Intro

Discover how 1099 income affects food stamp eligibility. Learn about SNAP benefits, gross income calculations, and how freelance or self-employment income impacts your application. Understand the rules and regulations surrounding 1099 income and food stamps to ensure you receive the benefits youre entitled to. Get informed, apply with confidence.

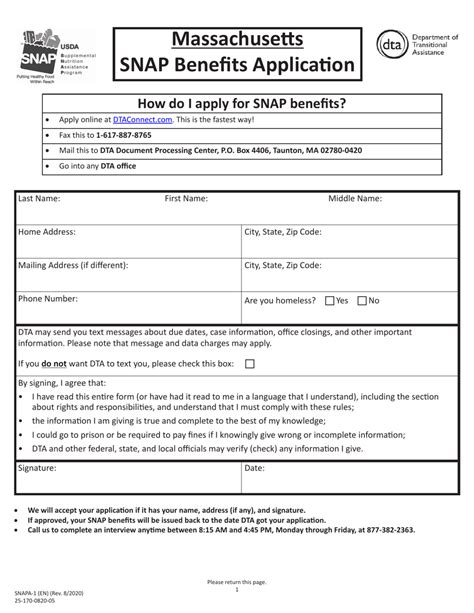

The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a government-funded program that provides financial assistance to low-income individuals and families to purchase food. When applying for SNAP benefits, understanding how different types of income are considered is crucial. In this article, we will explore how 1099 income is treated when applying for food stamps.

What is 1099 Income?

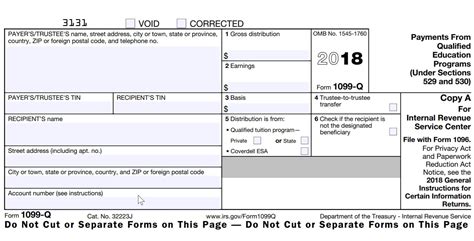

1099 income refers to income earned by individuals who are not employees of a company, but rather independent contractors or freelancers. This type of income is reported on a 1099-MISC form, which is filed with the Internal Revenue Service (IRS) by the payer. Examples of 1099 income include freelance writing, consulting, and independent contractor work.

How is 1099 Income Treated for SNAP Benefits?

When applying for SNAP benefits, the income of all household members is considered. 1099 income is treated as self-employment income, and it is subject to certain rules and deductions.

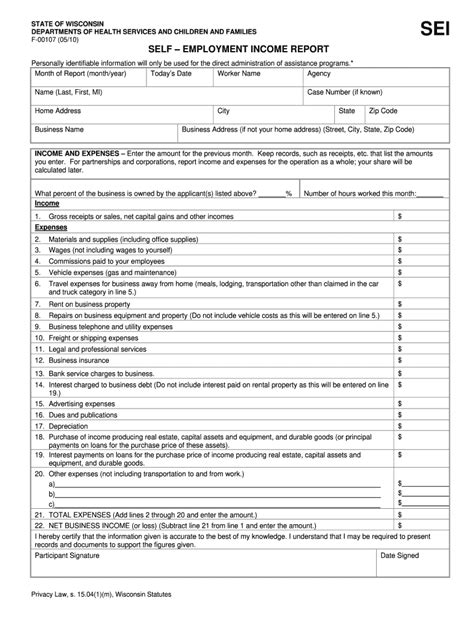

To calculate the amount of 1099 income that is counted towards SNAP eligibility, the following steps are taken:

- Gross Income: The gross amount of 1099 income is reported on the application.

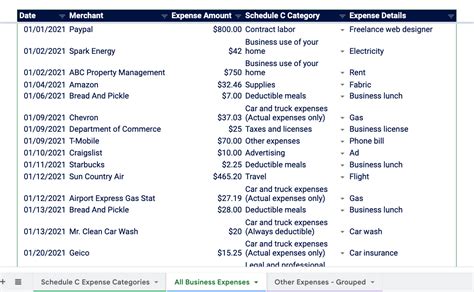

- Business Expenses: Certain business expenses can be deducted from the gross income to calculate the net income. These expenses may include costs related to the business, such as supplies, equipment, and travel expenses.

- Net Income: The net income is calculated by subtracting the business expenses from the gross income.

Which Business Expenses are Allowed?

Not all business expenses are allowed when calculating net income for SNAP benefits. The following expenses are typically allowed:

- Costs of goods sold

- Rent or mortgage interest

- Utilities

- Equipment and supplies

- Travel expenses

However, the following expenses are not allowed:

- Personal expenses, such as food and entertainment

- Expenses related to the purchase of a home or other property

- Expenses related to the operation of a vehicle for personal use

How is 1099 Income Counted Towards SNAP Eligibility?

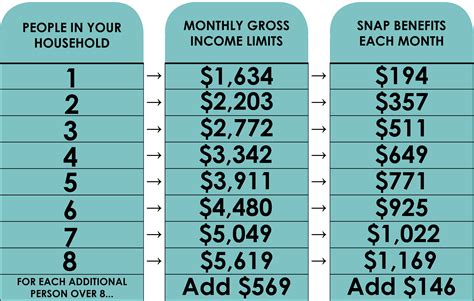

Once the net income from 1099 income is calculated, it is counted towards SNAP eligibility. The amount of income that is counted varies depending on the state and the individual's circumstances.

In general, the net income from 1099 income is counted as follows:

- 50% of the net income is counted towards the gross income limit

- The remaining 50% is disregarded

For example, if an individual has a net income of $1,000 from 1099 income, $500 would be counted towards the gross income limit, and the remaining $500 would be disregarded.

Other Factors that Affect SNAP Eligibility

While 1099 income is an important factor in determining SNAP eligibility, it is not the only factor. Other factors that are considered include:

- Gross income from all sources

- Household size and composition

- Expenses, such as rent or mortgage payments, utilities, and childcare costs

- Assets, such as cash, savings, and property

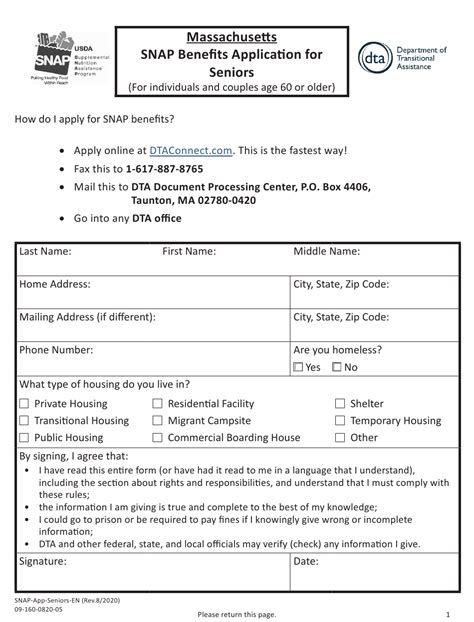

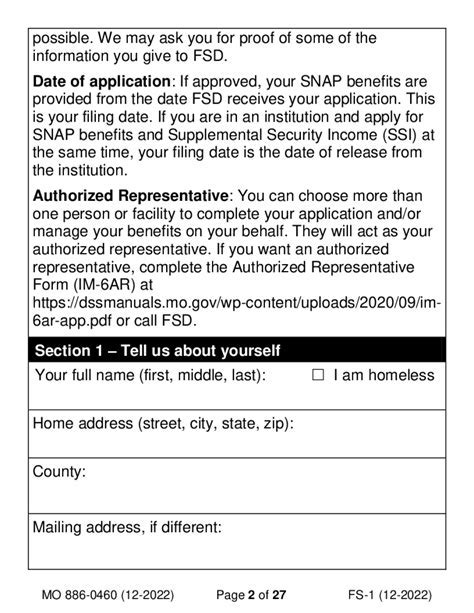

How to Report 1099 Income on a SNAP Application

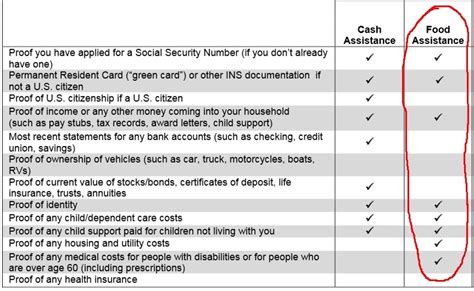

When applying for SNAP benefits, it is essential to accurately report 1099 income. The following documents may be required:

- 1099-MISC form

- Business expense records

- Proof of business income

It is recommended that applicants consult with a SNAP eligibility worker or a certified accountant to ensure that 1099 income is accurately reported and that all eligible business expenses are claimed.

Conclusion

In conclusion, 1099 income is considered when applying for SNAP benefits. The income is treated as self-employment income, and certain business expenses can be deducted to calculate the net income. Understanding how 1099 income is counted towards SNAP eligibility is crucial to ensure that applicants receive the correct amount of benefits.

Gallery of Food Stamps and 1099 Income

Food Stamps and 1099 Income Gallery

We hope this article has provided you with a comprehensive understanding of how 1099 income is considered when applying for SNAP benefits. If you have any further questions or concerns, please feel free to ask in the comments section below.