Intro

Discover if owning a home affects your eligibility for food stamps. Learn the rules and regulations surrounding food stamp benefits for homeowners, including asset limits, income requirements, and exceptions. Understand how your home ownership status impacts your ability to receive SNAP benefits and get the facts on qualifying for food assistance.

Owning a home is a significant accomplishment for many individuals and families. However, it can also raise questions about eligibility for government assistance programs, such as food stamps. In the United States, the Supplemental Nutrition Assistance Program (SNAP) provides food assistance to low-income individuals and families. The eligibility criteria for SNAP benefits vary from state to state, but generally, homeownership is not an automatic disqualifier.

To determine whether you can receive food stamps if you own a home, we need to explore the eligibility criteria and the role of assets in the SNAP program.

Eligibility Criteria for SNAP Benefits

To qualify for SNAP benefits, you must meet certain eligibility criteria, which include:

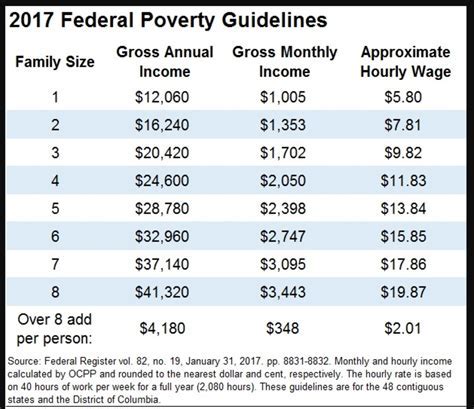

- Income: Your income must be below a certain threshold, which varies by state and household size.

- Resources: You must have limited resources, such as cash, savings, and other assets.

- Citizenship: You must be a U.S. citizen, national, or qualified non-citizen.

- Work Requirements: Able-bodied adults without dependents must work or participate in a work program to receive benefits.

The Role of Assets in SNAP Eligibility

Assets, including homeownership, play a significant role in determining SNAP eligibility. In most states, the value of your primary residence is exempt from the resource limit. This means that owning a home will not automatically disqualify you from receiving SNAP benefits.

However, other assets, such as:

- Cash and savings: These are counted towards the resource limit.

- Stocks and bonds: These are also counted towards the resource limit.

- Other real estate: If you own additional real estate, such as rental properties or vacation homes, the value of these properties may be counted towards the resource limit.

How Homeownership Affects SNAP Eligibility

Owning a home can affect your SNAP eligibility in several ways:

- Exempt from resource limit: As mentioned earlier, the value of your primary residence is exempt from the resource limit.

- Mortgage payments: Your mortgage payments may be considered a necessary expense, which can help reduce your income for SNAP eligibility purposes.

- Property taxes and insurance: These expenses may also be considered necessary expenses, which can help reduce your income for SNAP eligibility purposes.

However, if you own a home and have significant equity in the property, you may be subject to a ** asset test**. This test assesses the value of your assets, including your home, to determine whether you have excessive resources that would disqualify you from receiving SNAP benefits.

Steps to Take If You Own a Home and Need Food Stamps

If you own a home and are struggling to make ends meet, you may still be eligible for SNAP benefits. Here are some steps to take:

- Contact your local SNAP office: Reach out to your local SNAP office to discuss your eligibility and the application process.

- Gather required documents: You will need to provide documentation, such as proof of income, expenses, and assets.

- Apply for SNAP benefits: Submit your application and await a determination of your eligibility.

Frequently Asked Questions

Here are some frequently asked questions related to food stamps and homeownership:

FAQs

- Can I still get food stamps if I own a home? Yes, owning a home is not an automatic disqualifier for SNAP benefits. However, the value of your home may be subject to an asset test.

- Will my mortgage payments affect my SNAP eligibility? Yes, your mortgage payments may be considered a necessary expense, which can help reduce your income for SNAP eligibility purposes.

- Can I sell my home to qualify for SNAP benefits? While selling your home may seem like a viable option, it is essential to consider the potential consequences of doing so. You may want to explore other options, such as seeking assistance from a non-profit organization or a financial advisor.

Gallery of Food Stamps and Homeownership

Food Stamps and Homeownership Image Gallery

In conclusion, owning a home is not an automatic disqualifier for SNAP benefits. However, the value of your home may be subject to an asset test, and other factors, such as income and expenses, will be considered in determining your eligibility. If you are a homeowner struggling to make ends meet, it is essential to reach out to your local SNAP office to discuss your eligibility and the application process.

What's Next?

If you found this article informative and helpful, please share it with others who may be struggling to make ends meet. You can also leave a comment below with your thoughts or questions about food stamps and homeownership. Additionally, if you are a homeowner in need of food assistance, do not hesitate to reach out to your local SNAP office or a non-profit organization that provides food assistance and support.