Warning signs of a US economic crash are flashing. Is a dollar collapse imminent? Explore the alarming indicators, expert predictions, and potential consequences of a looming economic downturn. Discover the role of inflation, debt, and global market trends in shaping the US economys uncertain future.

The United States economy has been a cornerstone of global financial stability for decades, but there are growing concerns that a dollar collapse could be imminent. The notion of a US economic crash is a daunting prospect, with far-reaching implications for individuals, businesses, and governments around the world. In this article, we will delve into the factors that could contribute to a dollar collapse and explore the potential consequences of such an event.

Understanding the Dollar's Role in the Global Economy

The US dollar is the most widely traded and widely held currency in the world, serving as a reserve currency for many countries. Its stability and value are crucial for international trade, investment, and economic growth. However, the dollar's dominance is facing challenges from rising global powers, such as China, and the increasing use of alternative currencies, like the euro.

Factors Contributing to the Dollar's Decline

Several factors are contributing to the decline of the dollar's value and potentially setting the stage for a collapse:

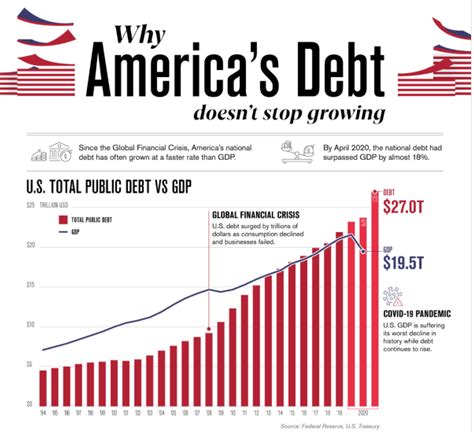

- National debt: The US national debt has surpassed $23 trillion, with no signs of slowing down. This level of debt can erode confidence in the dollar and lead to inflation.

- Trade deficits: The US has been running trade deficits for decades, which can weaken the dollar's value and make it less attractive to foreign investors.

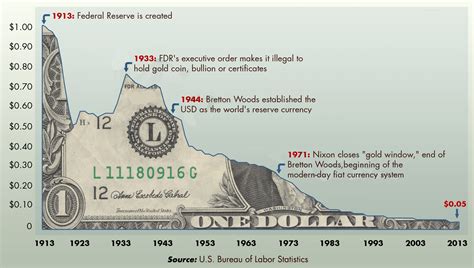

- Monetary policy: The Federal Reserve's expansionary monetary policies, including quantitative easing, have increased the money supply and potentially devalued the dollar.

- Global economic trends: The rise of emerging markets, particularly China, is challenging the dollar's status as a reserve currency.

The Consequences of a Dollar Collapse

A dollar collapse would have far-reaching consequences for the US economy and the world at large:

- Hyperinflation: A rapid decline in the dollar's value could lead to hyperinflation, rendering the currency nearly worthless and causing widespread economic disruption.

- Economic contraction: A dollar collapse would likely trigger a severe economic contraction, leading to widespread job losses, business failures, and a decline in living standards.

- Global instability: A US economic crash would have a ripple effect on the global economy, potentially leading to instability, trade wars, and social unrest.

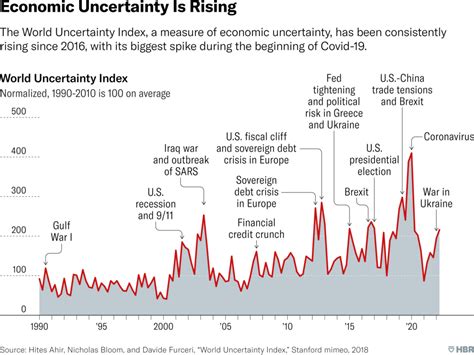

Warning Signs of a Dollar Collapse

While it is impossible to predict with certainty when or if a dollar collapse will occur, there are several warning signs that investors and policymakers should be aware of:

- Rising inflation: Increasing inflation rates can erode the dollar's value and lead to a collapse.

- Declining dollar reserves: A decline in foreign central banks' dollar reserves can indicate a loss of confidence in the currency.

- Increasing gold prices: Rising gold prices can be a sign of a declining dollar, as investors seek safe-haven assets.

Preparing for a Dollar Collapse

While no one can predict with certainty when or if a dollar collapse will occur, there are steps that individuals and businesses can take to prepare:

- Diversify investments: Spread investments across different asset classes, including foreign currencies, gold, and other safe-haven assets.

- Reduce debt: Minimize debt and avoid taking on new debt, especially in dollars.

- Build an emergency fund: Create an emergency fund to cover essential expenses in case of a dollar collapse.

Investment Strategies for a Dollar Collapse

Investors can prepare for a dollar collapse by adopting the following strategies:

- Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of the market's performance.

- Asset allocation: Allocate assets across different classes, including stocks, bonds, and alternative investments.

- Hedging: Use hedging strategies, such as options or futures, to mitigate potential losses.

Dollar Collapse Image Gallery

In conclusion, a dollar collapse is a possibility that cannot be ignored. While the consequences of such an event would be severe, there are steps that individuals and businesses can take to prepare. By understanding the factors contributing to the dollar's decline and taking proactive measures, investors can mitigate potential losses and protect their assets.