Intro

Reconciling your cash drawer is an essential task for any business that handles cash transactions. It's a crucial process that helps ensure accuracy, prevents discrepancies, and detects potential theft or errors. However, many businesses struggle with creating an effective cash drawer reconciliation template. In this article, we'll explore the importance of cash drawer reconciliation, provide a step-by-step guide on how to create a template, and offer tips on how to make the process easier and more efficient.

Why Cash Drawer Reconciliation is Important

Cash drawer reconciliation is a vital process that helps businesses maintain accuracy and accountability in their financial transactions. It involves verifying the amount of cash in the drawer against the recorded transactions to ensure that everything balances. This process helps to:

- Detect discrepancies or errors in cash handling

- Prevent theft or misappropriation of funds

- Identify areas for improvement in cash handling procedures

- Ensure compliance with accounting standards and regulations

Benefits of Using a Cash Drawer Reconciliation Template

Using a cash drawer reconciliation template can simplify the process and provide several benefits, including:

- Improved accuracy and efficiency

- Reduced risk of errors or discrepancies

- Enhanced accountability and transparency

- Better compliance with accounting standards and regulations

- Increased confidence in financial reporting

Creating a Cash Drawer Reconciliation Template

Creating a cash drawer reconciliation template is a straightforward process that involves the following steps:

- Determine the frequency of reconciliation: Decide how often you want to reconcile your cash drawer, whether it's daily, weekly, or monthly.

- Gather necessary information: Collect the following information:

- Cash in the drawer

- Recorded transactions (deposits, withdrawals, and sales)

- Any discrepancies or errors

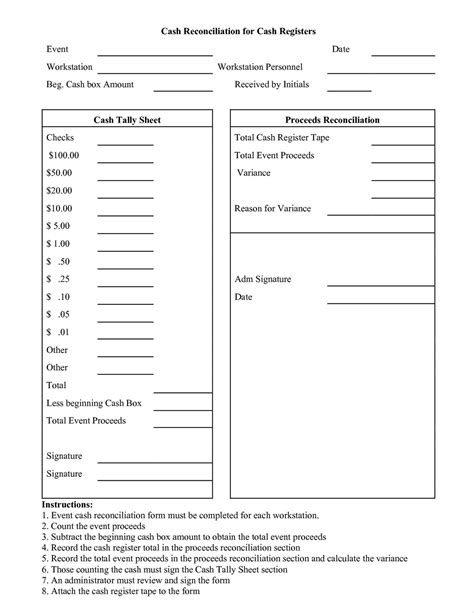

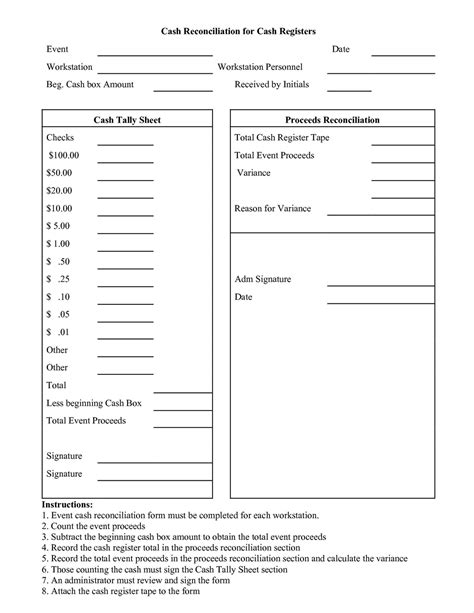

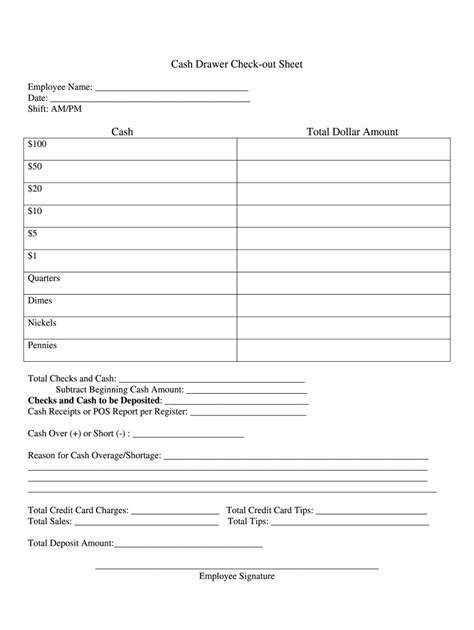

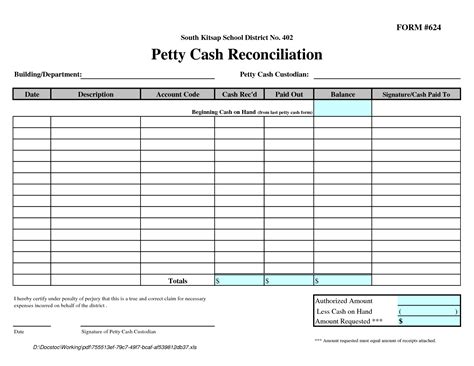

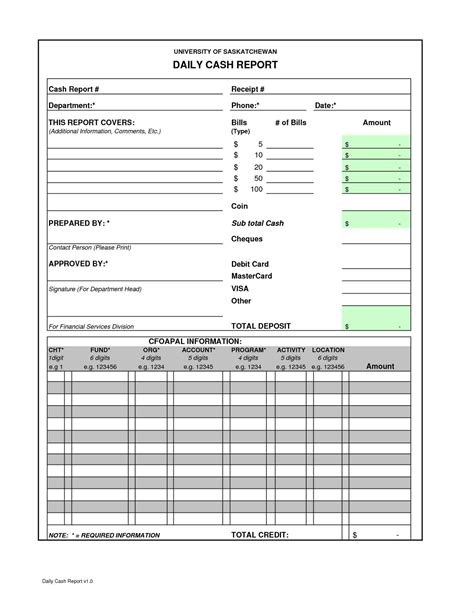

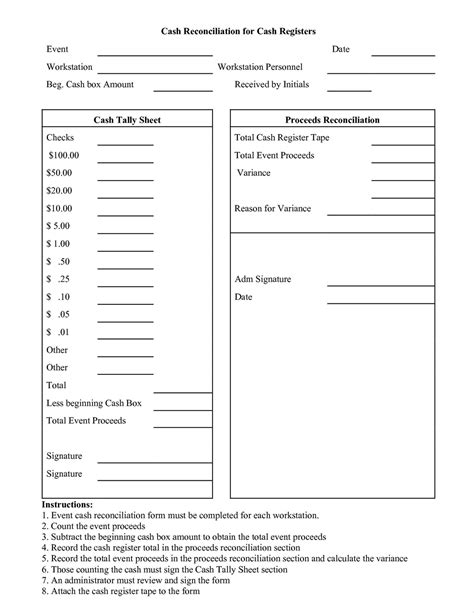

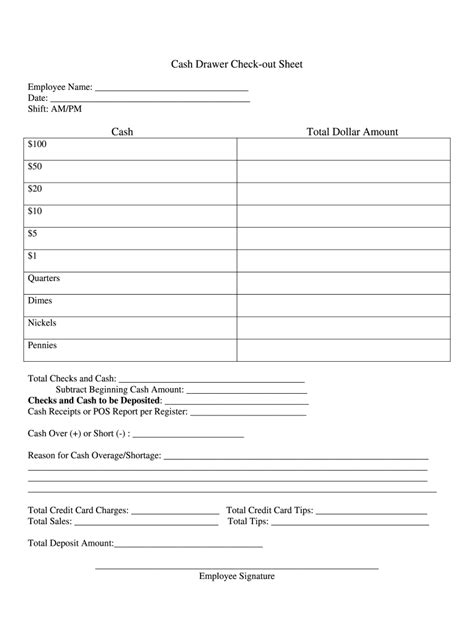

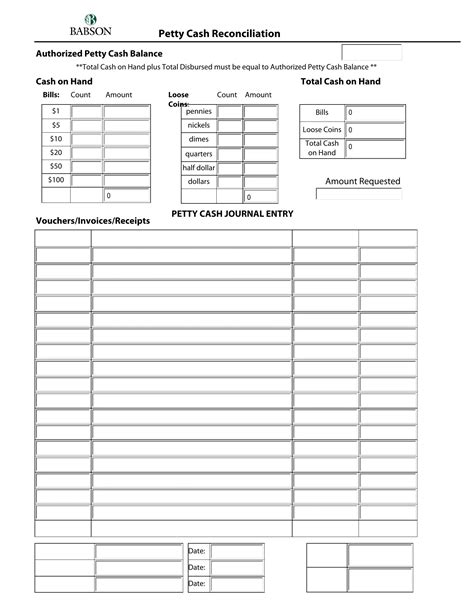

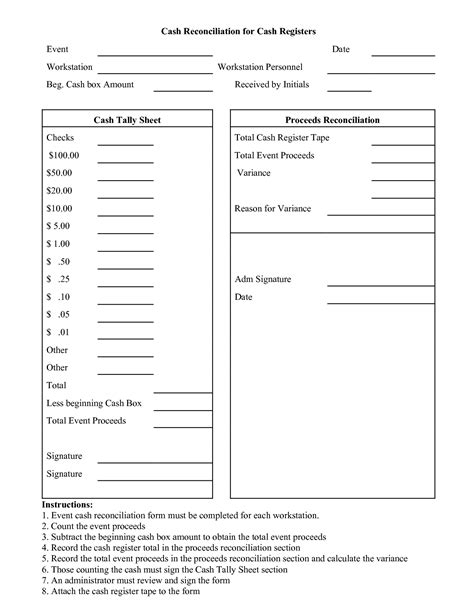

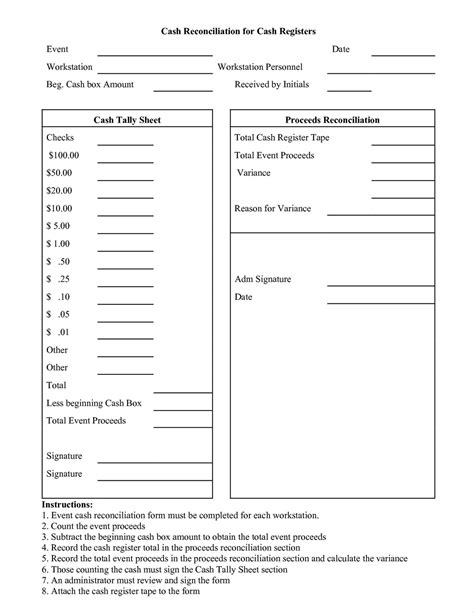

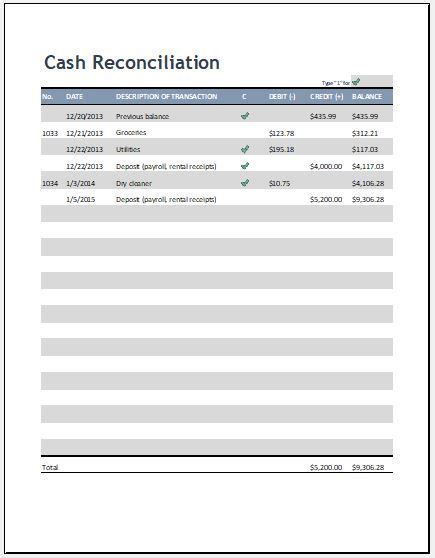

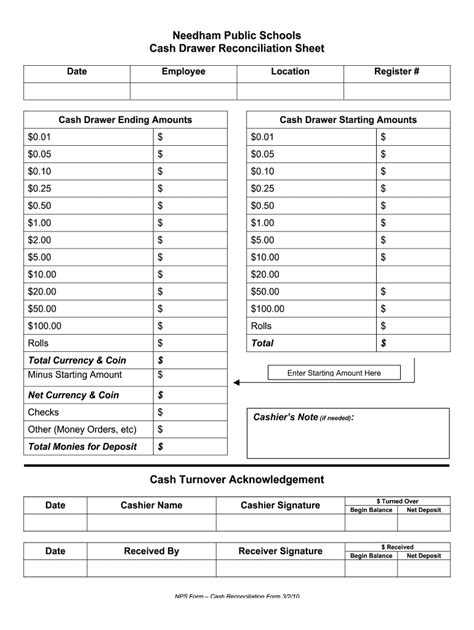

- Set up the template: Create a table or spreadsheet with the following columns:

- Date

- Cash in the drawer

- Recorded transactions

- Discrepancies or errors

- Reconciliation amount

- Calculate the reconciliation amount: Calculate the total amount of cash that should be in the drawer based on the recorded transactions.

- Compare the cash in the drawer to the reconciliation amount: Verify that the cash in the drawer matches the reconciliation amount.

Tips for Making the Process Easier

Here are some tips to make the cash drawer reconciliation process easier and more efficient:

- Use a standardized template: Create a standardized template that can be used for all cash drawer reconciliations.

- Automate the process: Consider using accounting software or a cash management system to automate the reconciliation process.

- Train staff: Train staff on the importance of cash drawer reconciliation and how to use the template.

- Regularly review and update the template: Regularly review and update the template to ensure it remains accurate and effective.

Common Challenges and Solutions

Here are some common challenges and solutions related to cash drawer reconciliation:

- Challenge: Discrepancies or errors in cash handling Solution: Implement a standardized cash handling procedure and train staff on its use.

- Challenge: Difficulty in identifying discrepancies or errors Solution: Use a reconciliation template that highlights discrepancies or errors.

- Challenge: Time-consuming reconciliation process Solution: Automate the reconciliation process using accounting software or a cash management system.

Best Practices for Cash Drawer Reconciliation

Here are some best practices for cash drawer reconciliation:

- Reconcile the cash drawer regularly: Regular reconciliation helps to detect discrepancies or errors early.

- Use a standardized template: A standardized template ensures consistency and accuracy in the reconciliation process.

- Train staff: Train staff on the importance of cash drawer reconciliation and how to use the template.

- Review and update the template: Regularly review and update the template to ensure it remains accurate and effective.

Common Mistakes to Avoid

Here are some common mistakes to avoid in cash drawer reconciliation:

- Not reconciling the cash drawer regularly

- Not using a standardized template

- Not training staff on cash handling procedures

- Not reviewing and updating the template regularly

Cash Drawer Reconciliation Template Gallery

In conclusion, cash drawer reconciliation is a critical process that helps businesses maintain accuracy and accountability in their financial transactions. By creating a standardized template and following best practices, businesses can simplify the process and ensure that their cash handling procedures are accurate and effective. Remember to regularly review and update the template to ensure it remains accurate and effective.