Intro

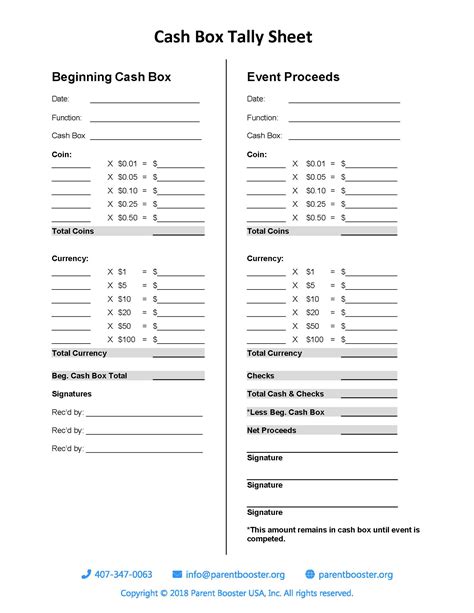

Boost financial accuracy with a cash count sheet template! Discover 5 practical ways to utilize this essential tool, streamlining cash handling, reducing errors, and increasing transparency. Learn how to optimize cash counting, reconcile discrepancies, and enhance internal controls with our expert guide, packed with actionable tips and best practices.

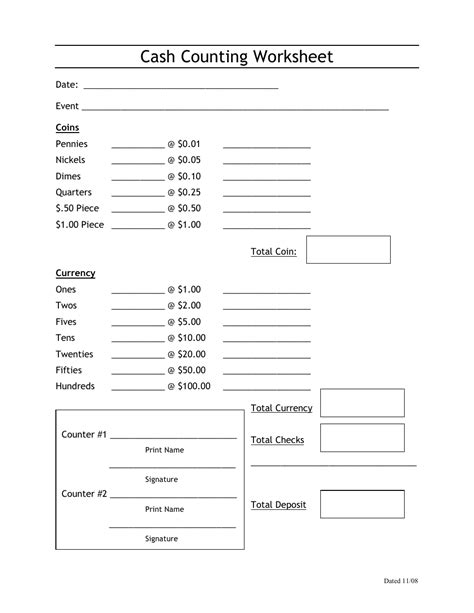

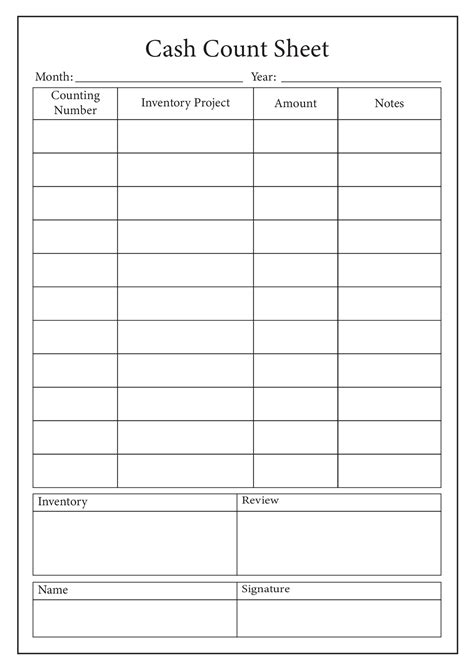

Managing cash flow is a critical aspect of any business, and using a cash count sheet template can help streamline this process. A cash count sheet is a tool used to track and record the amount of cash on hand, making it easier to manage and reconcile cash transactions. In this article, we will explore five ways to use a cash count sheet template to improve your cash management processes.

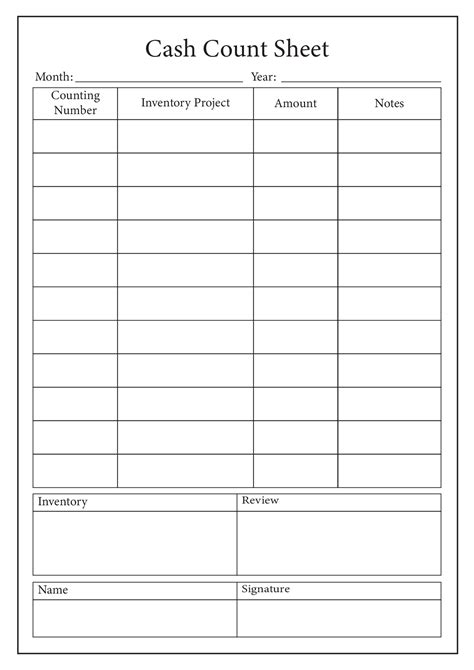

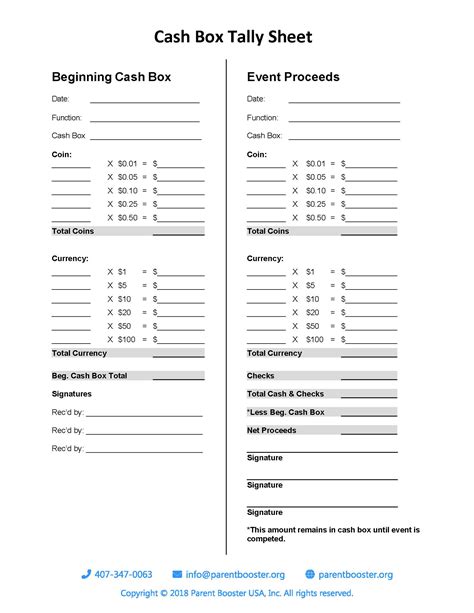

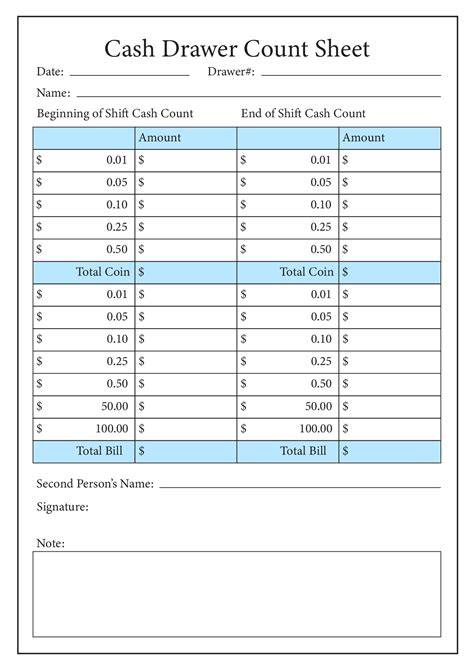

What is a Cash Count Sheet Template?

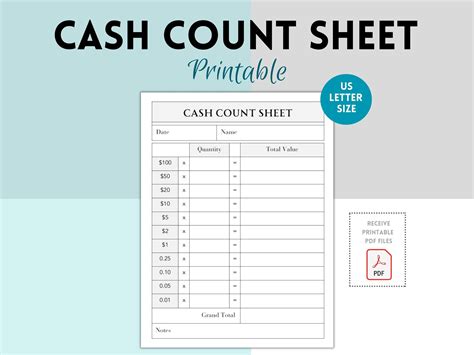

A cash count sheet template is a pre-designed document used to record and track cash transactions. It typically includes columns for recording the date, cash in, cash out, and running balance. Using a template can help ensure accuracy and consistency in recording cash transactions.

5 Ways to Use a Cash Count Sheet Template

1. Daily Cash Reconciliation

Using a cash count sheet template can help you reconcile your daily cash transactions. By recording every cash transaction, you can quickly identify any discrepancies and investigate any potential issues. This can help prevent errors and ensure that your cash records are accurate.

- Create a new cash count sheet for each day

- Record every cash transaction, including sales, refunds, and expenses

- Reconcile your cash count sheet with your sales reports and bank statements

2. Managing Petty Cash

A cash count sheet template can also be used to manage petty cash. Petty cash is a small amount of cash set aside for small expenses, such as office supplies or travel expenses. By using a cash count sheet template, you can track and record petty cash transactions, making it easier to manage and reconcile.

- Create a petty cash fund and set a limit for petty cash expenses

- Record every petty cash transaction on the cash count sheet

- Reconcile the petty cash fund on a regular basis

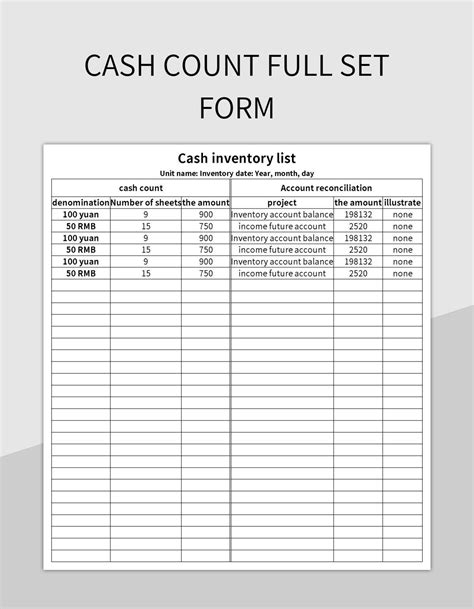

3. Tracking Cash Flow

A cash count sheet template can help you track cash flow, making it easier to identify patterns and trends. By recording every cash transaction, you can see how much cash is coming in and going out, and identify areas where you can improve cash flow.

- Record every cash transaction on the cash count sheet

- Use the cash count sheet to identify patterns and trends in cash flow

- Use this information to make informed decisions about cash management

4. Reconciling Bank Statements

A cash count sheet template can also be used to reconcile bank statements. By comparing your cash count sheet with your bank statement, you can identify any discrepancies and investigate any potential issues.

- Record every cash transaction on the cash count sheet

- Reconcile the cash count sheet with your bank statement

- Investigate any discrepancies and make any necessary adjustments

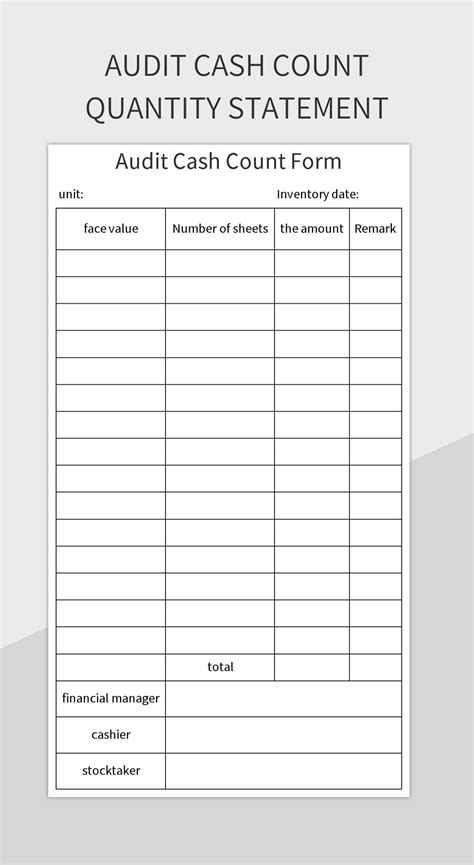

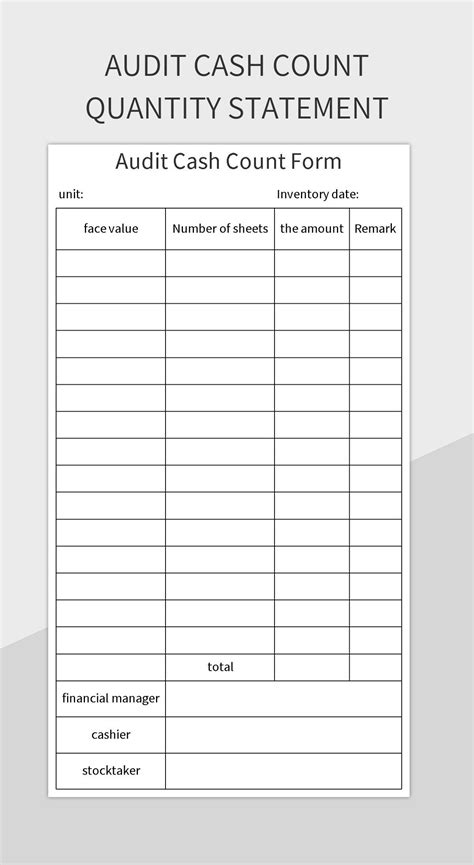

5. Auditing and Compliance

Using a cash count sheet template can also help with auditing and compliance. By maintaining accurate and detailed records of cash transactions, you can demonstrate compliance with regulatory requirements and reduce the risk of audit issues.

- Use the cash count sheet template to record every cash transaction

- Maintain accurate and detailed records of cash transactions

- Use this information to demonstrate compliance with regulatory requirements

Benefits of Using a Cash Count Sheet Template

Using a cash count sheet template can have numerous benefits, including:

- Improved accuracy and consistency in recording cash transactions

- Enhanced ability to track and manage cash flow

- Reduced risk of errors and discrepancies

- Improved compliance with regulatory requirements

- Increased efficiency and productivity

Best Practices for Using a Cash Count Sheet Template

To get the most out of a cash count sheet template, follow these best practices:

- Use a consistent and standardized template

- Record every cash transaction, no matter how small

- Reconcile your cash count sheet regularly

- Maintain accurate and detailed records of cash transactions

- Use the cash count sheet template to identify patterns and trends in cash flow

Conclusion

Using a cash count sheet template can be a valuable tool in managing cash flow and improving cash management processes. By following the five ways to use a cash count sheet template outlined in this article, you can improve accuracy and consistency in recording cash transactions, track and manage cash flow, and demonstrate compliance with regulatory requirements. Remember to follow best practices for using a cash count sheet template, including using a consistent and standardized template, recording every cash transaction, and maintaining accurate and detailed records of cash transactions.

Share your thoughts: How do you use cash count sheet templates in your business? What benefits have you seen from using this tool? Share your experiences and insights in the comments below!

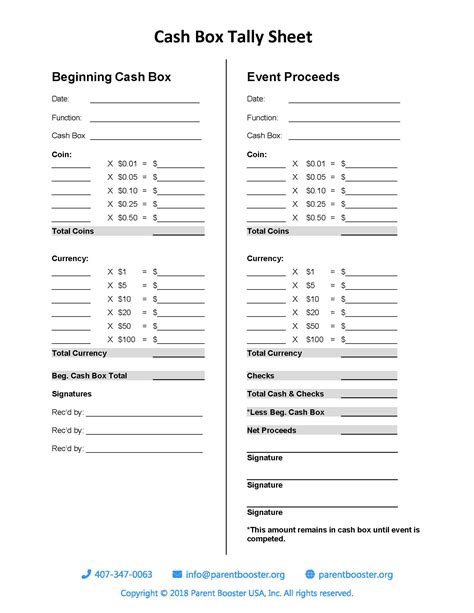

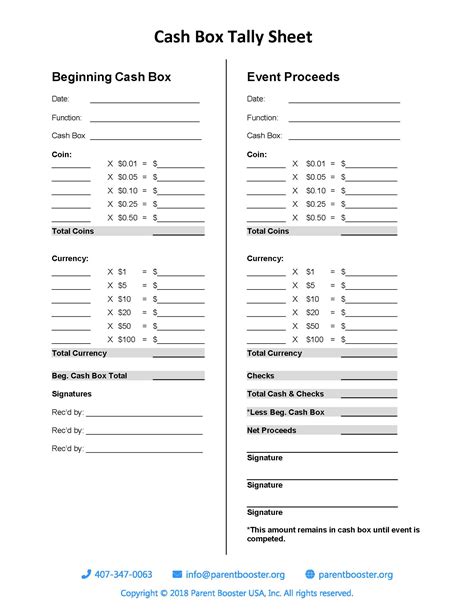

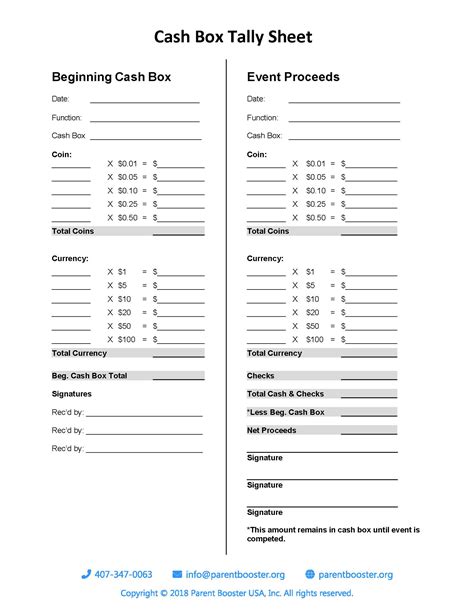

Gallery of Cash Count Sheet Templates

Gallery of Cash Count Sheet Templates

Note: The images used in this article are for illustration purposes only and are not actual cash count sheet templates.