Intro

Maximize your savings with a CD ladder strategy. Learn how to build a CD ladder with our free calculator spreadsheet, optimizing returns while minimizing risk. Discover the benefits of staggered maturity dates, interest rate risks, and liquidity management. Get started with our expert guide and calculator tool, perfect for investors seeking low-risk, high-yield savings solutions.

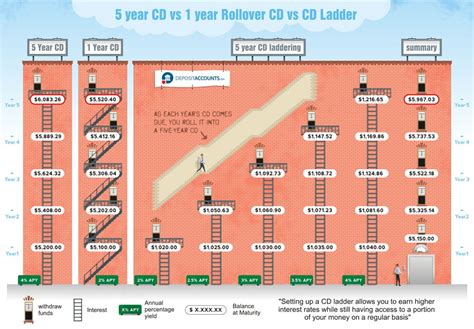

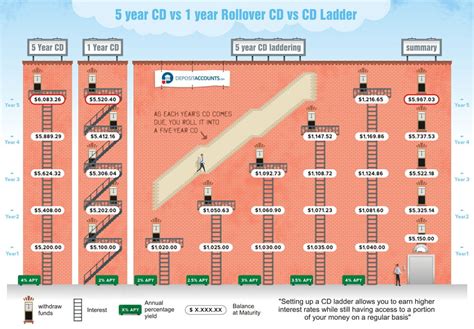

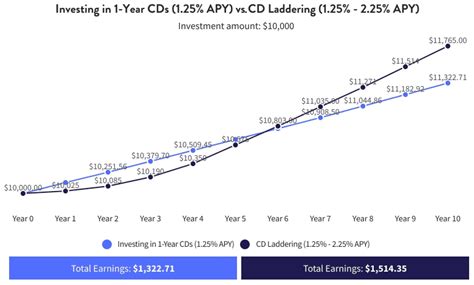

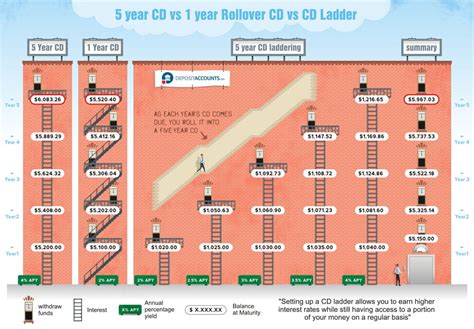

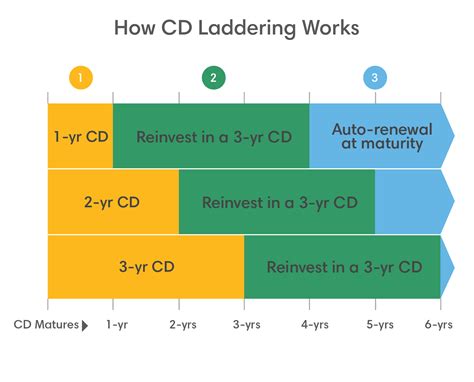

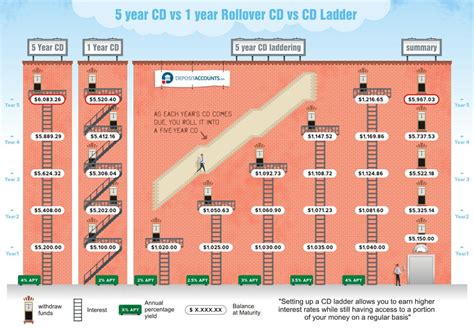

Building a CD ladder can be a great way to earn higher interest rates on your savings while maintaining liquidity. A CD ladder is a strategy where you invest in multiple certificates of deposit (CDs) with different maturity dates, creating a "ladder" of investments that mature at regular intervals.

Understanding CD Ladders

In this article, we'll explain how to build a CD ladder using our free calculator spreadsheet, highlighting the benefits and drawbacks of this investment strategy. We'll also provide practical examples and tips to help you get started.

Benefits of CD Ladders

- Higher interest rates: CDs typically offer higher interest rates than traditional savings accounts, especially for longer-term investments.

- Liquidity: By staggering the maturity dates of your CDs, you can ensure that you have access to a portion of your money at regular intervals.

- Reduced interest rate risk: A CD ladder can help you mitigate the risk of interest rate changes, as you'll have a mix of short-term and long-term investments.

- Disciplined savings: Building a CD ladder requires discipline and patience, which can help you stick to your savings goals.

How to Build a CD Ladder

To build a CD ladder, follow these steps:

- Determine your investment amount: Decide how much you want to invest in your CD ladder.

- Choose your CD terms: Select the maturity dates for your CDs, typically ranging from 3 months to 5 years.

- Decide on the number of CDs: Determine how many CDs you want to include in your ladder, depending on your investment amount and desired liquidity.

- Open your CDs: Open your CDs with the chosen terms and deposit your investment amount.

- Monitor and adjust: Regularly review your CD ladder and adjust as needed to ensure it remains aligned with your financial goals.

Using Our Free Calculator Spreadsheet

Our free calculator spreadsheet can help you build and optimize your CD ladder. Here's how to use it:

- Download the spreadsheet: Click on the link to download our free CD ladder calculator spreadsheet.

- Enter your investment amount: Input your investment amount in the designated cell.

- Choose your CD terms: Select your desired CD terms from the dropdown menu.

- Adjust the number of CDs: Enter the number of CDs you want to include in your ladder.

- Calculate your results: The spreadsheet will calculate your estimated interest earnings and liquidity.

Example CD Ladder Scenario

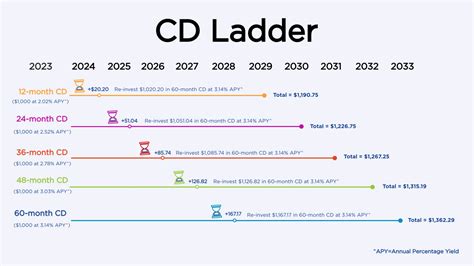

Let's say you want to invest $10,000 in a CD ladder with 5 CDs, each with a different maturity date:

| CD # | Maturity Date | Interest Rate | Investment Amount |

|---|---|---|---|

| 1 | 3 months | 2.50% | $2,000 |

| 2 | 6 months | 2.75% | $2,000 |

| 3 | 1 year | 3.00% | $2,000 |

| 4 | 2 years | 3.25% | $2,000 |

| 5 | 3 years | 3.50% | $2,000 |

Using our calculator spreadsheet, we can estimate the total interest earnings and liquidity for this CD ladder.

Conclusion

Building a CD ladder can be a great way to earn higher interest rates on your savings while maintaining liquidity. By using our free calculator spreadsheet, you can easily build and optimize your CD ladder to achieve your financial goals.CD Ladder Image Gallery

We hope this article has provided you with a comprehensive understanding of CD ladders and how to build one using our free calculator spreadsheet. If you have any questions or comments, please feel free to share them below.