When it comes to making financial decisions, understanding the return on investment (ROI) of a project or business venture is crucial. One key metric used to evaluate the viability of an investment is the payback period, which is the time it takes for the investment to generate returns equal to its initial cost. In this article, we will explore five easy ways to calculate the payback period in Excel.

The payback period is an important concept in finance, as it helps investors and businesses determine whether an investment is likely to generate returns within a reasonable timeframe. A shorter payback period generally indicates a more attractive investment opportunity.

What is Payback Period?

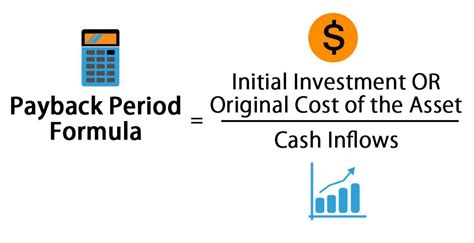

The payback period is the time it takes for an investment to break even, meaning that the returns generated by the investment equal the initial cost. It is typically expressed in years or months and is calculated by dividing the initial investment by the annual cash flows generated by the investment.

Why is Payback Period Important?

The payback period is important because it helps investors and businesses evaluate the risk and potential return on investment of a project or business venture. A shorter payback period generally indicates a lower risk investment, while a longer payback period may indicate a higher risk investment.

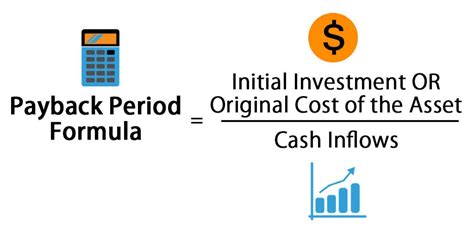

Method 1: Using the Payback Period Formula

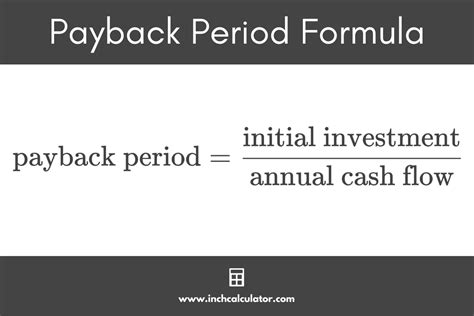

The payback period can be calculated using a simple formula in Excel:

Payback Period = Initial Investment / Annual Cash Flow

For example, if the initial investment is $10,000 and the annual cash flow is $2,000, the payback period would be:

Payback Period = $10,000 / $2,000 = 5 years

To calculate the payback period using this formula in Excel, follow these steps:

- Enter the initial investment in a cell (e.g. A1).

- Enter the annual cash flow in a cell (e.g. B1).

- In a third cell (e.g. C1), enter the formula: =A1/B1

- Press Enter to calculate the payback period.

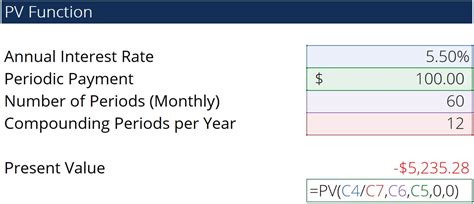

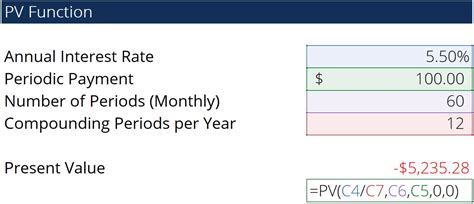

Method 2: Using the PV Function

The PV function in Excel can also be used to calculate the payback period. The PV function calculates the present value of a series of cash flows.

To use the PV function to calculate the payback period, follow these steps:

- Enter the initial investment in a cell (e.g. A1).

- Enter the annual cash flow in a cell (e.g. B1).

- In a third cell (e.g. C1), enter the formula: =PV(B1,A1,0)

- Press Enter to calculate the payback period.

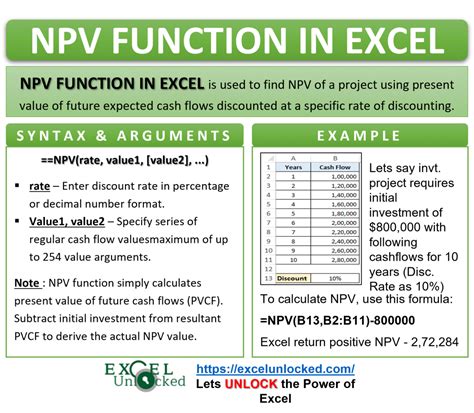

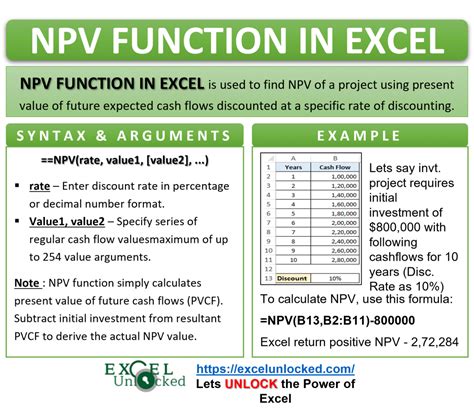

Method 3: Using the NPV Function

The NPV function in Excel can also be used to calculate the payback period. The NPV function calculates the net present value of a series of cash flows.

To use the NPV function to calculate the payback period, follow these steps:

- Enter the initial investment in a cell (e.g. A1).

- Enter the annual cash flow in a cell (e.g. B1).

- In a third cell (e.g. C1), enter the formula: =NPV(B1,A1,0)

- Press Enter to calculate the payback period.

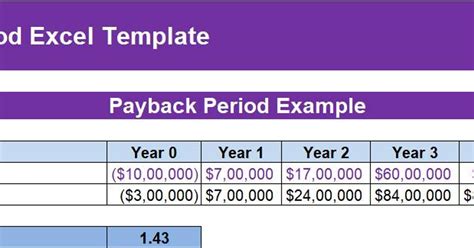

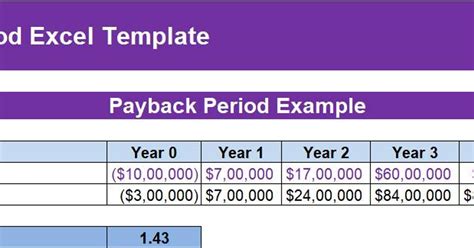

Method 4: Using a Payback Period Template

If you prefer not to use formulas, you can use a payback period template in Excel. A payback period template is a pre-built spreadsheet that allows you to enter the initial investment and annual cash flow, and calculates the payback period automatically.

To use a payback period template, follow these steps:

- Download a payback period template from a reputable website (e.g. Microsoft Excel templates).

- Enter the initial investment in the template (e.g. cell A1).

- Enter the annual cash flow in the template (e.g. cell B1).

- The template will calculate the payback period automatically.

Method 5: Using Excel Add-ins

If you use Excel frequently, you may want to consider using an Excel add-in to calculate the payback period. An Excel add-in is a software program that adds new functionality to Excel.

To use an Excel add-in to calculate the payback period, follow these steps:

- Download an Excel add-in from a reputable website (e.g. Excel add-ins).

- Install the add-in in Excel.

- Enter the initial investment and annual cash flow in the add-in.

- The add-in will calculate the payback period automatically.

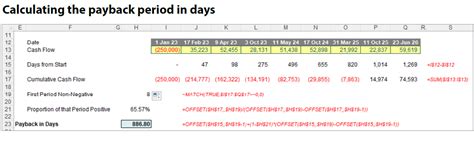

Gallery of Payback Period Calculation

Payback Period Calculation Gallery

We hope this article has provided you with a comprehensive understanding of how to calculate the payback period in Excel. Whether you use a formula, template, or Excel add-in, calculating the payback period is an essential step in evaluating the viability of an investment. Remember to always consider the payback period in conjunction with other financial metrics, such as ROI and net present value, to get a complete picture of an investment's potential.