Intro

Master your finances with a clear visual representation. Learn how to create a cash flow graph in Excel, helping you track income, expenses, and savings. Improve budgeting and forecasting with a simple, informative graph. Say goodbye to financial stress and hello to informed decision-making with our step-by-step guide to visualizing your finances.

Managing your finances effectively is crucial for achieving financial stability and success. One of the most important aspects of personal finance is understanding your cash flow. A cash flow graph in Excel can be a powerful tool to visualize your finances and make informed decisions. In this article, we will explore the importance of cash flow management, how to create a cash flow graph in Excel, and provide tips on how to use it to improve your financial situation.

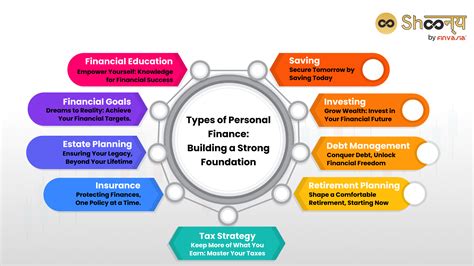

Why Cash Flow Management is Important

Cash flow management is the process of tracking the inflows and outflows of money in your personal or business finances. It helps you understand where your money is coming from and where it's going, making it easier to identify areas for improvement. Effective cash flow management can help you:

- Pay bills on time

- Avoid debt

- Build savings

- Invest in the future

- Make informed financial decisions

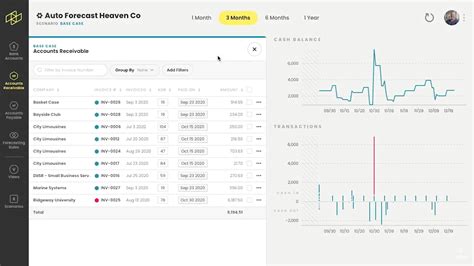

Benefits of Using a Cash Flow Graph in Excel

A cash flow graph in Excel can help you visualize your finances and make sense of complex financial data. The benefits of using a cash flow graph in Excel include:

- Easy to understand: A graph is a simple and intuitive way to understand your cash flow.

- Customizable: You can customize the graph to show the data that's most important to you.

- Dynamic: The graph will update automatically when you make changes to the data.

- Scalable: You can use the graph to track your cash flow over time, making it easier to identify trends and patterns.

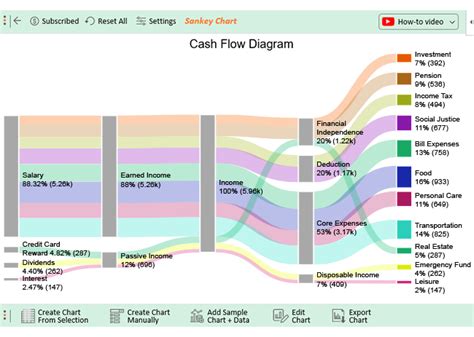

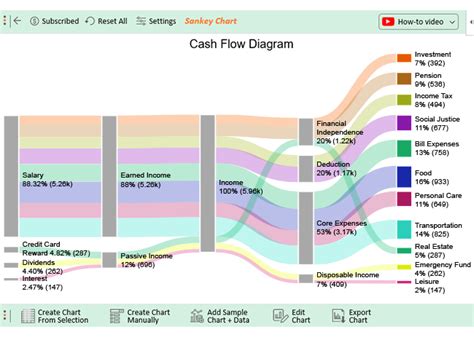

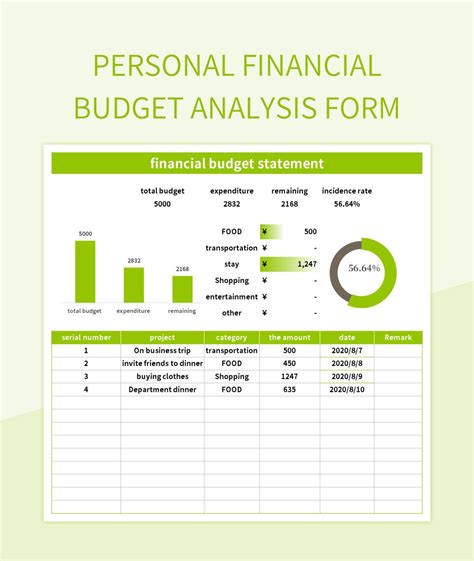

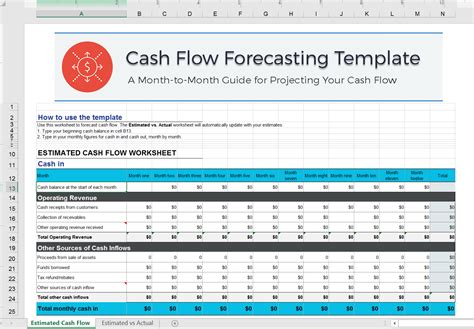

Creating a Cash Flow Graph in Excel

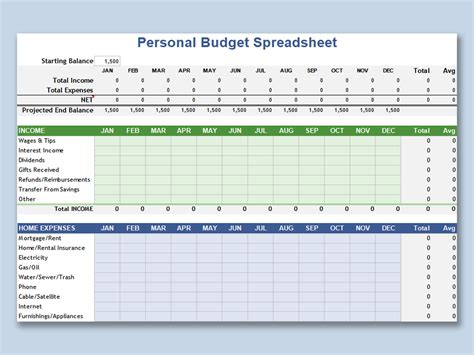

Creating a cash flow graph in Excel is a straightforward process. Here are the steps to follow:

- Set up a new Excel spreadsheet and create a table to track your income and expenses.

- Enter your income and expenses into the table, using separate columns for each.

- Calculate the total income and total expenses for each month.

- Create a new column to calculate the net cash flow (income minus expenses).

- Select the data range that you want to graph (e.g. income, expenses, net cash flow).

- Go to the "Insert" tab in Excel and click on "Bar Chart" or "Line Chart".

- Customize the chart as needed (e.g. add titles, labels, colors).

Tips for Using a Cash Flow Graph in Excel

Here are some tips for using a cash flow graph in Excel:

- Use a separate sheet for each month or quarter to track your cash flow over time.

- Use different colors to distinguish between income and expenses.

- Add a trend line to the graph to help identify patterns and trends.

- Use the graph to set financial goals and track progress over time.

- Consider adding additional data to the graph, such as savings rates or debt levels.

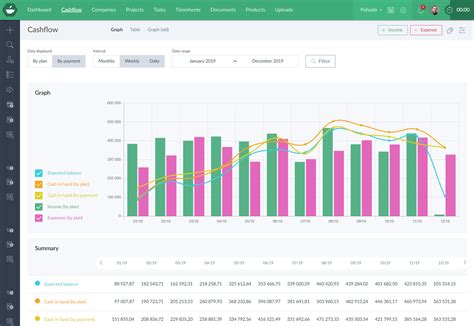

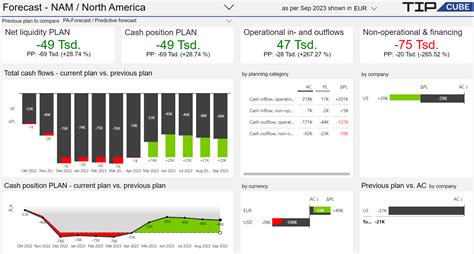

Interpreting Your Cash Flow Graph

Interpreting your cash flow graph is crucial to understanding your financial situation. Here are some things to look for:

- Positive net cash flow: This indicates that you have more income than expenses.

- Negative net cash flow: This indicates that you have more expenses than income.

- Trends: Look for patterns and trends in your cash flow over time.

- Seasonality: Identify any seasonal fluctuations in your income or expenses.

- Anomalies: Investigate any unusual or one-time expenses or income.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a cash flow graph in Excel:

- Inaccurate data: Make sure to enter accurate and up-to-date data into your spreadsheet.

- Insufficient data: Use a sufficient amount of data to create a meaningful graph.

- Misleading graph: Avoid creating a graph that's misleading or confusing.

- Not updating the graph: Regularly update the graph to reflect changes in your financial situation.

Conclusion

A cash flow graph in Excel is a powerful tool for visualizing your finances and making informed decisions. By following the steps outlined in this article, you can create a cash flow graph that helps you understand your financial situation and achieve your financial goals. Remember to regularly update the graph and avoid common mistakes to ensure that you get the most out of this valuable tool.

Cash Flow Management Image Gallery

We hope this article has helped you understand the importance of cash flow management and how to create a cash flow graph in Excel. If you have any questions or comments, please don't hesitate to reach out.