Intro

The Food Stamp program, also known as the Supplemental Nutrition Assistance Program (SNAP), is a vital assistance program designed to help low-income individuals and families access nutritious food. While the primary focus of the program is on providing support to those in need, there are situations where a sponsor may be involved in the application process. In this article, we will explore the concept of a sponsor applying for food stamps and delve into the eligibility criteria.

Understanding the Role of a Sponsor

A sponsor is typically an individual who has agreed to provide financial support to an immigrant or non-citizen who is applying for a green card or other immigration benefits. In the context of food stamps, a sponsor may be responsible for providing financial assistance to the applicant, which can impact their eligibility for the program. However, it is essential to note that the sponsor's financial situation is not directly considered when determining the applicant's eligibility for food stamps.

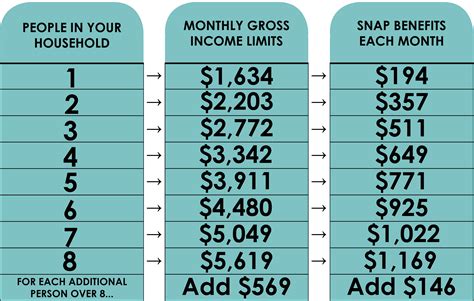

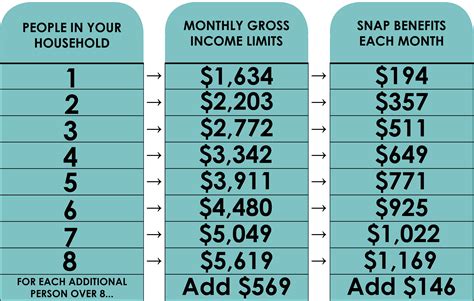

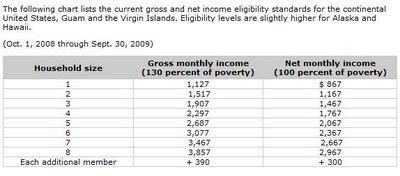

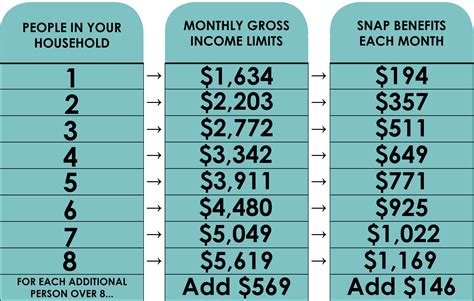

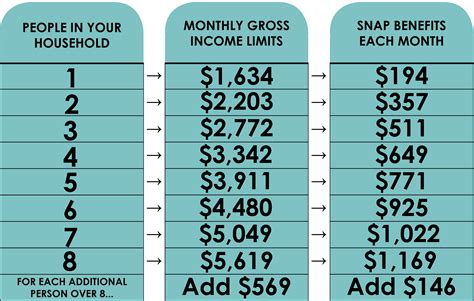

Eligibility Criteria for Food Stamps

To be eligible for food stamps, an individual or family must meet certain income and resource requirements. These requirements vary by state, but generally, an applicant's gross income must be at or below 130% of the federal poverty level, and their net income must be at or below 100% of the federal poverty level. Additionally, applicants must also meet certain resource requirements, such as having limited assets, including cash, savings, and investments.

Can a Sponsor Apply for Food Stamps?

A sponsor cannot directly apply for food stamps on behalf of the applicant. However, the sponsor's income and resources may be considered when determining the applicant's eligibility. If the sponsor provides financial support to the applicant, this support may be considered as part of the applicant's income. This is known as "deeming," and it can impact the applicant's eligibility for food stamps.

How Deeming Works

Deeming is a process where the income and resources of a sponsor are attributed to the applicant, which can affect their eligibility for food stamps. The deeming process typically involves calculating the sponsor's income and resources and then attributing a portion of these to the applicant. The amount of income and resources deemed to the applicant will depend on the sponsor's financial situation and the applicant's circumstances.

Types of Income and Resources Subject to Deeming

Not all types of income and resources are subject to deeming. Generally, the following types of income and resources may be considered:

- Earned income, such as wages and salaries

- Unearned income, such as interest and dividends

- Cash and savings

- Investments, such as stocks and bonds

- Real estate, excluding the sponsor's primary residence

Exemptions from Deeming

There are certain exemptions from deeming, which can vary by state. For example:

- Income and resources that are exempt from consideration, such as Supplemental Security Income (SSI) benefits

- Income and resources that are not considered available, such as income that is necessary for the sponsor's own support

- Income and resources that are received by the applicant but not considered available, such as income received by a minor child

Applying for Food Stamps as a Sponsor

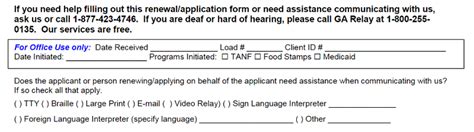

While a sponsor cannot directly apply for food stamps, they may be required to provide information about their income and resources as part of the application process. This information will be used to determine the applicant's eligibility for food stamps.

Gathering Required Documents

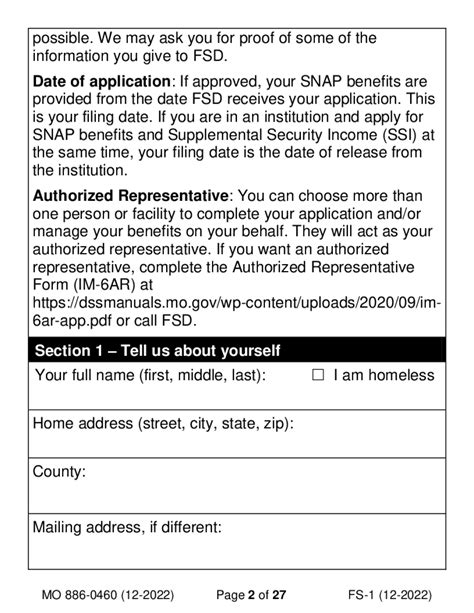

To apply for food stamps, the sponsor will need to gather certain documents, including:

- Proof of income, such as pay stubs and tax returns

- Proof of resources, such as bank statements and investment documents

- Identification, such as a driver's license or passport

- Proof of immigration status, if applicable

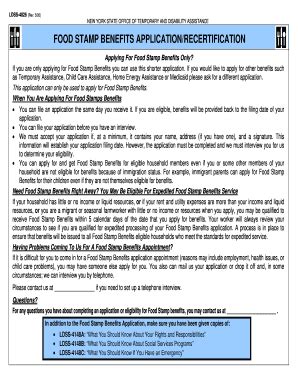

Submitting the Application

Once all required documents have been gathered, the sponsor can submit the application to the local social services office or online, depending on the state's application process.

What Happens After Submitting the Application?

After submitting the application, the local social services office will review the application and determine the applicant's eligibility for food stamps. This may involve a phone or in-person interview to gather additional information.

Denial of Benefits

If the applicant is found ineligible for food stamps, the sponsor will be notified of the decision and the reasons for the denial. The sponsor may appeal the decision if they believe it was made in error.

Renewing Benefits

If the applicant is found eligible for food stamps, the sponsor will need to renew the benefits periodically, typically every 6-12 months. This will involve submitting an updated application and providing proof of continued eligibility.

Conclusion

In conclusion, while a sponsor cannot directly apply for food stamps, their income and resources may be considered when determining the applicant's eligibility. Understanding the deeming process and exemptions is crucial for sponsors who are providing financial support to applicants. By gathering required documents and submitting the application, sponsors can help applicants access vital nutrition assistance.

Gallery of Food Stamp Sponsor Eligibility

Food Stamp Sponsor Eligibility Image Gallery

FAQs

Q: Can a sponsor apply for food stamps on behalf of the applicant? A: No, a sponsor cannot directly apply for food stamps on behalf of the applicant. However, the sponsor's income and resources may be considered when determining the applicant's eligibility.

Q: What types of income and resources are subject to deeming? A: Earned income, unearned income, cash and savings, investments, and real estate, excluding the sponsor's primary residence.

Q: Are there any exemptions from deeming? A: Yes, certain types of income and resources are exempt from deeming, such as Supplemental Security Income (SSI) benefits.

Q: How often do I need to renew food stamp benefits? A: Typically every 6-12 months.

Q: What happens if my application is denied? A: You will be notified of the decision and the reasons for the denial. You may appeal the decision if you believe it was made in error.