Intro

Decode your Chime Bank statement with ease! Learn how to read and understand your Chime Bank statement template with our expert guide. Discover 5 ways to break down transaction records, identify fees, and reconcile your account. Master bank statement analysis and simplify your finances with our comprehensive tutorial.

In today's digital age, managing personal finances has become more convenient than ever. One of the most popular online banking platforms is Chime, which offers a range of features to help users track their expenses and stay on top of their finances. One of the key features of Chime is its bank statement template, which provides a clear and concise overview of your financial activity. In this article, we will explore five ways to understand the Chime bank statement template and how it can help you manage your finances effectively.

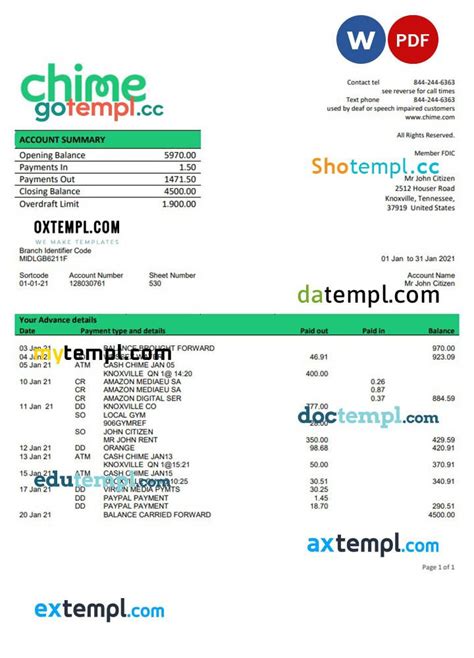

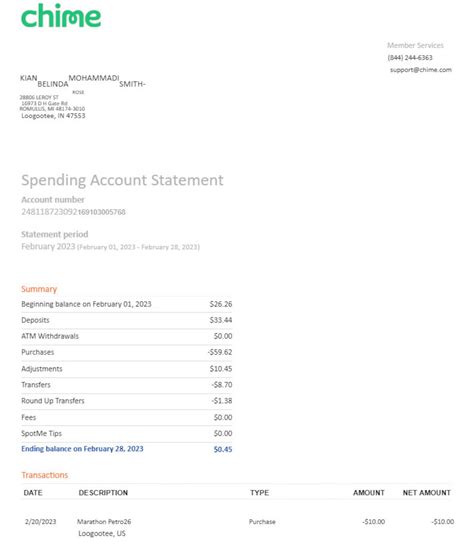

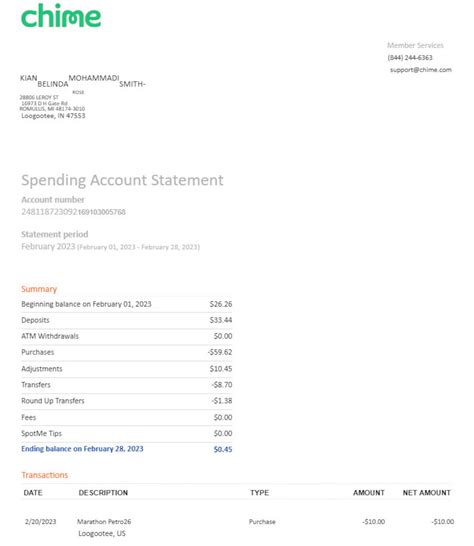

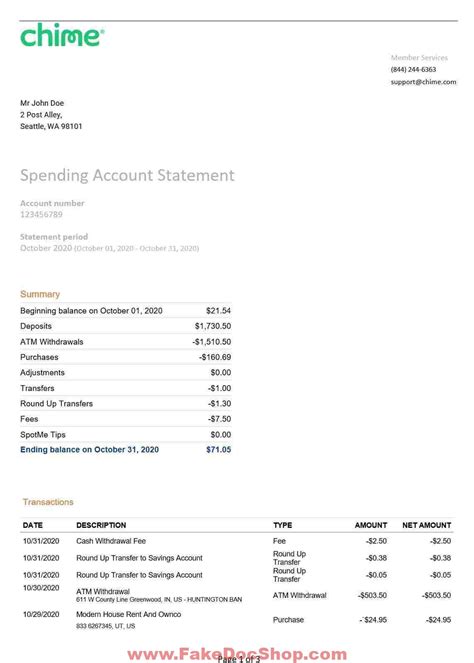

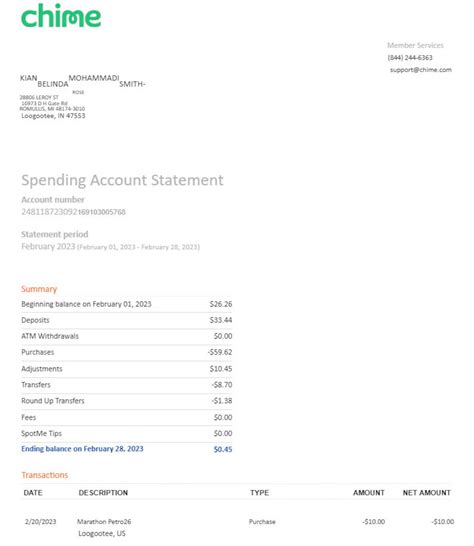

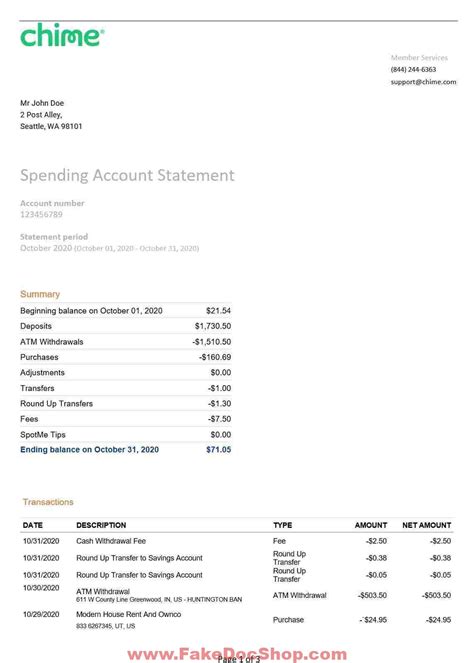

What is a Chime Bank Statement Template?

A Chime bank statement template is a digital document that provides a detailed summary of your financial activity over a specific period. It includes information such as your account balance, transactions, deposits, withdrawals, and any fees associated with your account. The template is designed to be easy to read and understand, making it a valuable tool for managing your finances.

Benefits of Using a Chime Bank Statement Template

Using a Chime bank statement template can help you stay on top of your finances in several ways:

- It provides a clear and concise overview of your financial activity, making it easier to track your spending and stay within your budget.

- It helps you identify any errors or discrepancies in your account, allowing you to address them promptly.

- It provides a record of your financial history, which can be useful for tax purposes or when applying for credit.

- It helps you stay organized and in control of your finances, reducing stress and anxiety.

5 Ways to Understand the Chime Bank Statement Template

Now that we have explored the benefits of using a Chime bank statement template, let's take a closer look at five ways to understand it:

1. Review Your Account Balance

The first step in understanding your Chime bank statement template is to review your account balance. This will give you an idea of how much money you have available in your account and help you plan your finances accordingly.

2. Identify Your Transactions

The next step is to identify your transactions, including deposits, withdrawals, and any fees associated with your account. This will help you understand where your money is going and make informed decisions about your spending.

3. Check for Errors or Discrepancies

It's essential to review your Chime bank statement template regularly to check for any errors or discrepancies. This could include incorrect transactions, missing deposits, or unexplained fees.

4. Use the Template to Budget

Your Chime bank statement template can also be used to budget and plan your finances. By reviewing your income and expenses, you can create a budget that helps you stay within your means and achieve your financial goals.

5. Monitor Your Spending Habits

Finally, your Chime bank statement template can help you monitor your spending habits and identify areas where you can cut back. By reviewing your transactions, you can see where you are spending the most money and make adjustments to save more.

Practical Examples of Using a Chime Bank Statement Template

Here are some practical examples of using a Chime bank statement template:

- Use the template to track your income and expenses over a specific period, such as a month or quarter.

- Use the template to identify areas where you can cut back on spending and save more.

- Use the template to create a budget that helps you stay within your means and achieve your financial goals.

- Use the template to monitor your spending habits and identify areas where you can improve.

- Use the template to track your financial history and provide a record of your financial activity.

Chime Bank Statement Template Gallery

We hope this article has provided you with a better understanding of the Chime bank statement template and how it can help you manage your finances effectively. By following the tips and examples outlined in this article, you can use your Chime bank statement template to take control of your finances and achieve your financial goals.