Discover 5 CFPB tips for navigating consumer finance, including debt relief, credit reporting, and loan guidance, to empower informed financial decisions and protect consumer rights.

In today's complex financial landscape, navigating the world of consumer finance can be daunting. The Consumer Financial Protection Bureau (CFPB) plays a crucial role in protecting consumers from unfair, deceptive, and abusive practices. With its wide-ranging authority, the CFPB has been instrumental in implementing rules and guidelines that safeguard consumers' interests. For individuals seeking to make informed financial decisions, understanding the CFPB's role and leveraging its resources is essential. This article delves into the importance of the CFPB, its functions, and provides actionable tips for consumers to protect their financial well-being.

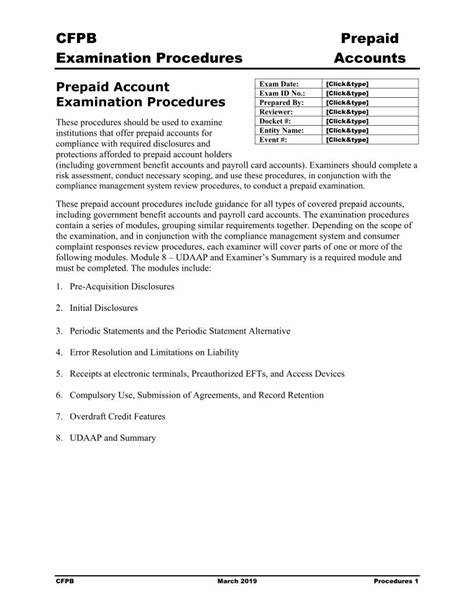

The CFPB was created in response to the financial crisis of 2008, with the primary goal of overseeing consumer financial products and services. Its mandate includes regulating banks, credit unions, and other financial institutions to ensure they operate fairly and transparently. By doing so, the CFPB aims to prevent the kind of predatory lending practices that contributed to the crisis. For consumers, this means having access to clearer information about financial products, protection from hidden fees, and recourse when they encounter unfair practices.

Given the CFPB's broad responsibilities, it's crucial for consumers to be aware of how they can benefit from its protections and resources. Whether it's understanding credit scores, navigating the mortgage application process, or dealing with debt collectors, the CFPB offers a wealth of information and tools. Moreover, the agency's complaint system allows consumers to report issues with financial products or services, which can lead to investigations and, potentially, regulatory actions against offending companies. By engaging with the CFPB and utilizing its resources, consumers can empower themselves to make better financial decisions and avoid pitfalls.

Understanding the CFPB's Role

The CFPB's role in consumer finance is multifaceted, encompassing enforcement, rulemaking, and consumer education. It enforces federal consumer financial laws, supervises and regulates certain financial institutions, and restricts unfair, deceptive, or abusive acts or practices. Additionally, the CFPB engages in rulemaking to implement federal consumer financial laws and provides guidance to help financial institutions comply with these laws. Consumer education is another key aspect, with the CFPB working to empower consumers to make informed financial decisions.

Key Responsibilities of the CFPB

The CFPB's responsibilities include: - Conducting rulemaking and issuing guidance to implement and interpret federal consumer financial laws. - Supervising and examining financial institutions to ensure compliance with federal consumer financial laws. - Enforcing federal consumer financial laws through administrative, civil, and other actions. - Monitoring and responding to consumer complaints. - Providing financial education and empowerment programs for consumers.5 CFPB Tips for Consumers

-

Know Your Rights: Familiarize yourself with the consumer protections afforded by the CFPB. Understanding your rights when dealing with financial institutions can help you avoid predatory practices and know when to seek help.

-

Check Your Credit Report: The CFPB emphasizes the importance of credit reports in determining your financial health. Consumers are entitled to a free credit report from each of the three major credit reporting agencies once a year. Reviewing these reports can help you identify and correct errors, which is crucial for maintaining a good credit score.

-

Be Informed About Financial Products: Before signing up for any financial product, such as a credit card, loan, or mortgage, make sure you understand all the terms and conditions. The CFPB provides resources and tools to help consumers make informed decisions about financial products.

-

File a Complaint: If you encounter a problem with a financial product or service, the CFPB's complaint system is a powerful tool. By filing a complaint, you not only seek a resolution to your issue but also contribute to the CFPB's efforts to identify and address broader patterns of unfair practices.

-

Seek Help When Needed: The CFPB offers guidance and resources for consumers facing financial challenges, such as dealing with debt collectors or avoiding foreclosure. Don't hesitate to seek help if you're struggling financially; the CFPB's resources can provide valuable assistance and support.

Additional Resources

For consumers looking for more information or assistance, the CFPB's website (consumerfinance.gov) is a comprehensive resource. It offers detailed guides on various financial topics, a database of consumer complaints, and tools for comparing financial products.Empowering Consumers Through Education

Education is a critical component of the CFPB's mission. By empowering consumers with knowledge, the CFPB aims to promote financial well-being and prevent financial harm. This includes providing resources for students, servicemembers, and older Americans, who may face unique financial challenges.

Financial Literacy

Financial literacy is the foundation upon which informed financial decisions are made. It involves understanding basic financial concepts, such as budgeting, saving, and investing, as well as being aware of the risks and benefits associated with different financial products. The CFPB supports financial literacy through various initiatives and resources, including educational materials, workshops, and online tools.Protecting Vulnerable Populations

The CFPB recognizes that certain populations, such as older Americans, students, and servicemembers, may be more vulnerable to financial exploitation. It has implemented specific protections and offers targeted resources to help these groups navigate financial challenges and avoid predatory practices.

Resources for Vulnerable Populations

- **Older Americans**: The CFPB provides guidance on managing someone else's money, avoiding scams, and understanding reverse mortgages. - **Students**: Resources include information on student loans, credit cards for students, and how to manage finances while in college. - **Servicemembers**: The CFPB offers protections and resources related to credit, loans, and other financial products tailored to the unique needs of military personnel.Conclusion and Next Steps

In conclusion, the CFPB plays a vital role in protecting consumers and promoting financial well-being. By understanding the CFPB's role, leveraging its resources, and following the tips outlined above, consumers can better navigate the complex financial landscape and avoid potential pitfalls. Whether you're a student, servicemember, older American, or simply looking to make more informed financial decisions, the CFPB's guidance and protections are invaluable.

Final Thoughts

As consumers continue to face new financial challenges and opportunities, staying informed and engaged is more important than ever. The CFPB's work in enforcing consumer financial laws, educating consumers, and promoting financial inclusion is crucial for building a stronger, more equitable financial system. By working together and utilizing the resources available, we can create a future where all consumers have the knowledge, tools, and protections needed to thrive financially.CFPB Image Gallery

We invite you to share your thoughts and experiences with the CFPB's resources and protections. How have you benefited from the CFPB's work? What challenges do you still face in navigating the financial system? Your insights can help inform and improve the CFPB's efforts to protect consumers. Please comment below, and consider sharing this article with others who may find it useful. Together, we can work towards a more transparent, equitable, and consumer-friendly financial system.