Intro

Receiving a tax refund can be a significant relief for many individuals, especially those who rely on government assistance programs like food stamps to make ends meet. However, some people may be concerned that their tax refund could be taken by the government to pay off debts related to their food stamp benefits. In this article, we will explore the circumstances under which food stamps could take your tax refund and what you can do to minimize the risk.

What are Food Stamps?

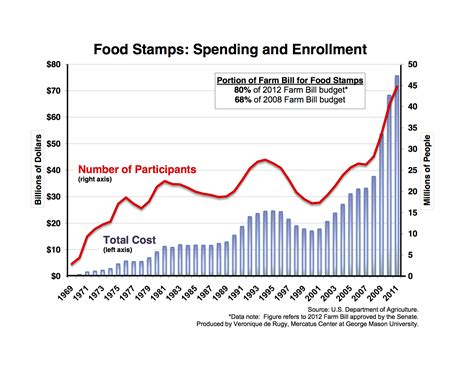

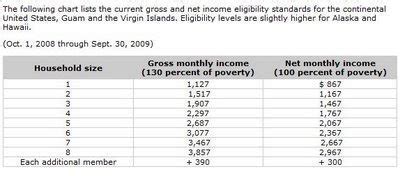

Before we dive into the topic of tax refunds and food stamps, let's briefly explain what food stamps are. The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a government program that provides financial assistance to low-income individuals and families to purchase food. The program is administered by the United States Department of Agriculture (USDA) and is funded by the federal government.

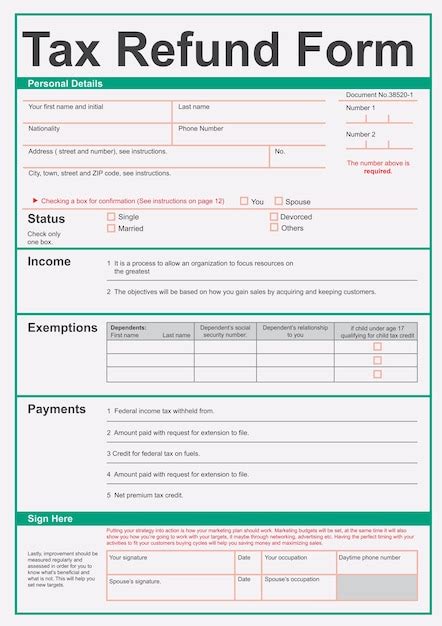

Can Food Stamps Take Your Tax Refund?

In some cases, yes, food stamps can take your tax refund. This can happen if you owe a debt related to your food stamp benefits, such as an overpayment or a penalty. The government can use your tax refund to offset these debts through a process called tax refund offset.

What is Tax Refund Offset?

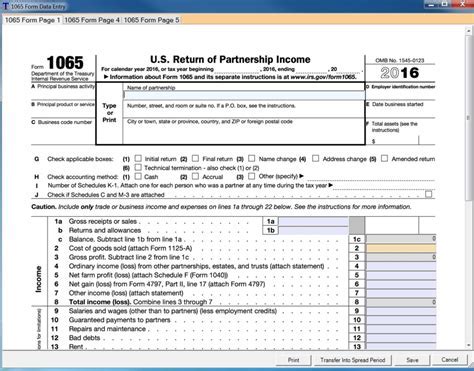

Tax refund offset is a program administered by the Treasury Department's Bureau of the Fiscal Service (BFS) that allows government agencies to collect debts from individuals by offsetting their tax refunds. When you file your taxes, the IRS will check if you owe any debts to government agencies, including debts related to food stamps. If you do, the BFS will offset your tax refund to pay off these debts.

Why Might Food Stamps Take Your Tax Refund?

There are several reasons why food stamps might take your tax refund. Some of the most common reasons include:

- Overpayment: If you received more food stamp benefits than you were eligible for, you may be required to repay the excess amount.

- Penalty: If you failed to report changes in your income or household composition, you may be subject to a penalty.

- Administrative error: In some cases, administrative errors can result in an overpayment or penalty.

How to Minimize the Risk of Food Stamps Taking Your Tax Refund

While it's impossible to completely eliminate the risk of food stamps taking your tax refund, there are steps you can take to minimize it. Here are some tips:

- Report changes in your income or household composition promptly.

- Verify your eligibility for food stamp benefits before applying.

- Keep accurate records of your food stamp benefits and tax refunds.

- If you owe a debt related to your food stamp benefits, try to pay it off before tax season.

What to Do if Food Stamps Take Your Tax Refund

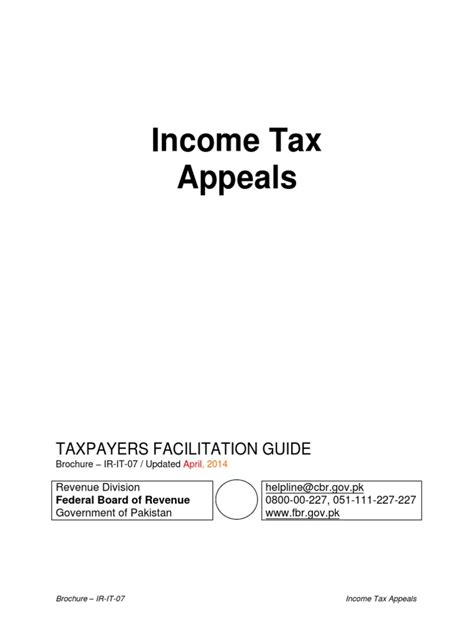

If food stamps take your tax refund, you may be able to appeal the decision or negotiate a payment plan. Here are some steps you can take:

- Contact the food stamp agency: Reach out to the agency that administered your food stamp benefits to inquire about the debt and the tax refund offset.

- Appeal the decision: If you disagree with the decision to take your tax refund, you can appeal it. You will need to provide documentation to support your appeal.

- Negotiate a payment plan: If you are unable to pay the debt in full, you may be able to negotiate a payment plan.

Gallery of Food Stamps and Tax Refund Images

Food Stamps and Tax Refund Gallery

We hope this article has provided you with valuable information about food stamps and tax refunds. If you have any further questions or concerns, please don't hesitate to reach out. Share this article with others who may be interested in learning more about this topic.