Calculate car loan payments with Navy Federals tool, using auto loan rates, terms, and credit scores to estimate costs, refinance options, and savings, making informed financing decisions easier.

Purchasing a vehicle can be an exciting experience, but it also involves a significant financial commitment. For many people, securing a car loan is a necessary step in affording their dream car. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a range of car loan options to its members. To help individuals make informed decisions about their car loan, Navy Federal provides a car loan calculator tool. This tool is designed to assist borrowers in determining how much they can afford to borrow, what their monthly payments will be, and how long it will take to pay off the loan.

The Navy Federal car loan calculator tool is a valuable resource for anyone considering a car loan. By using this tool, individuals can input various factors such as the loan amount, interest rate, and loan term to calculate their monthly payments. This information can help borrowers determine whether a particular car loan is affordable and aligns with their budget. Additionally, the calculator tool can help individuals compare different car loan options and choose the one that best suits their needs. With the Navy Federal car loan calculator tool, borrowers can make informed decisions about their car loan and avoid financial pitfalls.

The importance of using a car loan calculator tool cannot be overstated. Without a clear understanding of the total cost of the loan, including the interest paid over the life of the loan, borrowers may find themselves struggling to make monthly payments. By using the Navy Federal car loan calculator tool, individuals can avoid this common mistake and ensure that they are making a smart financial decision. Furthermore, the tool can help borrowers identify areas where they can save money, such as by opting for a shorter loan term or a lower interest rate. By taking the time to use the Navy Federal car loan calculator tool, individuals can take control of their finances and make a more informed decision about their car loan.

Navy Federal Car Loan Calculator Tool Features

How to Use the Navy Federal Car Loan Calculator Tool

Using the Navy Federal car loan calculator tool is easy and straightforward. To get started, individuals simply need to visit the Navy Federal website and navigate to the car loan calculator tool. From there, they can input various factors such as the loan amount, interest rate, and loan term to calculate their monthly payments. The tool will then provide a detailed breakdown of the total cost of the loan, including the interest paid over the life of the loan. By following these simple steps, individuals can use the Navy Federal car loan calculator tool to make informed decisions about their car loan.Benefits of Using the Navy Federal Car Loan Calculator Tool

Navy Federal Car Loan Options

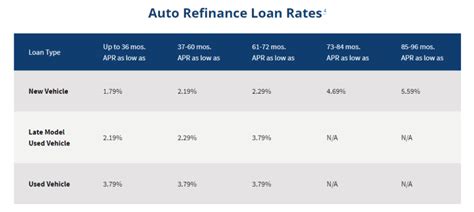

Navy Federal offers a range of car loan options to its members. These options include new and used car loans, as well as refinancing options for existing car loans. The credit union also offers competitive interest rates and flexible loan terms, making it easy for individuals to find a car loan that meets their needs. By using the Navy Federal car loan calculator tool, individuals can compare different car loan options and choose the one that best suits their needs.Navy Federal Car Loan Interest Rates

Navy Federal Car Loan Requirements

To qualify for a car loan from Navy Federal, individuals must meet certain requirements. These requirements include being a member of the credit union, having a good credit score, and meeting the credit union's income and debt requirements. By using the Navy Federal car loan calculator tool, individuals can determine whether they meet the requirements for a car loan and get an estimate of how much they can afford to borrow.Navy Federal Car Loan Calculator Tool Tips

Navy Federal Car Loan Calculator Tool FAQs

There are several frequently asked questions about the Navy Federal car loan calculator tool. One of the main questions is how to use the tool, which is easy and straightforward. Individuals simply need to visit the Navy Federal website and navigate to the car loan calculator tool. From there, they can input various factors such as the loan amount, interest rate, and loan term to calculate their monthly payments.Gallery of Navy Federal Car Loan Calculator Tool

Navy Federal Car Loan Calculator Tool Image Gallery

In conclusion, the Navy Federal car loan calculator tool is a valuable resource for anyone considering a car loan. By using this tool, individuals can make informed decisions about their car loan and avoid financial pitfalls. With its range of features and competitive interest rates, Navy Federal is a great option for anyone looking for a car loan. We encourage you to try out the Navy Federal car loan calculator tool and see how it can help you make a smart financial decision. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family who may be in the market for a new car, and help them make informed decisions about their car loan.