The Exponential Moving Average (EMA) is a widely used indicator in finance and investing, helping traders and analysts understand the direction and momentum of a stock's price movement. While calculating EMA can seem daunting, Excel makes it relatively straightforward. In this article, we'll break down the steps to calculate Exponential Moving Average in Excel, making it easy for you to apply this powerful tool to your financial analysis.

What is Exponential Moving Average (EMA)?

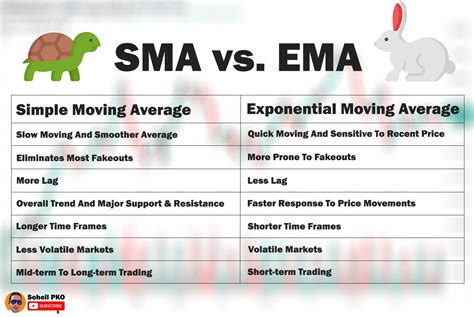

Before diving into the calculation, let's quickly define what EMA is. The Exponential Moving Average is a type of moving average that gives more weight to recent price movements, making it more responsive to recent changes in the market. This is in contrast to the Simple Moving Average (SMA), which gives equal weight to all prices within a given period.

Why Use Exponential Moving Average?

The EMA is a popular tool among traders and analysts because it:

- Helps identify trends and momentum

- Provides a more accurate representation of recent price movements

- Can be used to generate buy and sell signals

Calculating Exponential Moving Average in Excel

Now, let's move on to the calculation. To calculate the Exponential Moving Average in Excel, you'll need to follow these steps:

Step 1: Prepare Your Data

First, organize your data in a table with the following columns:

| Date | Close Price |

|---|---|

Enter your historical price data into the table, making sure to include the date and closing price for each trading day.

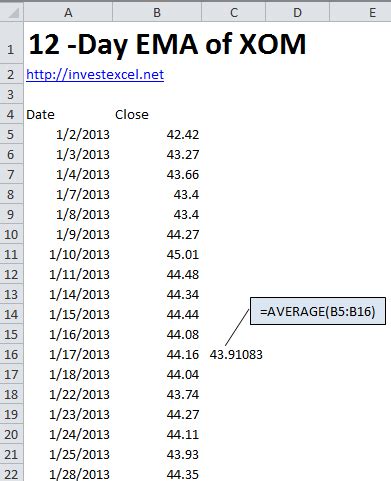

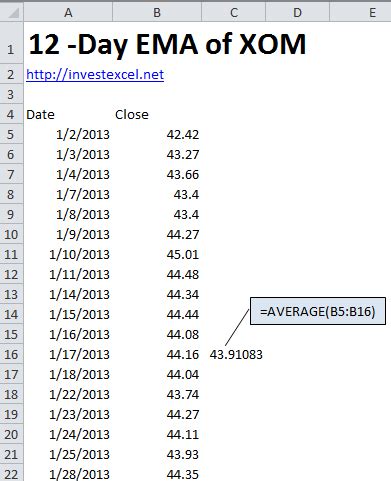

Step 2: Calculate the Simple Moving Average (SMA)

Next, calculate the Simple Moving Average (SMA) for a given period (e.g., 20 days). You can use the AVERAGE function in Excel to calculate the SMA.

Formula: =AVERAGE(Close Price, 20)

Where:

Close Priceis the range of cells containing the closing prices20is the number of periods for the SMA

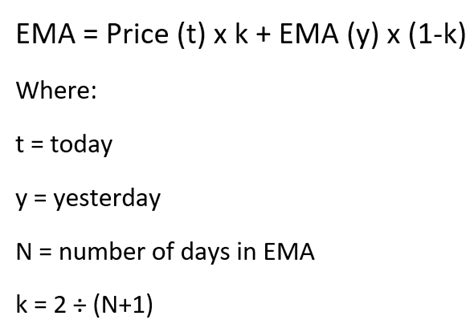

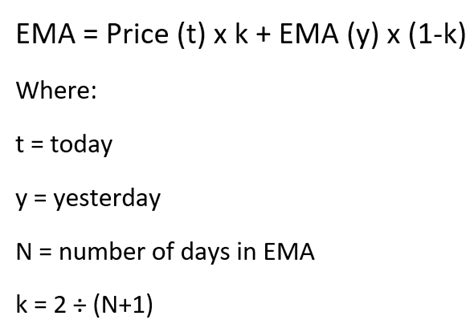

Step 3: Calculate the Exponential Moving Average (EMA)

Now, calculate the Exponential Moving Average (EMA) using the following formula:

Formula: =Close Price \* (2 / (N + 1)) + EMA (previous period) \* (1 - (2 / (N + 1)))

Where:

Close Priceis the current closing priceNis the number of periods (e.g., 20)EMA (previous period)is the EMA value from the previous period

How to Calculate EMA in Excel

To calculate the EMA in Excel, you can use the following steps:

- Enter the formula

=Close Price \* (2 / (N + 1)) + EMA (previous period) \* (1 - (2 / (N + 1)))in a new column. - Press

Enterto calculate the EMA value for the first period. - Copy the formula down to the rest of the cells in the column.

Example EMA Calculation

Suppose we have the following data:

| Date | Close Price |

|---|---|

| 2022-01-01 | 100 |

| 2022-01-02 | 102 |

| 2022-01-03 | 105 |

| ... | ... |

To calculate the EMA for a 20-period moving average, we would:

- Calculate the SMA for 20 periods:

=AVERAGE(Close Price, 20) - Calculate the EMA for the first period:

=Close Price \* (2 / (20 + 1)) + EMA (previous period) \* (1 - (2 / (20 + 1))) - Copy the formula down to the rest of the cells in the column.

Gallery of Exponential Moving Average Examples

Exponential Moving Average Image Gallery

Final Thoughts

Calculating the Exponential Moving Average in Excel is a straightforward process that can help you better understand market trends and momentum. By following these steps, you can easily apply the EMA to your financial analysis and make more informed investment decisions.

Actionable Tips

- Use the EMA in conjunction with other technical indicators to confirm trading signals.

- Experiment with different periods (e.g., 20, 50, 100) to find the best fit for your trading strategy.

- Monitor the EMA closely for crossovers and divergences, which can indicate potential trend reversals.

Share Your Thoughts

Have you used the Exponential Moving Average in your trading or investing strategy? Share your experiences and insights in the comments below!