Calculating simple interest in Excel can be a straightforward process, and with the right formulas and techniques, you can easily compute the interest on your investments or loans. In this article, we will explore the basics of simple interest, how to calculate it manually, and how to use Excel formulas to make the process easier.

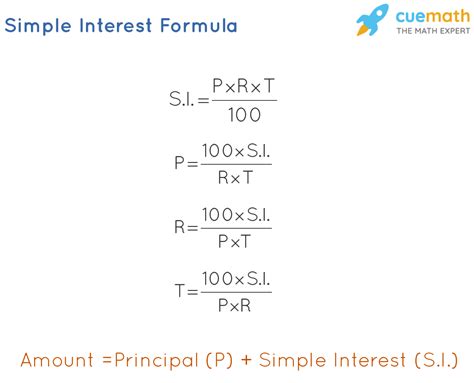

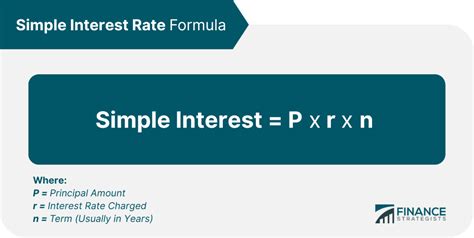

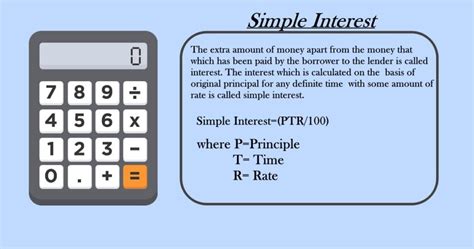

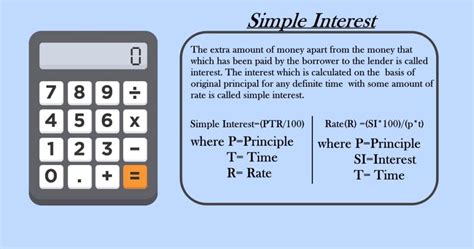

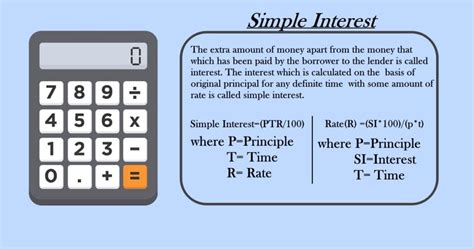

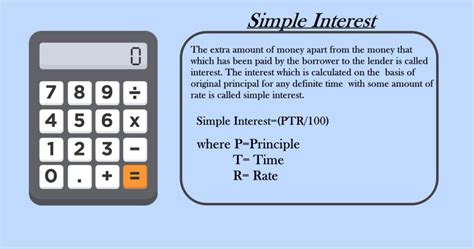

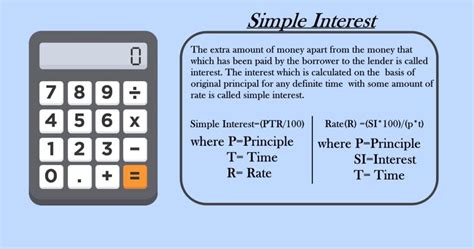

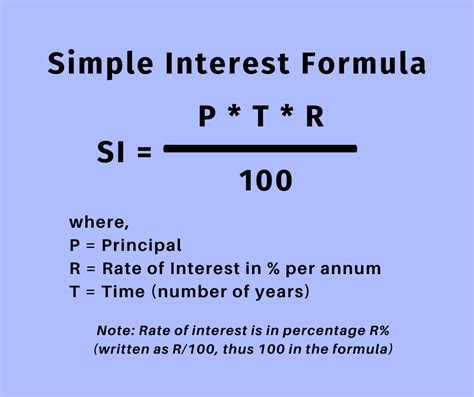

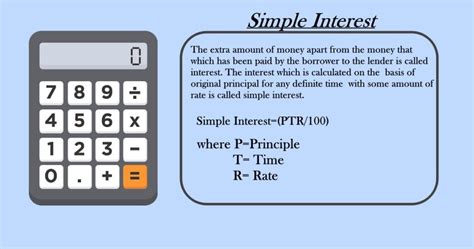

Simple interest is a type of interest that is calculated as a percentage of the principal amount borrowed or invested. It is commonly used in savings accounts, certificates of deposit, and bonds. The formula for calculating simple interest is:

Simple Interest = Principal x Rate x Time

Where:

- Principal is the initial amount borrowed or invested

- Rate is the interest rate as a decimal

- Time is the time period in years

For example, let's say you deposit $1,000 into a savings account that earns a 2% interest rate per year. After one year, the interest earned would be:

Simple Interest = $1,000 x 0.02 x 1 = $20

The total amount in the account after one year would be:

$1,000 (Principal) + $20 (Interest) = $1,020

Now, let's see how to calculate simple interest in Excel.

Calculating Simple Interest in Excel

To calculate simple interest in Excel, you can use the following formula:

=PrincipalRateTime

Where:

- Principal is the initial amount borrowed or invested

- Rate is the interest rate as a decimal

- Time is the time period in years

For example, let's say you want to calculate the interest on a $1,000 deposit that earns a 2% interest rate per year for 5 years. You can enter the following formula in Excel:

=10000.025

The result would be:

$100

This is the total interest earned on the deposit over 5 years.

Using Excel Functions to Calculate Simple Interest

Excel provides several functions that can be used to calculate simple interest, including the IPMT function and the ACCRINT function.

The IPMT function calculates the interest portion of a payment for a loan or investment based on the principal, rate, and time. The syntax for the IPMT function is:

IPMT(rate, per, nper, pv, [fv], [type])

Where:

- rate is the interest rate per period

- per is the payment period

- nper is the total number of payment periods

- pv is the present value (the initial amount borrowed or invested)

- fv is the future value (the total amount paid or received)

- type is the type of interest (0 for simple interest, 1 for compound interest)

For example, let's say you want to calculate the interest on a $1,000 deposit that earns a 2% interest rate per year for 5 years. You can enter the following formula in Excel:

=IPMT(0.02, 1, 5, 1000)

The result would be:

$20

This is the interest earned on the deposit for the first year.

The ACCRINT function calculates the accrued interest on a security that pays periodic interest. The syntax for the ACCRINT function is:

ACCRINT(issue, first_interest, settlement, rate, [par], [frequency])

Where:

- issue is the issue date of the security

- first_interest is the first interest date of the security

- settlement is the settlement date of the security

- rate is the interest rate

- par is the par value of the security

- frequency is the frequency of interest payments

For example, let's say you want to calculate the accrued interest on a bond that pays 5% interest per year, with a par value of $1,000, and a settlement date of 5 years from now. You can enter the following formula in Excel:

=ACCRINT(TODAY(), TODAY()+365, TODAY()+365*5, 0.05, 1000)

The result would be:

$250

This is the accrued interest on the bond over 5 years.

Calculating Simple Interest with Multiple Interest Rates

In some cases, you may need to calculate simple interest with multiple interest rates. For example, let's say you have a savings account that earns a 2% interest rate for the first year, and then a 3% interest rate for the next 4 years. To calculate the total interest earned, you can use the following formula:

=PrincipalRate1Time1 + PrincipalRate2Time2

Where:

- Principal is the initial amount borrowed or invested

- Rate1 is the first interest rate as a decimal

- Time1 is the time period for the first interest rate in years

- Rate2 is the second interest rate as a decimal

- Time2 is the time period for the second interest rate in years

For example, let's say you deposit $1,000 into a savings account that earns a 2% interest rate for the first year, and then a 3% interest rate for the next 4 years. You can enter the following formula in Excel:

=10000.021 + 10000.034

The result would be:

$130

This is the total interest earned on the deposit over 5 years.

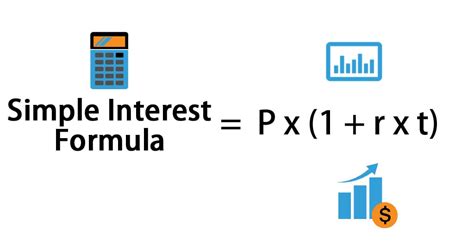

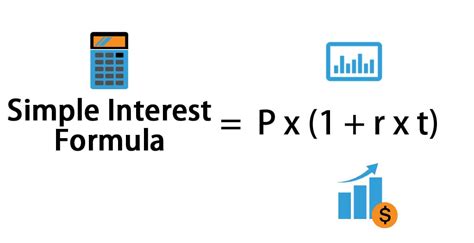

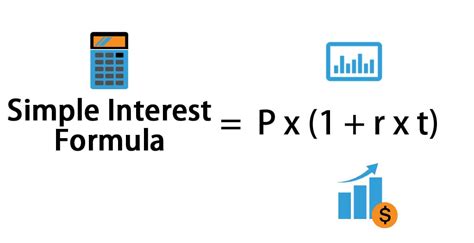

Calculating Simple Interest with Compound Interest

In some cases, you may need to calculate simple interest with compound interest. Compound interest is the interest on both the principal and any accrued interest. To calculate compound interest, you can use the following formula:

A = P x (1 + r/n)^(nt)

Where:

- A is the future value of the investment/loan, including interest

- P is the principal investment amount (the initial deposit or loan amount)

- r is the annual interest rate (in decimal)

- n is the number of times that interest is compounded per year

- t is the number of years the money is invested or borrowed for

For example, let's say you deposit $1,000 into a savings account that earns a 2% interest rate per year, compounded annually, for 5 years. You can enter the following formula in Excel:

=1000*(1+0.02/1)^(1*5)

The result would be:

$1,104.08

This is the future value of the deposit over 5 years, including compound interest.

Simple Interest Calculator in Excel

You can create a simple interest calculator in Excel using the formulas and techniques discussed above. Here's an example of how you can create a simple interest calculator:

- Create a table with the following columns:

- Principal

- Rate

- Time

- Interest

- Enter the principal amount, interest rate, and time period in the corresponding columns.

- Use the simple interest formula to calculate the interest earned, and enter the formula in the Interest column.

- Use the IPMT function or ACCRINT function to calculate the interest portion of a payment or the accrued interest on a security.

- Create a chart or graph to visualize the interest earned over time.

By following these steps, you can create a simple interest calculator in Excel that can help you calculate interest on your investments or loans.

Gallery of Simple Interest Calculators

Simple Interest Calculators

We hope this article has helped you understand how to calculate simple interest in Excel. Whether you're a student, a business owner, or an individual investor, calculating simple interest can help you make informed decisions about your finances. By using the formulas and techniques discussed in this article, you can easily calculate simple interest in Excel and make the most of your investments or loans.

We encourage you to try out the simple interest calculator template in Excel and experiment with different scenarios to see how simple interest works. If you have any questions or need further clarification, please don't hesitate to ask.