Intro

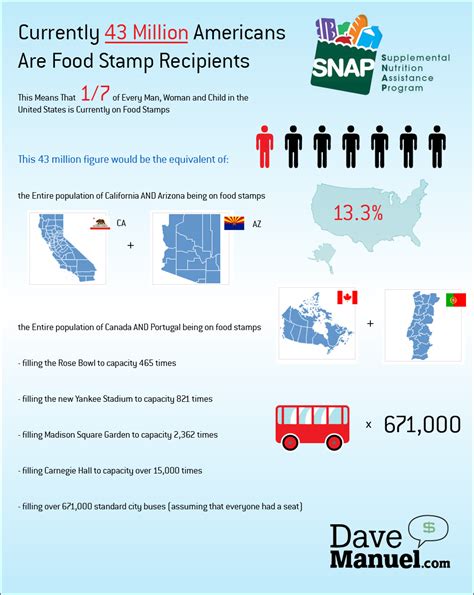

Discover how owning a home impacts food stamp eligibility and benefits. Learn the 5 key ways homeownership affects food stamps, including income calculations, asset tests, and more. Get the facts on how owning a home can influence your food assistance, and understand the implications for homeowners receiving SNAP benefits.

Owning a home can have a significant impact on an individual's or family's eligibility for food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP). The rules and regulations surrounding home ownership and SNAP benefits can be complex, and it's essential to understand how owning a home can affect your eligibility. In this article, we'll explore five ways owning a home can impact your food stamp benefits.

1. Asset Limits and Equity

In most states, owning a home is not considered an asset when determining SNAP eligibility. However, the equity in your home can affect your benefits. Equity is the value of your home minus any outstanding mortgage or loans. If you have a significant amount of equity in your home, it may be considered a countable asset, which can reduce your SNAP benefits or make you ineligible.

For example, let's say you own a home worth $200,000, and you have a mortgage of $150,000. Your equity would be $50,000. If your state has an asset limit of $2,250, your home equity would exceed that limit, potentially affecting your SNAP benefits.

2. Income and Expenses

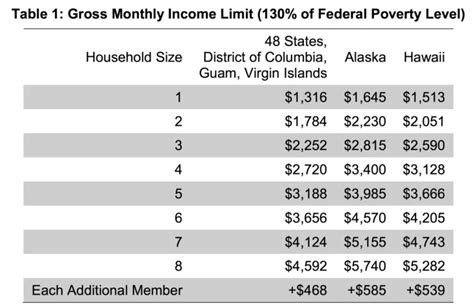

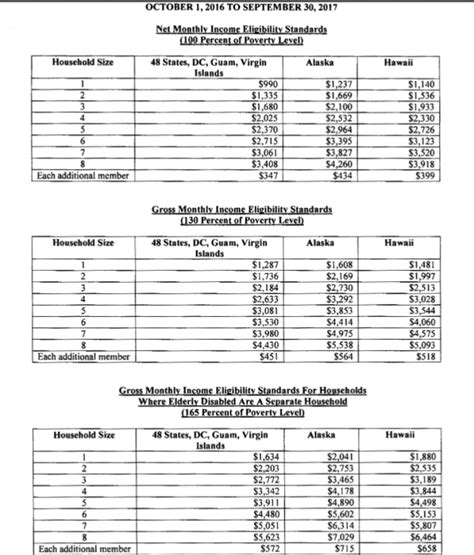

As a homeowner, you may have expenses such as mortgage payments, property taxes, and insurance. These expenses can affect your income, which is a critical factor in determining SNAP eligibility. If your income is too high, you may not qualify for SNAP benefits.

However, some expenses, such as mortgage payments and property taxes, can be deducted from your income when calculating your SNAP benefits. This can help reduce your income and make you eligible for benefits.

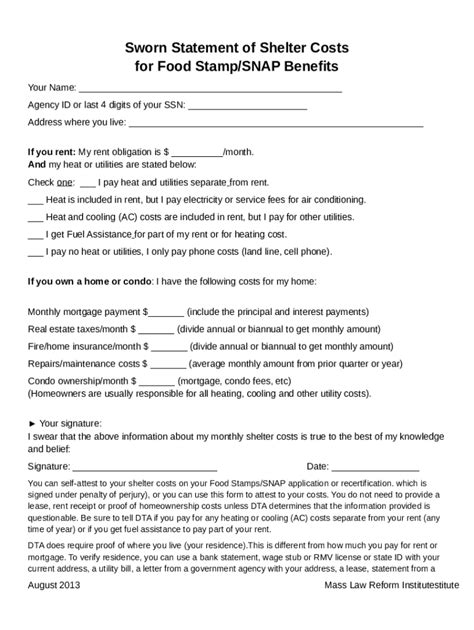

3. Shelter Costs and Allowances

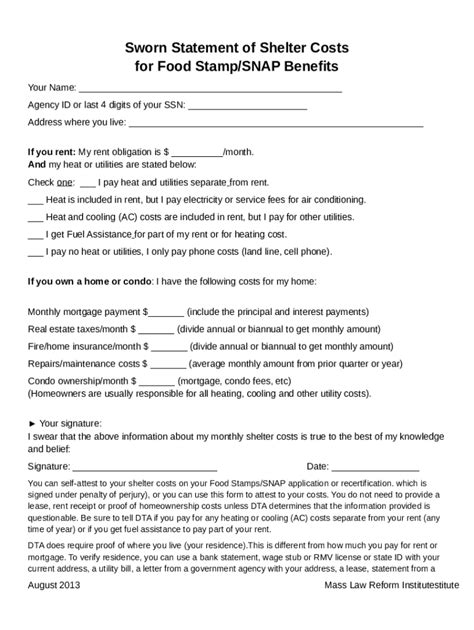

SNAP benefits take into account your shelter costs, including rent or mortgage payments, utilities, and insurance. As a homeowner, your shelter costs may be higher than those of renters. However, SNAP allows for a shelter deduction, which can help reduce your income and increase your benefits.

For example, let's say your monthly mortgage payment is $1,500, and your utilities and insurance costs are $300. Your total shelter costs would be $1,800. If you're eligible for a shelter deduction, your SNAP benefits may increase to help offset these costs.

4. Child Support and Alimony

If you're receiving child support or alimony, it may affect your SNAP benefits as a homeowner. In some states, child support and alimony are considered income and can reduce your SNAP benefits.

However, if you're paying child support or alimony, it may be deducted from your income when calculating your SNAP benefits. This can help increase your benefits and make you eligible for SNAP.

5. Special Circumstances and Exemptions

There are special circumstances and exemptions that can affect your SNAP benefits as a homeowner. For example, if you're a disabled or elderly homeowner, you may be exempt from asset limits or have a higher shelter deduction.

Additionally, some states offer special programs for low-income homeowners, such as the Home Energy Assistance Program (HEAP). These programs can help with energy costs and other expenses, which can affect your SNAP benefits.

Gallery of Home Ownership and Food Stamps

Home Ownership and Food Stamps Image Gallery

FAQs

- Q: Does owning a home affect my SNAP benefits? A: Yes, owning a home can affect your SNAP benefits, depending on the equity in your home, your income, and your shelter costs.

- Q: Can I deduct my mortgage payments from my income when calculating my SNAP benefits? A: Yes, you may be able to deduct your mortgage payments from your income, depending on the state you live in and your individual circumstances.

- Q: Are there special circumstances that can affect my SNAP benefits as a homeowner? A: Yes, there are special circumstances, such as disability or elderly status, that can affect your SNAP benefits as a homeowner.

Final Thoughts

Owning a home can have a significant impact on your SNAP benefits, but it's essential to understand the rules and regulations surrounding home ownership and SNAP eligibility. By knowing how your home ownership affects your SNAP benefits, you can make informed decisions about your financial situation and ensure you're receiving the benefits you're eligible for. If you have questions or concerns about your SNAP benefits, it's always best to consult with a qualified professional or your local SNAP office.