Intro

Get instant access to 5 free Chime bank statement templates. Easily track your transactions, manage your finances, and stay organized with these downloadable templates. Say goodbye to tedious record-keeping and hello to a streamlined banking experience with Chime statement templates, perfect for personal or business use.

Having a clear and organized bank statement is essential for managing your finances effectively. For Chime Bank users, having a template to help you keep track of your transactions can be incredibly helpful. In this article, we will provide you with 5 free Chime Bank statement templates that you can use to simplify your financial record-keeping.

Why Use a Chime Bank Statement Template?

Using a Chime Bank statement template can help you in several ways. Firstly, it allows you to keep a clear and organized record of your transactions, making it easier to track your spending and stay on top of your finances. Secondly, it helps you to identify areas where you can cut back on unnecessary expenses and make adjustments to your budget. Finally, having a template can save you time and effort in managing your financial records, allowing you to focus on more important things.

Benefits of Using a Chime Bank Statement Template

Here are some benefits of using a Chime Bank statement template:

- Helps you keep track of your transactions and stay organized

- Allows you to identify areas where you can cut back on unnecessary expenses

- Saves you time and effort in managing your financial records

- Helps you to create a budget and stick to it

- Provides a clear and concise record of your financial transactions

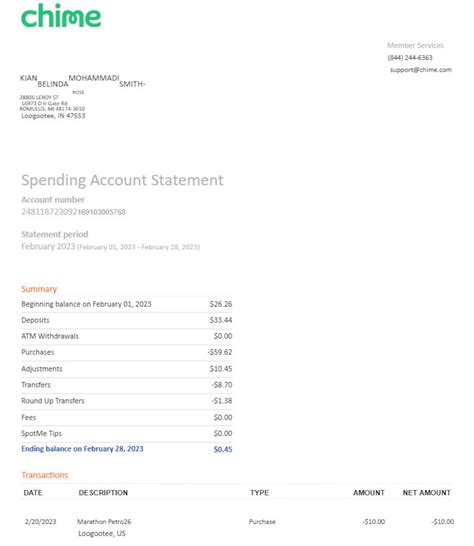

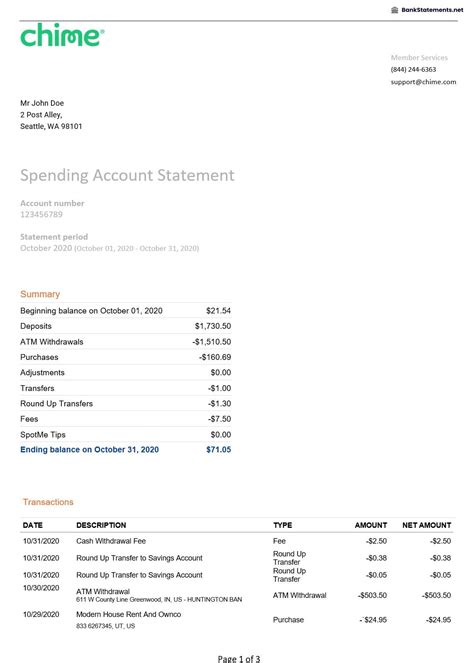

5 Free Chime Bank Statement Templates

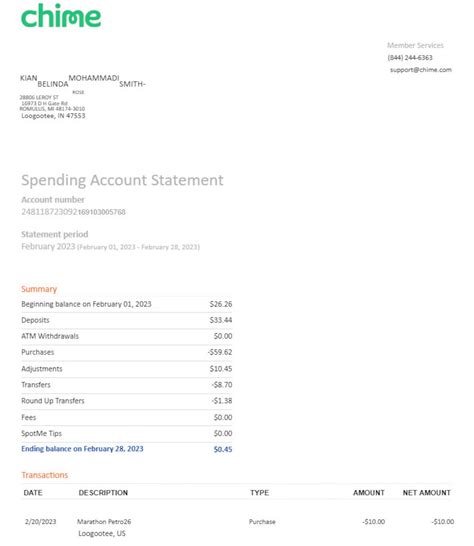

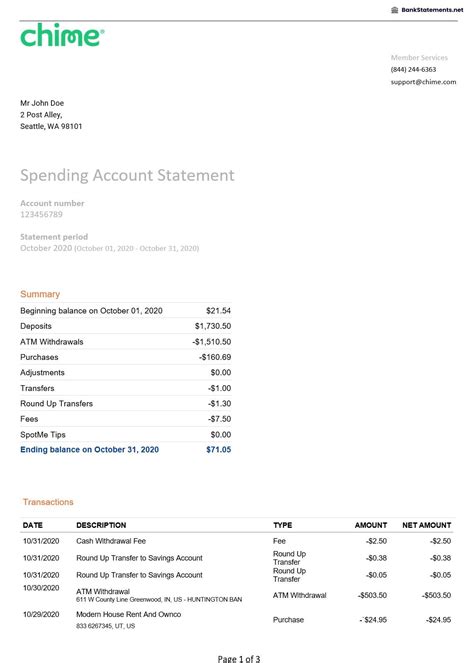

Here are 5 free Chime Bank statement templates that you can use to simplify your financial record-keeping:

- Simple Chime Bank Statement Template: This template provides a basic layout for tracking your transactions, including date, description, debit, credit, and balance.

- Chime Bank Statement Template with Budgeting: This template includes a budgeting section, allowing you to track your income and expenses and make adjustments to your budget as needed.

- Chime Bank Statement Template with Categories: This template allows you to categorize your transactions, making it easier to track your spending and identify areas where you can cut back.

- Chime Bank Statement Template with Running Balance: This template includes a running balance section, allowing you to keep track of your current balance and make adjustments as needed.

- Chime Bank Statement Template with Transaction Details: This template provides a detailed layout for tracking your transactions, including date, description, debit, credit, and balance, as well as a section for notes and comments.

How to Use a Chime Bank Statement Template

Using a Chime Bank statement template is easy. Here are the steps to follow:

- Choose a template that suits your needs

- Download and print the template

- Fill in the template with your transaction information

- Update the template regularly to keep track of your transactions

- Use the template to identify areas where you can cut back on unnecessary expenses and make adjustments to your budget

Chime Bank Statement Template FAQs

Here are some frequently asked questions about Chime Bank statement templates:

- Q: What is a Chime Bank statement template? A: A Chime Bank statement template is a pre-designed layout for tracking your transactions and managing your finances.

- Q: Why do I need a Chime Bank statement template? A: Using a Chime Bank statement template can help you keep track of your transactions, identify areas where you can cut back on unnecessary expenses, and make adjustments to your budget.

- Q: How do I use a Chime Bank statement template? A: Simply choose a template that suits your needs, download and print it, fill it in with your transaction information, and update it regularly.

Gallery of Chime Bank Statement Templates

Chime Bank Statement Template Gallery

We hope this article has been helpful in providing you with 5 free Chime Bank statement templates that you can use to simplify your financial record-keeping. Remember to choose a template that suits your needs and update it regularly to keep track of your transactions. If you have any questions or comments, please feel free to share them below.