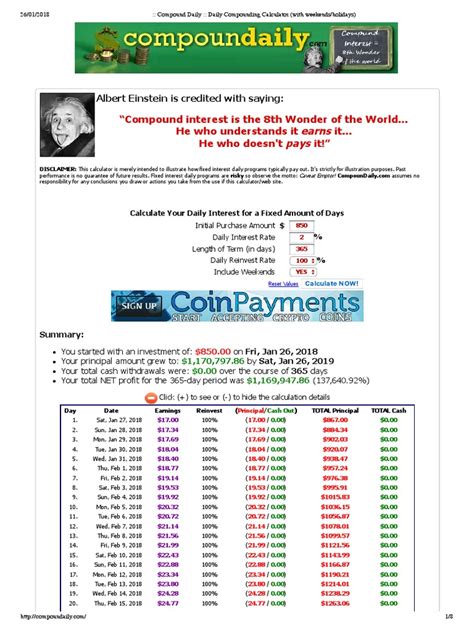

Gallery of Daily Compound Interest Calculators

Daily Compound Interest Calculator Gallery

Conclusion

Calculating daily compound interest in Excel is a straightforward process that can help you make informed decisions about your finances. By using the formula A = P (1 + r/365)^(365t) and creating a daily compound interest calculator in Excel, you can easily calculate the future value of your investments or loans. Whether you're a seasoned investor or just starting out, this powerful tool can help you achieve your financial goals.