The Supplemental Nutrition Assistance Program (SNAP), also known as food stamps, is a vital program that helps millions of Americans access nutritious food. However, the complexities of the program can be overwhelming, especially when it comes to taxes. The food stamp tax is a crucial aspect of the program that affects many recipients. In this article, we will delve into the world of food stamp tax, exploring its intricacies and providing you with the necessary information to navigate the system.

What is the Food Stamp Tax?

The food stamp tax is a tax on the benefits received by SNAP recipients. It's essential to understand that this tax is not a new concept, but rather a continuation of the existing tax laws. The tax is calculated based on the amount of benefits received, and it's typically a small percentage of the total benefits.

Who is Affected by the Food Stamp Tax?

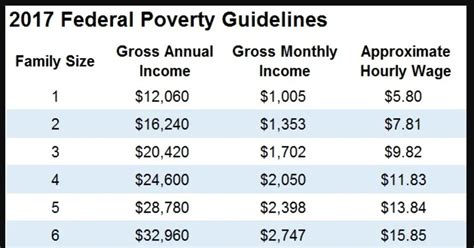

The food stamp tax affects a significant number of SNAP recipients. According to the USDA, over 40 million people participate in the SNAP program. While the tax may not be a substantial burden for some, it can be a significant challenge for those living on a tight budget.

How Does the Food Stamp Tax Work?

The food stamp tax is calculated based on the amount of benefits received by the SNAP recipient. The tax rate varies depending on the state and the individual's income level. In some states, the tax rate is as low as 1%, while in others, it can be as high as 10%.

Here's an example of how the food stamp tax works:

- Let's say a SNAP recipient receives $500 in benefits per month.

- The tax rate in their state is 5%.

- The tax amount would be $25 (5% of $500).

How to Calculate the Food Stamp Tax

Calculating the food stamp tax can be a bit complex, but it's essential to understand the process to ensure you're not overpaying or underpaying taxes. Here's a step-by-step guide to help you calculate the food stamp tax:

- Determine your monthly SNAP benefits.

- Check the tax rate in your state.

- Multiply the tax rate by the monthly benefits amount.

For example:

- Monthly SNAP benefits: $500

- Tax rate: 5%

- Tax amount: $25 (5% of $500)

Food Stamp Tax Exemptions

While the food stamp tax can be a significant burden, there are some exemptions available. These exemptions vary by state, so it's essential to check with your local authorities to determine if you qualify.

Some common exemptions include:

- Recipients with disabilities or blindness

- Recipients who are 60 years or older

- Recipients who receive Supplemental Security Income (SSI) benefits

Food Stamp Tax Deductions

In addition to exemptions, there are also some deductions available to reduce the food stamp tax liability. These deductions include:

- Medical expenses

- Child care expenses

- Education expenses

It's essential to keep receipts and documentation for these expenses, as they can help reduce your tax liability.

Food Stamp Tax Credits

The food stamp tax credit is a refundable credit that can help reduce your tax liability. The credit is based on the amount of taxes paid on your SNAP benefits.

Here's an example of how the food stamp tax credit works:

- Tax liability: $25

- Credit amount: $10

- Refund: $15 ($25 - $10)

How to Claim the Food Stamp Tax Credit

To claim the food stamp tax credit, you'll need to file a tax return and complete the necessary forms. You can file for the credit electronically or by mail.

Here's a step-by-step guide to help you claim the food stamp tax credit:

- Gather your tax documents, including your SNAP benefit statement.

- Complete Form 1040 and attach the necessary schedules.

- Claim the food stamp tax credit on Schedule 2.

- File your tax return electronically or by mail.

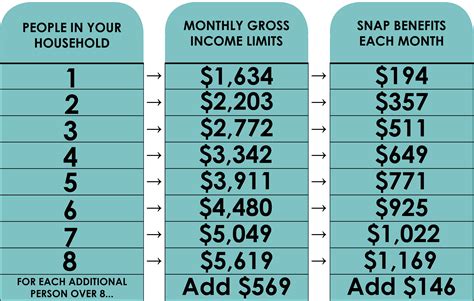

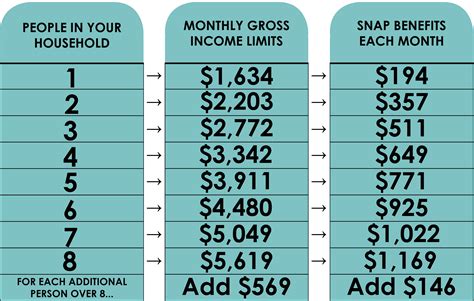

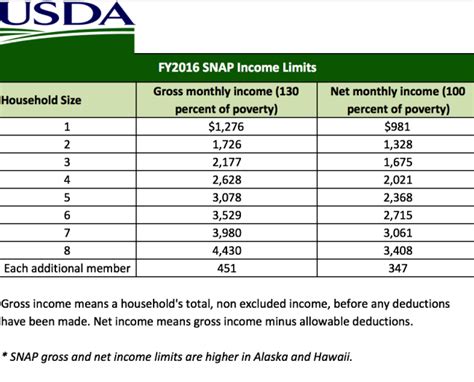

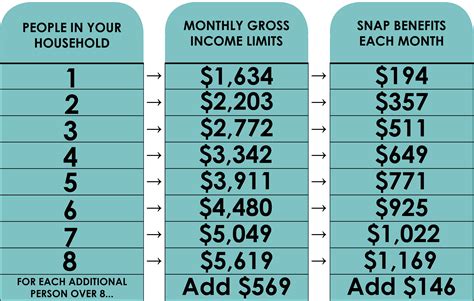

Food Stamp Tax Image Gallery

Final Thoughts

The food stamp tax can be a complex and overwhelming topic, but it's essential to understand the intricacies of the program to ensure you're not overpaying or underpaying taxes. By following the guidelines outlined in this article, you'll be better equipped to navigate the system and make informed decisions about your SNAP benefits.

Remember, the food stamp tax is a necessary aspect of the program, but it's also essential to take advantage of exemptions, deductions, and credits to reduce your tax liability. By staying informed and seeking help when needed, you can ensure you're getting the most out of your SNAP benefits.

We hope this article has provided you with the necessary information to understand the food stamp tax. If you have any questions or concerns, please don't hesitate to reach out. We're here to help.

Share Your Thoughts

Have you experienced any challenges with the food stamp tax? Do you have any questions or concerns about the program? Share your thoughts in the comments section below. Your input can help others who may be facing similar challenges.

By sharing your experiences and insights, you can help create a supportive community that's dedicated to making the food stamp tax more accessible and understandable. So don't be shy – share your thoughts and let's start a conversation!