Intro

Receiving cash assistance can be a vital lifeline for individuals and families in need. However, it's essential to understand how this type of assistance affects your tax filing. The impact of cash assistance on your taxes can vary depending on the type of assistance, the amount received, and your individual tax situation. In this article, we'll explore five ways cash assistance can affect your tax filing.

Understanding the Types of Cash Assistance

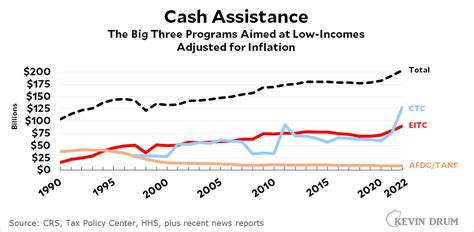

Before we dive into the tax implications of cash assistance, it's essential to understand the different types of assistance available. Some common types of cash assistance include:

- Temporary Assistance for Needy Families (TANF)

- Supplemental Security Income (SSI)

- Unemployment benefits

- Social Security benefits

- Cash assistance from non-profit organizations or charities

Each type of assistance has its own rules and regulations regarding taxability. It's crucial to understand the specific type of assistance you're receiving and how it's treated for tax purposes.

Tax Implications of Cash Assistance

Now that we've covered the types of cash assistance, let's explore the tax implications. Here are five ways cash assistance can affect your tax filing:

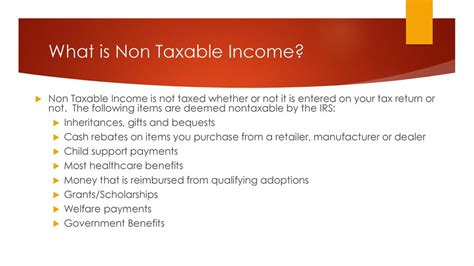

1. Taxable vs. Non-Taxable Assistance

Some types of cash assistance are taxable, while others are not. For example:

- Unemployment benefits are generally taxable and must be reported on your tax return.

- Social Security benefits may be taxable, depending on your income level.

- SSI benefits are not taxable.

- Cash assistance from non-profit organizations or charities may be tax-free, but this depends on the specific organization and the purpose of the assistance.

It's essential to understand whether the cash assistance you're receiving is taxable or non-taxable to ensure you're reporting it correctly on your tax return.

2. Reporting Cash Assistance on Your Tax Return

If you receive taxable cash assistance, you'll need to report it on your tax return. This typically involves completing a specific form or schedule, such as:

- Form 1099-G for unemployment benefits

- Schedule E (Form 1040) for Social Security benefits

- Form 1099-MISC for miscellaneous income, including cash assistance from non-profit organizations

Ensure you receive the necessary forms and instructions from the organization providing the assistance to accurately report the income on your tax return.

Consequences of Not Reporting Cash Assistance

Failing to report cash assistance on your tax return can result in penalties and interest. The IRS may also delay or deny your refund if they discover unreported income. It's crucial to accurately report all taxable cash assistance to avoid these consequences.

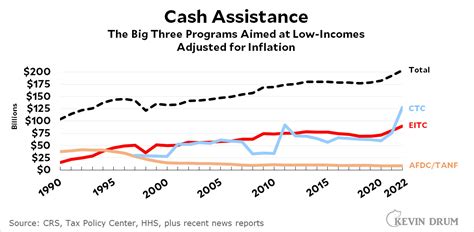

3. Impact on Tax Credits and Deductions

Cash assistance can impact your eligibility for tax credits and deductions. For example:

- Receiving cash assistance may affect your eligibility for the Earned Income Tax Credit (EITC).

- Cash assistance may be considered income when calculating your eligibility for other tax credits, such as the Child Tax Credit.

It's essential to understand how cash assistance affects your eligibility for tax credits and deductions to ensure you're taking advantage of all the tax savings available to you.

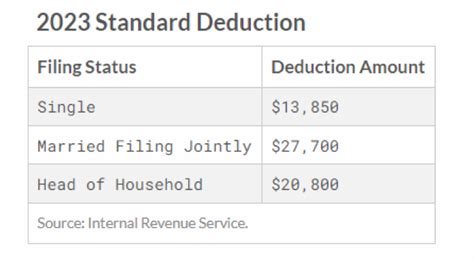

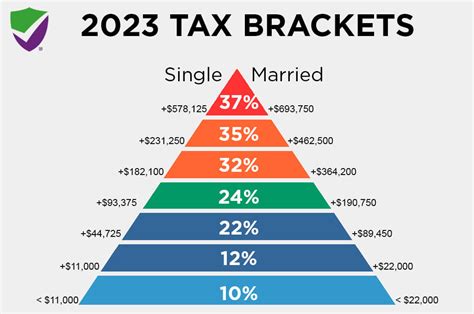

4. Effect on Your Tax Bracket

Receiving cash assistance can also impact your tax bracket. If you're receiving taxable cash assistance, it may increase your taxable income, potentially pushing you into a higher tax bracket. This could result in a higher tax liability.

However, some types of cash assistance, such as SSI benefits, are not taxable and will not affect your tax bracket.

5. Record-Keeping and Documentation

Finally, it's essential to maintain accurate records and documentation related to your cash assistance. This includes:

- Keeping copies of forms and schedules related to your cash assistance

- Documenting the type and amount of assistance received

- Retaining records of any correspondence with the organization providing the assistance

Accurate record-keeping will help ensure you're reporting the assistance correctly on your tax return and can provide evidence in case of an audit.

Conclusion

Receiving cash assistance can have a significant impact on your tax filing. It's essential to understand the tax implications of the assistance you're receiving, including whether it's taxable or non-taxable, how to report it on your tax return, and how it affects your eligibility for tax credits and deductions. By maintaining accurate records and seeking professional advice when needed, you can ensure you're navigating the tax implications of cash assistance with confidence.

Cash Assistance and Taxes Image Gallery