Intro

Receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), can be a vital lifeline for many individuals and families who are struggling to make ends meet. However, there is often a misconception that owning a house disqualifies someone from receiving food stamps. In this article, we will delve into the specifics of food stamp eligibility and explore whether it is possible to receive food stamps while owning a home.

Understanding Food Stamp Eligibility

To be eligible for food stamps, applicants must meet certain requirements, which vary from state to state. Generally, to qualify for SNAP, an individual or family must:

- Meet income and resource requirements

- Be a U.S. citizen, national, or qualified alien

- Have a valid Social Security number

- Meet work requirements (in some states)

Income and Resource Requirements

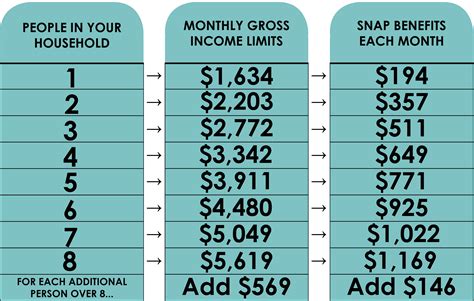

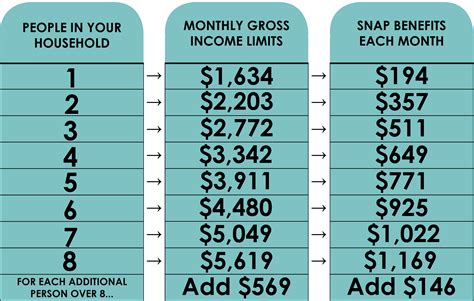

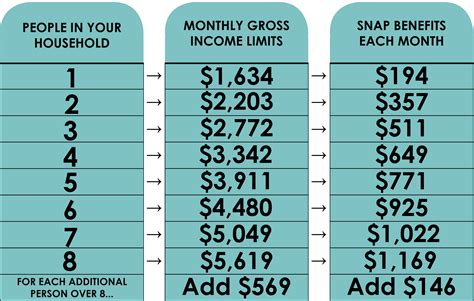

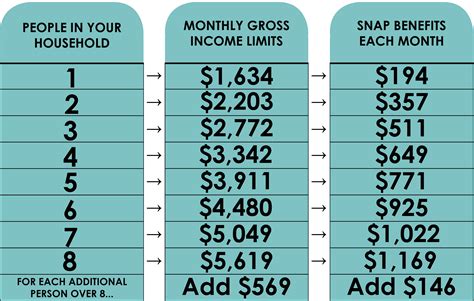

The income and resource requirements for food stamp eligibility are as follows:

- Gross income: This is the income before taxes and deductions. The gross income limit varies by state and household size.

- Net income: This is the income after taxes and deductions. The net income limit also varies by state and household size.

- Resources: This includes cash, savings, and other liquid assets. The resource limit varies by state, but generally, it is around $2,250 for most households.

Home Ownership and Food Stamp Eligibility

Now, let's address the question of whether owning a house affects food stamp eligibility. In most cases, owning a home does not automatically disqualify someone from receiving food stamps. However, the value of the home can impact the resource limit.

If the home is the applicant's primary residence, its value is generally exempt from the resource limit. This means that the value of the home is not considered when determining eligibility for food stamps.

However, if the applicant has a second home or rental property, the value of that property may be counted towards the resource limit.

Additional Factors to Consider

While owning a home may not directly affect food stamp eligibility, there are other factors to consider:

- Mortgage payments: If the applicant has a mortgage, the monthly payments may be considered when determining the household's net income.

- Property taxes: If the applicant pays property taxes, these may be considered as a deductible expense when calculating net income.

- Home equity: If the applicant has significant equity in their home, they may be required to use some of that equity to meet their food needs before being eligible for food stamps.

Examples of Food Stamp Eligibility Scenarios

To illustrate how owning a home can impact food stamp eligibility, let's consider the following scenarios:

Scenario 1:

- John owns a home worth $200,000, but has a mortgage with a monthly payment of $1,500. His household income is $3,000 per month, and he has $1,000 in savings. John may be eligible for food stamps, as the value of his home is exempt from the resource limit, and his mortgage payments are considered when determining his net income.

Scenario 2:

- Sarah owns a second home worth $150,000, which she rents out for $1,000 per month. Her household income is $4,000 per month, and she has $2,500 in savings. Sarah may not be eligible for food stamps, as the value of her second home is counted towards the resource limit, and her rental income is considered when determining her net income.

Conclusion

In conclusion, owning a home does not automatically disqualify someone from receiving food stamps. However, the value of the home, mortgage payments, property taxes, and home equity may all impact food stamp eligibility. It's essential to consider these factors and review the specific eligibility requirements in your state to determine whether you or your family may be eligible for food stamps.

Frequently Asked Questions

- Can I still get food stamps if I own a home? Yes, owning a home does not automatically disqualify you from receiving food stamps.

- How does the value of my home impact food stamp eligibility? The value of your primary residence is generally exempt from the resource limit.

- What if I have a second home or rental property? The value of that property may be counted towards the resource limit.

- Can I use my home equity to meet my food needs? You may be required to use some of your home equity to meet your food needs before being eligible for food stamps.

Food Stamp Eligibility Image Gallery

We hope this article has provided you with a comprehensive understanding of how owning a home can impact food stamp eligibility. If you have any further questions or concerns, please don't hesitate to comment below or reach out to your local social services department.