Calculating income tax can be a daunting task, especially for those who are not familiar with tax laws and regulations. However, with the help of Excel, you can calculate your income tax with ease and accuracy. In this article, we will guide you through the process of calculating income tax in Excel, providing you with a step-by-step approach to ensure you get it right.

Understanding Income Tax Calculation

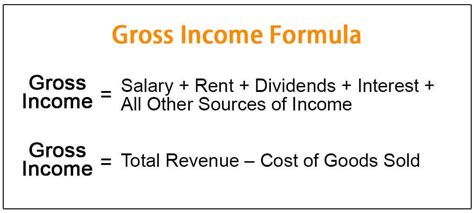

Before we dive into the Excel calculation, it's essential to understand the basics of income tax calculation. Income tax is a type of tax levied by the government on an individual's income or profits. The tax rate varies depending on the income slab, and there are different types of income tax, including:

- Salary income

- Business income

- Capital gains income

- Interest income

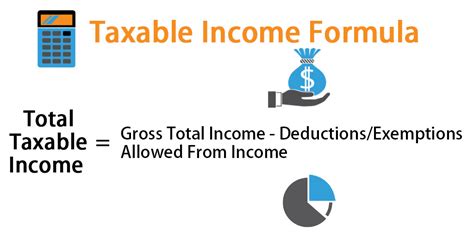

The income tax calculation involves determining the taxable income, applying the tax rates, and calculating the total tax liability.

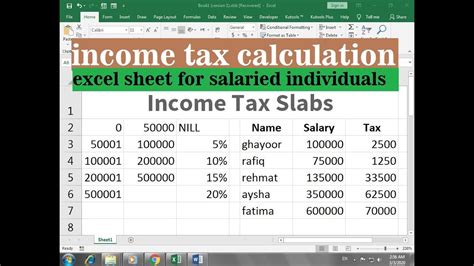

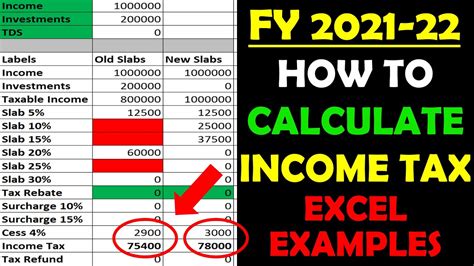

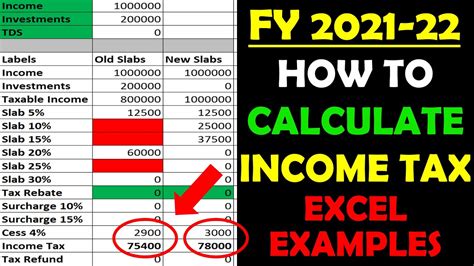

Setting Up the Excel Worksheet

To calculate income tax in Excel, you need to set up a worksheet with the necessary columns and formulas. Here's a step-by-step guide to help you get started:

- Create a new Excel worksheet and give it a title, such as "Income Tax Calculation."

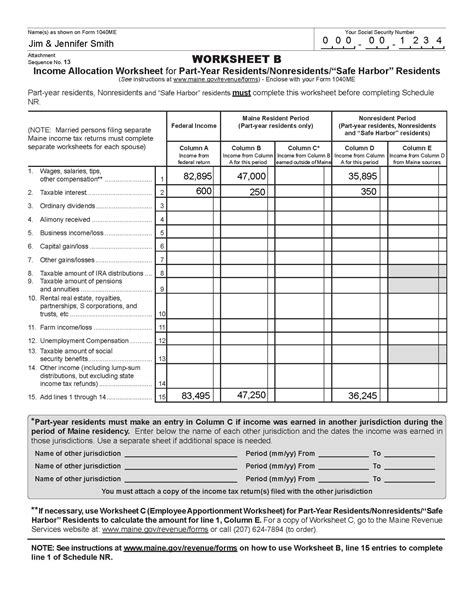

- Set up the following columns:

- Income Type (e.g., salary, business, capital gains, interest)

- Income Amount

- Taxable Income

- Tax Rate

- Tax Liability

- Enter the income data for each type of income.

Calculating Taxable Income

The next step is to calculate the taxable income for each type of income. You can use the following formulas:

- For salary income:

=Income Amount - Deductions(e.g.,=B2-C2) - For business income:

=Income Amount - Business Expenses(e.g.,=B3-D3) - For capital gains income:

=Income Amount - Capital Losses(e.g.,=B4-E4) - For interest income:

=Income Amount - Interest Deductions(e.g.,=B5-F5)

Enter these formulas in the Taxable Income column.

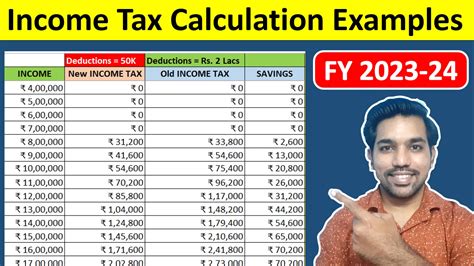

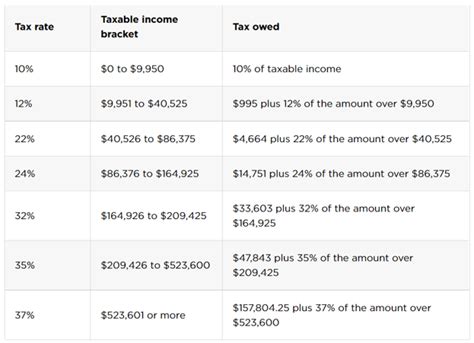

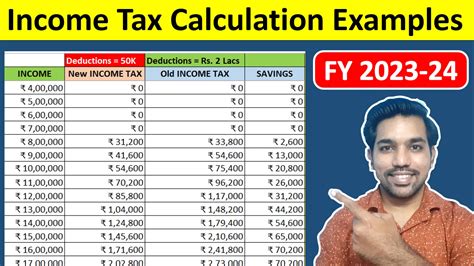

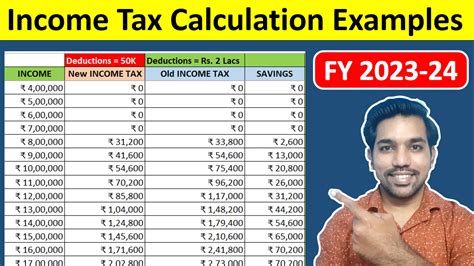

Applying Tax Rates

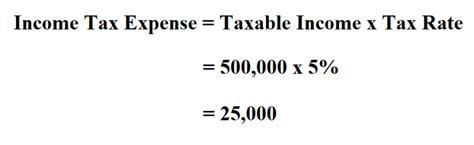

Once you have calculated the taxable income, you need to apply the tax rates. You can use the following formulas:

- For salary income:

=Taxable Income x Tax Rate(e.g.,=C2 x 0.25) - For business income:

=Taxable Income x Tax Rate(e.g.,=C3 x 0.30) - For capital gains income:

=Taxable Income x Tax Rate(e.g.,=C4 x 0.20) - For interest income:

=Taxable Income x Tax Rate(e.g.,=C5 x 0.15)

Enter these formulas in the Tax Liability column.

Calculating Total Tax Liability

Finally, you need to calculate the total tax liability by summing up the tax liabilities for each type of income. You can use the following formula:

=SUM(Tax Liability)(e.g.,=SUM(E2:E5))

Enter this formula in the Total Tax Liability cell.

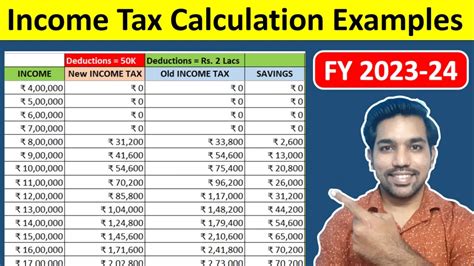

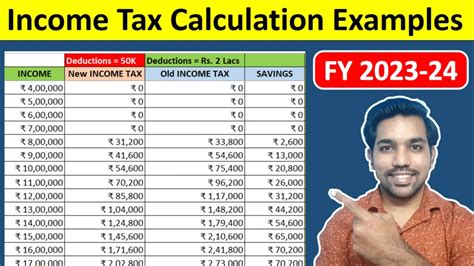

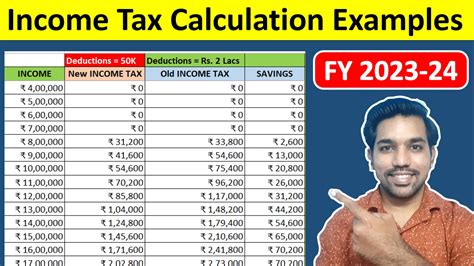

Gallery of Income Tax Calculation Formulas

Income Tax Calculation Formulas

Conclusion

Calculating income tax in Excel can be a straightforward process if you follow the steps outlined in this article. By setting up a worksheet with the necessary columns and formulas, you can accurately calculate your taxable income, apply tax rates, and determine your total tax liability. Remember to keep your worksheet organized and use clear labels to ensure ease of use.

If you have any questions or need further assistance, please don't hesitate to comment below.