Intro

Minimize financial losses with a proven plan to reduce chargebacks. Discover a step-by-step template to identify and prevent disputes, improve customer communication, and optimize your businesss chargeback management process. Learn how to reduce chargeback ratios, recover revenue, and maintain a healthy merchant account with our expert-approved strategy.

Reducing chargebacks is a crucial aspect of any business that accepts credit card payments. Chargebacks can lead to significant financial losses, damage to a company's reputation, and even the loss of a merchant account. In this article, we will discuss the importance of reducing chargebacks and provide a proven plan template to help businesses minimize these costly transactions.

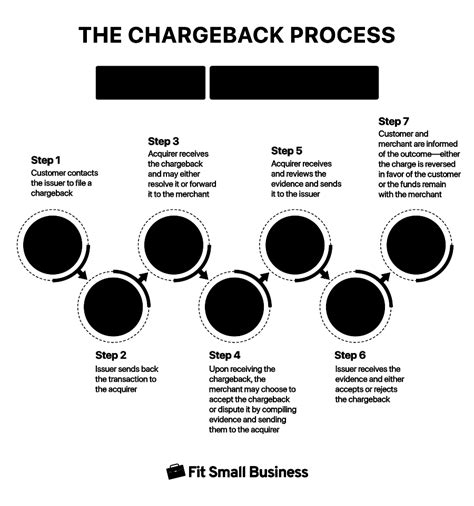

Chargebacks occur when a customer disputes a transaction with their credit card issuer, resulting in the reversal of the sale and the return of the funds to the customer. While some chargebacks are legitimate, many are the result of friendly fraud, where a customer makes a purchase and then claims they did not receive the product or service. Other common causes of chargebacks include misunderstandings about the transaction, dissatisfaction with the product or service, and unauthorized transactions.

The financial impact of chargebacks can be significant. According to the Federal Trade Commission (FTC), chargebacks cost businesses an estimated $40 billion annually. In addition to the direct financial loss, chargebacks can also lead to fees and penalties, damage to a company's credit score, and even the loss of a merchant account.

To reduce chargebacks, businesses must implement a comprehensive plan that addresses the root causes of these transactions. The following plan template provides a proven framework for minimizing chargebacks and reducing the financial impact of these costly transactions.

Understanding Chargebacks

Before implementing a plan to reduce chargebacks, it is essential to understand the chargeback process and the reasons why chargebacks occur. This includes:

- Familiarizing yourself with the chargeback process and the rules and regulations that govern it

- Analyzing your company's chargeback data to identify patterns and trends

- Identifying the root causes of chargebacks, such as friendly fraud, misunderstandings about the transaction, and dissatisfaction with the product or service

Preventing Chargebacks

Preventing chargebacks requires a proactive approach that addresses the root causes of these transactions. The following strategies can help:

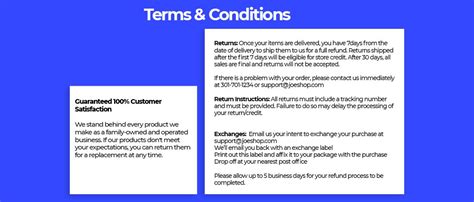

- Clear Communication: Clearly communicate with customers about the transaction, including the product or service being sold, the price, and the terms and conditions of the sale.

- Accurate Descriptions: Ensure that product or service descriptions are accurate and complete, including information about the product or service, pricing, and any limitations or restrictions.

- Customer Support: Provide excellent customer support to address any issues or concerns that customers may have about the transaction.

- Secure Transactions: Ensure that transactions are secure and that sensitive information is protected.

**Chargeback Prevention Strategies**

In addition to the strategies outlined above, the following chargeback prevention strategies can help minimize the risk of chargebacks:

- Addressing Friendly Fraud: Implement measures to prevent friendly fraud, such as requiring customers to provide identification and verifying the authenticity of transactions.

- Monitoring Transactions: Monitor transactions in real-time to identify and address any potential issues before they escalate into chargebacks.

- Customer Education: Educate customers about the chargeback process and the potential consequences of filing a false chargeback claim.

Responding to Chargebacks

While preventing chargebacks is essential, it is also crucial to have a plan in place for responding to chargebacks. The following strategies can help:

- Timely Response: Respond to chargebacks in a timely manner, ideally within 24-48 hours of receiving notification.

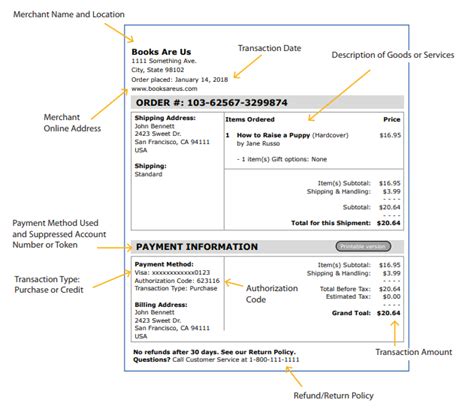

- Documentation: Gather and provide documentation to support the transaction, including receipts, invoices, and communication with the customer.

- Effective Communication: Communicate effectively with the customer and the credit card issuer to resolve the dispute.

**Chargeback Response Strategies**

The following chargeback response strategies can help minimize the risk of losing a chargeback dispute:

- Gathering Evidence: Gather evidence to support the transaction, including documentation and witness statements.

- Crafting a Compelling Response: Craft a compelling response to the chargeback claim, including a clear and concise explanation of the transaction and the evidence to support it.

- Negotiating a Resolution: Negotiate a resolution with the customer and the credit card issuer to avoid a lengthy and costly dispute.

Conclusion

Reducing chargebacks requires a comprehensive plan that addresses the root causes of these costly transactions. By understanding the chargeback process, preventing chargebacks, and responding effectively to chargebacks, businesses can minimize the financial impact of these transactions. The plan template outlined above provides a proven framework for reducing chargebacks and ensuring the long-term success of your business.

We encourage you to share your experiences and strategies for reducing chargebacks in the comments below. Don't forget to share this article with your colleagues and friends to help spread the word about the importance of chargeback prevention.

Gallery of Chargeback Prevention and Response

Chargeback Prevention and Response Image Gallery