Calculate Nevada sales tax easily with our guide, covering tax rates, exemptions, and online calculators for accurate computation and filing, including local options and retail sales.

Calculating sales tax in Nevada can seem like a daunting task, but it doesn't have to be. With the right tools and knowledge, you can easily determine how much sales tax you owe on your purchases. In this article, we will explore five ways to calculate Nevada sales tax, making it easier for you to understand and comply with the state's tax laws. Whether you're a business owner or an individual, knowing how to calculate sales tax is crucial for avoiding penalties and ensuring you're in good standing with the state.

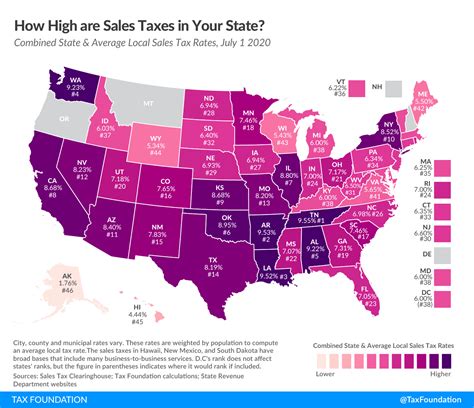

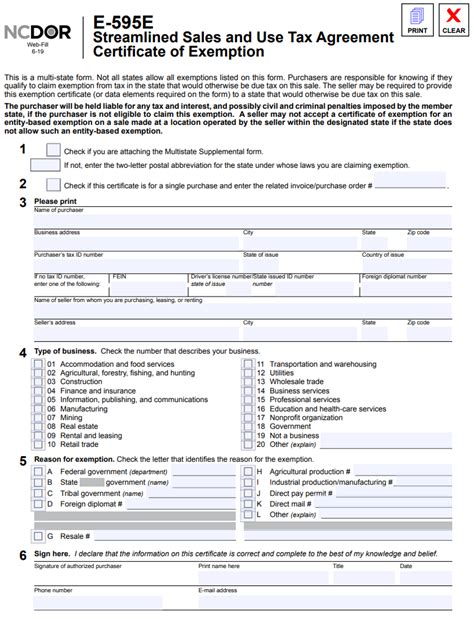

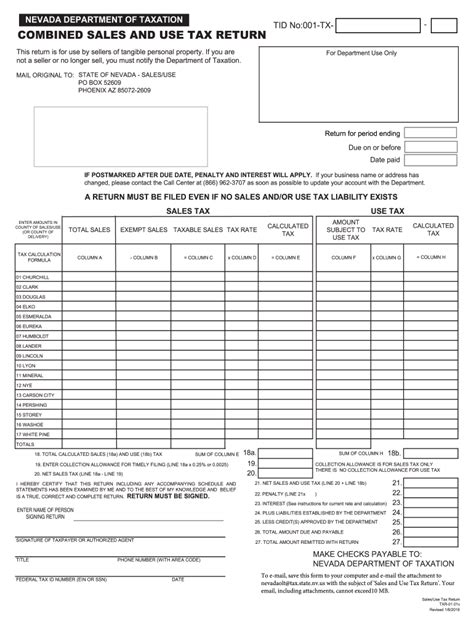

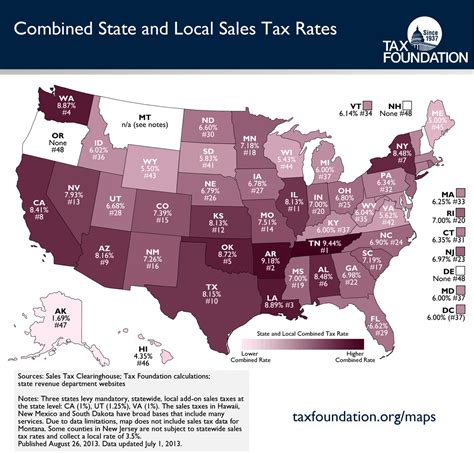

Nevada sales tax is a combined rate that includes both state and local taxes. The state sales tax rate is 6.85%, and local jurisdictions can add their own rates on top of that. This means that the total sales tax rate can vary depending on where you are in the state. For example, in Clark County, which includes Las Vegas, the total sales tax rate is 8.38%, while in Washoe County, which includes Reno, the total sales tax rate is 8.265%. Understanding these rates is essential for accurate sales tax calculation.

The importance of calculating sales tax correctly cannot be overstated. Not only can incorrect calculations result in fines and penalties, but they can also impact your business's bottom line. By taking the time to learn how to calculate sales tax, you can avoid costly mistakes and ensure that you're in compliance with Nevada's tax laws. In the following sections, we will delve into the five ways to calculate Nevada sales tax, providing you with a comprehensive understanding of the process.

Understanding Nevada Sales Tax Rates

Breaking Down the Tax Rates

The tax rates in Nevada can be broken down into several components: * State sales tax rate: 6.85% * Local sales tax rate: varies by jurisdiction, ranging from 0.5% to 3.3% * Combined sales tax rate: varies by jurisdiction, ranging from 7.35% to 8.38% Understanding these rates is essential for calculating sales tax accurately.Using a Sales Tax Calculator

Benefits of Using a Sales Tax Calculator

Using a sales tax calculator has several benefits, including: * Accuracy: Sales tax calculators can provide accurate calculations, reducing the risk of errors. * Convenience: Sales tax calculators are easy to use and can save time. * Accessibility: Sales tax calculators are available online, making them accessible from anywhere.Calculating Sales Tax Manually

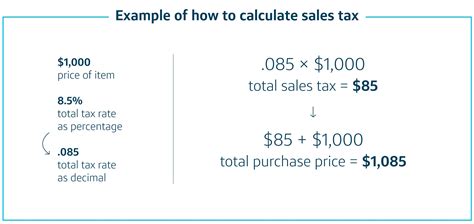

Step-by-Step Instructions

To calculate sales tax manually, follow these steps: 1. Determine the purchase amount. 2. Determine the applicable tax rate. 3. Multiply the purchase amount by the tax rate. 4. Round the result to the nearest cent.Using a Spreadsheet to Calculate Sales Tax

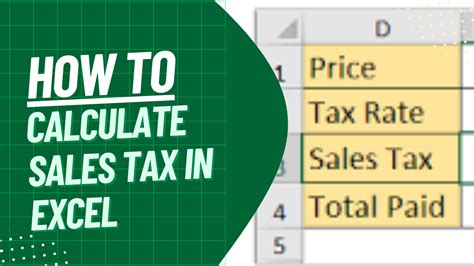

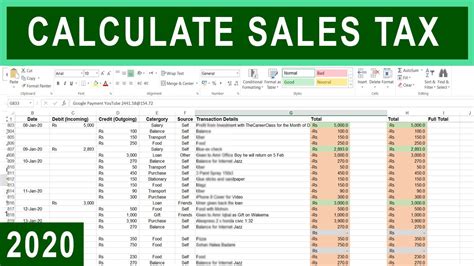

Benefits of Using a Spreadsheet

Using a spreadsheet to calculate sales tax has several benefits, including: * Organization: Spreadsheets can help you keep track of multiple purchases and sales tax calculations. * Accuracy: Spreadsheets can provide accurate calculations, reducing the risk of errors. * Flexibility: Spreadsheets can be customized to meet your specific needs.Consulting with a Tax Professional

Benefits of Consulting with a Tax Professional

Consulting with a tax professional has several benefits, including: * Expertise: Tax professionals have extensive knowledge of tax laws and regulations. * Accuracy: Tax professionals can provide accurate calculations, reducing the risk of errors. * Peace of mind: Consulting with a tax professional can give you peace of mind, knowing that your sales tax calculations are accurate and compliant with Nevada's tax laws.5 Ways to Calculate Nevada Sales Tax

Choosing the Best Method

The best method for calculating Nevada sales tax depends on your specific needs and preferences. If you want a quick and easy solution, using a sales tax calculator may be the best option. If you prefer to calculate sales tax manually, you can do so by multiplying the purchase amount by the applicable tax rate. If you need to calculate sales tax for multiple purchases or if you want to keep a record of your sales tax calculations, using a spreadsheet may be the best option. If you're unsure about how to calculate Nevada sales tax or if you have complex tax situation, consulting with a tax professional may be the best option.Nevada Sales Tax Image Gallery

We hope this article has provided you with a comprehensive understanding of how to calculate Nevada sales tax. Whether you're a business owner or an individual, knowing how to calculate sales tax is crucial for avoiding penalties and ensuring you're in good standing with the state. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may find it helpful, and let's work together to make sales tax calculation easier and more accurate for everyone. Take the first step today and start calculating your Nevada sales tax with confidence!