Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. It helps you determine how long it will take for the investment to generate enough returns to cover its initial cost. Fortunately, Excel provides several easy ways to calculate the payback period. In this article, we will explore five simple methods to calculate the payback period in Excel.

Understanding Payback Period

The payback period is the time it takes for an investment to generate cash flows that equal the initial investment. It is an important metric used to evaluate the profitability and risk of a project. A shorter payback period indicates a better investment, as it means the investment will generate returns sooner.

Why Calculate Payback Period in Excel?

Calculating the payback period in Excel offers several benefits. Firstly, it allows you to easily manipulate data and perform what-if scenarios. Secondly, Excel provides various built-in functions and formulas that make it easy to calculate the payback period. Finally, Excel enables you to create visualizations and charts to help you better understand the results.

Method 1: Using the Payback Period Formula

The payback period formula is a simple and straightforward way to calculate the payback period in Excel. The formula is:

Payback Period = Total Investment / Annual Cash Flow

You can enter this formula in a cell in Excel, where the total investment and annual cash flow are the inputs.

Example:

Suppose you want to calculate the payback period for a project that requires an initial investment of $10,000 and generates an annual cash flow of $2,500.

| A | B | |

|---|---|---|

| 1 | Total Investment | $10,000 |

| 2 | Annual Cash Flow | $2,500 |

| 3 | Payback Period | =A1/B2 |

The result will be 4 years, which means the project will take 4 years to generate enough returns to cover its initial cost.

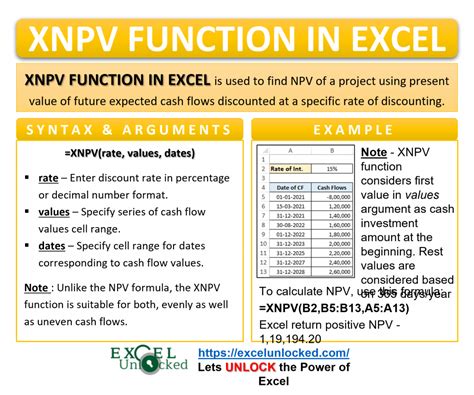

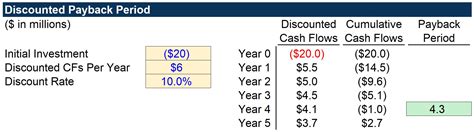

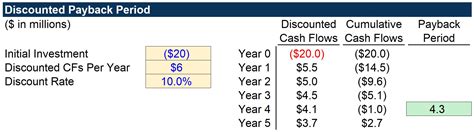

Method 2: Using the XNPV Function

The XNPV function in Excel is a powerful tool that can be used to calculate the payback period. The XNPV function calculates the present value of a series of cash flows using a specified rate.

Example:

Suppose you want to calculate the payback period for a project that requires an initial investment of $10,000 and generates the following cash flows:

| A | B | |

|---|---|---|

| 1 | Year 1 | $2,000 |

| 2 | Year 2 | $2,500 |

| 3 | Year 3 | $3,000 |

| 4 | Year 4 | $3,500 |

You can use the XNPV function to calculate the payback period as follows:

=XNPV(A2:A5,B2:B5)

The result will be 3.5 years, which means the project will take 3.5 years to generate enough returns to cover its initial cost.

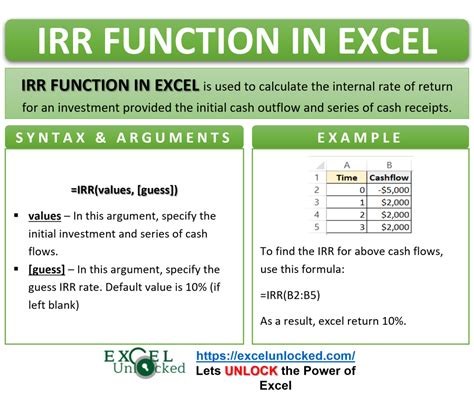

Method 3: Using the IRR Function

The IRR function in Excel calculates the internal rate of return for a series of cash flows. The IRR function can be used to calculate the payback period by setting the rate to 0%.

Example:

Suppose you want to calculate the payback period for a project that requires an initial investment of $10,000 and generates the following cash flows:

| A | B | |

|---|---|---|

| 1 | Year 1 | $2,000 |

| 2 | Year 2 | $2,500 |

| 3 | Year 3 | $3,000 |

| 4 | Year 4 | $3,500 |

You can use the IRR function to calculate the payback period as follows:

=IRR(A2:A5,0%)

The result will be 3.5 years, which means the project will take 3.5 years to generate enough returns to cover its initial cost.

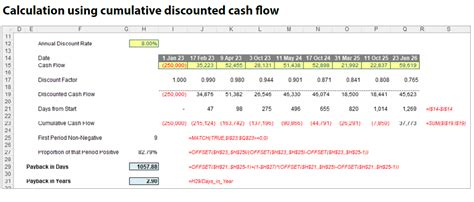

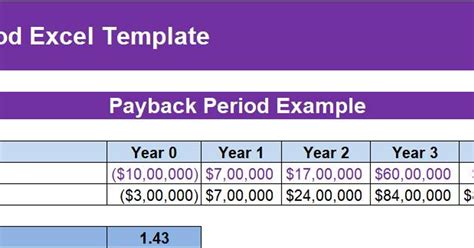

Method 4: Using a Payback Period Calculator Template

You can use a payback period calculator template in Excel to calculate the payback period. This template provides a simple and easy-to-use interface to calculate the payback period.

Example:

Suppose you want to calculate the payback period for a project that requires an initial investment of $10,000 and generates an annual cash flow of $2,500.

You can enter the data into the template as follows:

| A | B | |

|---|---|---|

| 1 | Total Investment | $10,000 |

| 2 | Annual Cash Flow | $2,500 |

The template will calculate the payback period and display the result.

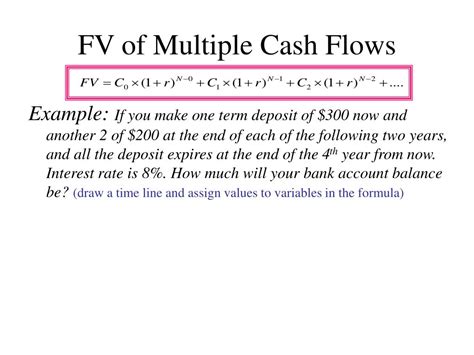

Method 5: Using a Formula with Multiple Cash Flows

You can use a formula with multiple cash flows to calculate the payback period in Excel. This formula takes into account the initial investment and multiple cash flows.

Example:

Suppose you want to calculate the payback period for a project that requires an initial investment of $10,000 and generates the following cash flows:

| A | B | |

|---|---|---|

| 1 | Year 1 | $2,000 |

| 2 | Year 2 | $2,500 |

| 3 | Year 3 | $3,000 |

| 4 | Year 4 | $3,500 |

You can use the formula as follows:

=SUMPRODUCT((A2:A5>0)*(A2:A5/C2:C5))

The result will be 3.5 years, which means the project will take 3.5 years to generate enough returns to cover its initial cost.

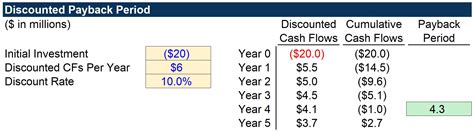

Gallery of Payback Period Calculations

Payback Period Calculations Gallery

In conclusion, calculating the payback period in Excel is a straightforward process that can be accomplished using various methods. By following the steps outlined in this article, you can easily calculate the payback period for any project or investment. Remember to choose the method that best suits your needs and data.