When it comes to technical analysis in finance, the Relative Strength Index (RSI) is a popular indicator used to measure the magnitude of recent price changes to determine overbought or oversold conditions. Calculating RSI in Excel can be a bit tricky, but don't worry, we've got you covered. In this article, we'll explore five ways to calculate RSI in Excel.

Understanding RSI

Before we dive into the calculations, let's quickly review what RSI is and how it works. RSI is a momentum oscillator that measures the speed and change of price movements. It's calculated based on the average gain of up days and the average loss of down days over a specified period, usually 14 days. The RSI value ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

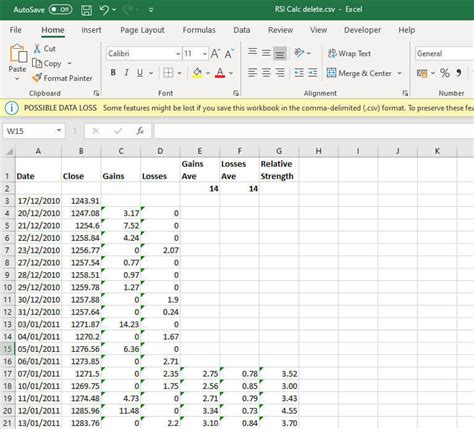

Method 1: Using Excel Formulas

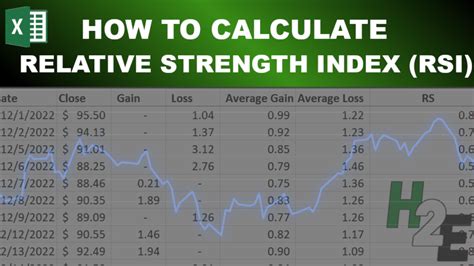

One way to calculate RSI in Excel is by using formulas. You'll need to create a table with the following columns: Date, Close Price, Gain, Loss, Average Gain, Average Loss, and RSI.

Assuming your data starts in cell A2, enter the following formulas:

- Gain:

=IF(C2>C1,C2-C1,0) - Loss:

=IF(C2<C1,C1-C2,0) - Average Gain:

=AVERAGE(Gain,14) - Average Loss:

=AVERAGE(Loss,14) - RSI:

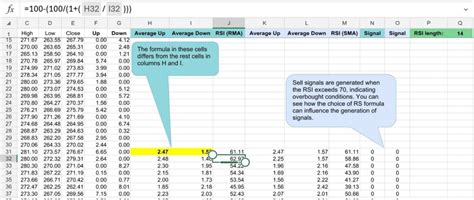

=100-(100/(1+(Average Gain/Average Loss)))

Method 2: Using Excel Functions

Another way to calculate RSI in Excel is by using built-in functions, specifically the AVERAGEIF and AVERAGEIFS functions.

Assuming your data starts in cell A2, enter the following formulas:

- Average Gain:

=AVERAGEIF(C:C,">"&C1,14) - Average Loss:

=AVERAGEIFS(C:C,C:C,"<"&C1,14) - RSI:

=100-(100/(1+(Average Gain/Average Loss)))

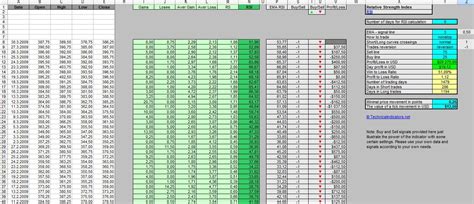

Method 3: Using Excel Add-ins

If you're not comfortable with formulas or functions, you can use Excel add-ins like the Analysis ToolPak or third-party add-ins like TradingSolutions.

These add-ins usually provide a user-friendly interface for calculating technical indicators, including RSI.

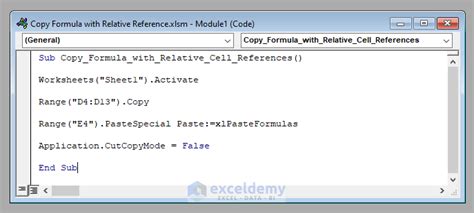

Method 4: Using VBA Macros

For more advanced users, you can create a VBA macro to calculate RSI in Excel.

You'll need to open the Visual Basic Editor, create a new module, and paste the following code:

Sub CalculateRSI()

' Define variables

Dim rsi As Double

Dim avgGain As Double

Dim avgLoss As Double

Dim i As Integer

' Loop through data

For i = 2 To lastRow

' Calculate gain and loss

gain = IIf(Cells(i, 3) > Cells(i - 1, 3), Cells(i, 3) - Cells(i - 1, 3), 0)

loss = IIf(Cells(i, 3) < Cells(i - 1, 3), Cells(i - 1, 3) - Cells(i, 3), 0)

' Calculate average gain and loss

avgGain = Application.AverageIf(Range("C:C"), ">0", 14)

avgLoss = Application.AverageIfs(Range("C:C"), Range("C:C"), "<0", 14)

' Calculate RSI

rsi = 100 - (100 / (1 + (avgGain / avgLoss)))

' Output RSI

Cells(i, 5) = rsi

Next i

End Sub

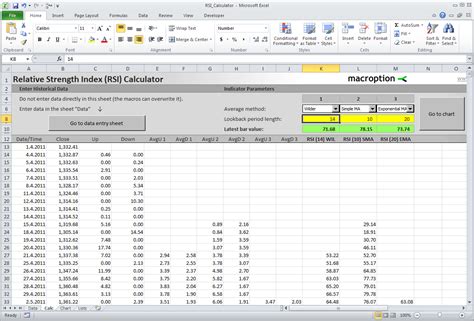

Method 5: Using Excel Templates

Finally, you can use pre-built Excel templates that include RSI calculations.

These templates usually provide a user-friendly interface for inputting data and calculating technical indicators, including RSI.

Gallery of RSI Calculation Methods

RSI Calculation Methods

In conclusion, calculating RSI in Excel can be done in various ways, from using formulas and functions to add-ins and VBA macros. Each method has its advantages and disadvantages, and the choice ultimately depends on your personal preference and level of expertise.

We hope this article has provided you with a comprehensive understanding of RSI calculation methods in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.