Intro

Snap insurance is a rapidly growing provider of affordable insurance options for individuals and families. Their focus on quick and easy sign-up processes, flexible plans, and affordable premiums has made them a popular choice among those seeking health insurance.

Now, when it comes to coverage for energy drinks, it's essential to understand the nuances of health insurance and how it relates to everyday expenses like beverages.

What Does Snap Insurance Cover?

Snap insurance offers a range of plans that cater to different needs and budgets. Their coverage typically includes essential health benefits, such as:

- Doctor visits and check-ups

- Hospital stays and surgical procedures

- Prescription medication

- Preventive care and screenings

- Maternity care

However, it's crucial to note that health insurance is designed to cover medical expenses, not everyday purchases like food and beverages.

Does Snap Insurance Cover Energy Drinks?

Energy drinks, including Monster Energy, are not considered a medical expense. Therefore, Snap insurance does not cover the cost of energy drinks.

Health insurance is intended to help policyholders manage medical expenses, not pay for everyday purchases. If you're looking to save money on energy drinks, consider exploring discounts, coupons, or loyalty programs offered by the manufacturer or retailers.

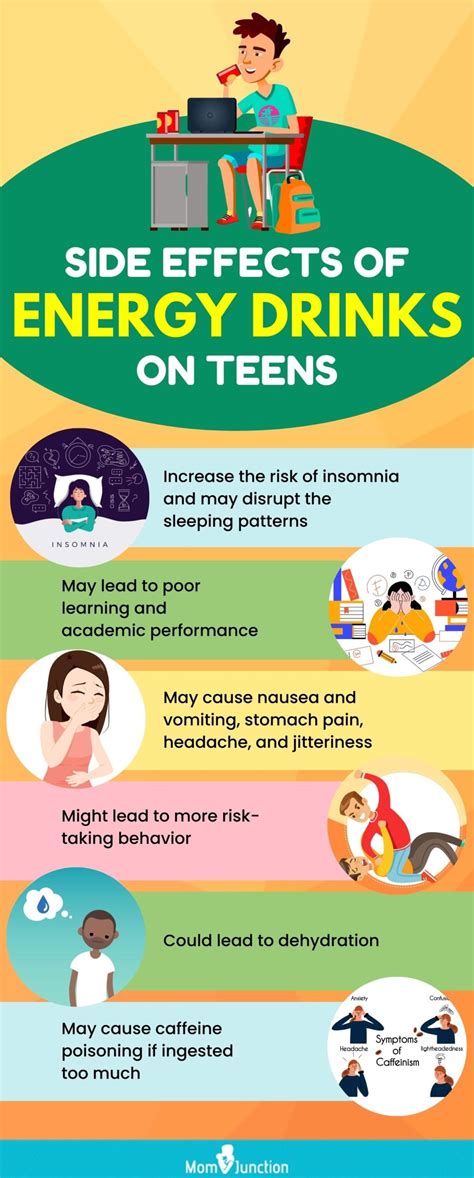

What About Medical Expenses Related to Energy Drink Consumption?

While Snap insurance won't cover the cost of energy drinks, it may cover medical expenses related to their consumption. For example, if you experience an adverse reaction or a medical condition due to excessive energy drink consumption, your insurance plan may cover the costs associated with diagnosis and treatment.

However, it's essential to review your policy documents and understand what's covered and what's not. If you have specific questions or concerns, it's always best to reach out to Snap insurance directly for clarification.

How Can You Save Money on Energy Drinks?

If you're a fan of energy drinks and want to save money, consider the following tips:

- Look for discounts and coupons online or in local stores

- Sign up for loyalty programs or rewards cards

- Buy in bulk or purchase larger sizes

- Opt for store-brand or generic energy drinks

- Consider alternative energy-boosting options, such as coffee or exercise

Conclusion

In conclusion, Snap insurance does not cover the cost of energy drinks, including Monster Energy. However, if you experience medical issues related to energy drink consumption, your insurance plan may cover the associated medical expenses.Remember to always review your policy documents and understand what's covered and what's not. If you have questions or concerns, don't hesitate to reach out to Snap insurance directly.

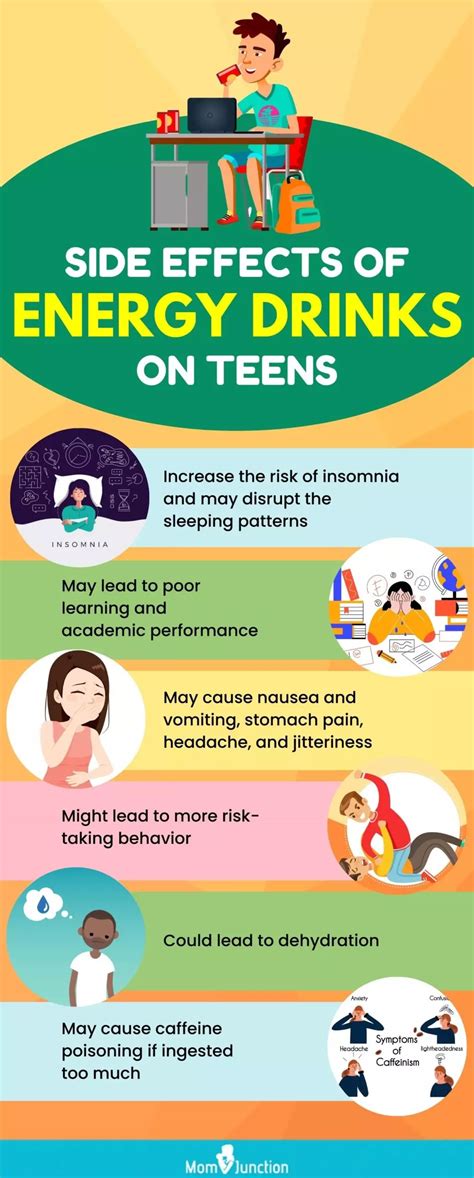

Energy Drink-Related Images

We hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.