Intro

Mastering your Capital One bank statement is easy with these 5 simple methods. Learn how to read and understand your statement, including transaction details, account balances, and fees. Improve your financial literacy and stay on top of your accounts with our expert guide, covering statement analysis, budgeting, and expense tracking.

Are you having trouble understanding your Capital One bank statement? You're not alone. Many people find it challenging to decipher the various sections and codes on their bank statements. However, being able to read your bank statement is crucial for managing your finances effectively. In this article, we'll break down the key components of a Capital One bank statement and provide you with 5 easy ways to read and understand it.

Understanding the Importance of Reading Your Bank Statement

Reading your bank statement is essential for several reasons. Firstly, it helps you keep track of your spending and ensure that you're not overspending. Secondly, it allows you to detect any errors or unauthorized transactions on your account. Finally, it provides you with a clear picture of your financial situation, enabling you to make informed decisions about your money.

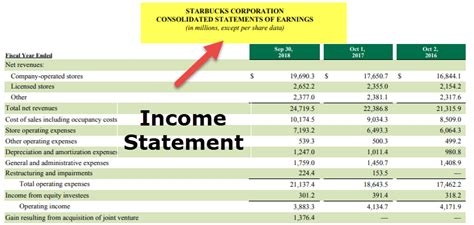

Breaking Down the Components of a Capital One Bank Statement

A typical Capital One bank statement consists of several sections, including:

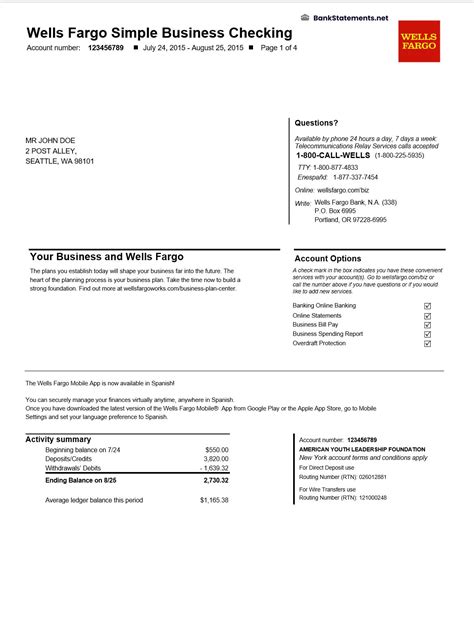

- Account information: This section displays your account details, such as your account number, name, and address.

- Transaction history: This section lists all the transactions that have occurred on your account since the last statement.

- Balance summary: This section provides a summary of your account balance, including your current balance, available balance, and any pending transactions.

- Fees and charges: This section lists any fees or charges that have been applied to your account, such as maintenance fees or overdraft fees.

5 Easy Ways to Read Your Capital One Bank Statement

1. Start with the Account Information Section

The account information section is usually located at the top of the statement and provides important details about your account. Make sure to verify that your name, address, and account number are correct.

2. Review Your Transaction History

The transaction history section is the most detailed part of the statement. It lists every transaction that has occurred on your account, including deposits, withdrawals, and payments. Take the time to review each transaction to ensure that it's accurate and authorized.

3. Check Your Balance Summary

The balance summary section provides a snapshot of your account balance. Verify that your current balance, available balance, and pending transactions are accurate.

4. Look Out for Fees and Charges

The fees and charges section lists any fees or charges that have been applied to your account. Review this section carefully to ensure that you understand why you're being charged and whether the fees are legitimate.

5. Verify Your Statement Period

The statement period is the period during which the transactions on your statement occurred. Verify that the statement period is correct and that you're not missing any transactions.

Tips for Managing Your Finances Effectively

In addition to reading your bank statement, there are several other tips that can help you manage your finances effectively. These include:

- Creating a budget: A budget helps you track your income and expenses and make informed decisions about your money.

- Monitoring your credit report: Your credit report provides a snapshot of your credit history and can help you detect any errors or unauthorized activity.

- Building an emergency fund: An emergency fund provides a cushion in case of unexpected expenses or financial setbacks.

Common Mistakes to Avoid When Reading Your Bank Statement

When reading your bank statement, there are several common mistakes to avoid. These include:

- Not verifying your account information

- Not reviewing your transaction history carefully

- Not checking for fees and charges

- Not verifying your statement period

Conclusion

Reading your Capital One bank statement is a crucial step in managing your finances effectively. By following the 5 easy ways outlined in this article, you can ensure that you understand your statement and can make informed decisions about your money. Remember to review your statement carefully, verify your account information, and look out for fees and charges.

Bank Statement Image Gallery

We hope this article has provided you with a better understanding of how to read your Capital One bank statement. If you have any questions or comments, please feel free to share them below.