Intro

Unlock the secrets of Chinas Producer Price Index (PPI) and its far-reaching economic impact. Learn how PPI affects inflation, manufacturing, and global trade. Discover the key drivers and trends shaping Chinas economic landscape, from commodity prices to monetary policy. Stay ahead of the curve with expert insights and analysis.

The China Producer Price Index (PPI) is a crucial economic indicator that measures the average change in prices of goods and services produced by Chinese manufacturers and producers. It is a key metric that helps policymakers, economists, and investors understand the overall health of China's economy. In this article, we will delve into the world of the China PPI, exploring its importance, working mechanism, and economic impact.

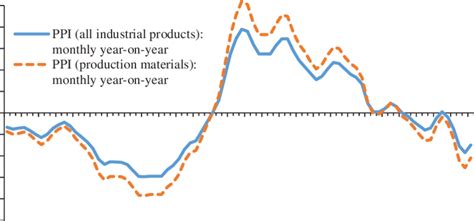

The China PPI is released monthly by the National Bureau of Statistics of China (NBS) and is widely followed by market participants, policymakers, and analysts. The index is calculated based on a basket of goods and services produced by Chinese manufacturers, including industrial products, agricultural products, and energy commodities. The PPI is considered a leading indicator of inflation, as it measures the prices of goods at the production level, which eventually trickle down to consumers.

How is the China PPI Calculated?

The China PPI is calculated using a complex methodology that involves collecting price data from thousands of Chinese manufacturers and producers. The NBS uses a Laspeyres index formula, which is a weighted average of price changes of a basket of goods and services. The basket is composed of over 800 goods and services, which are grouped into 11 major categories, including:

- Coal mining and washing

- Oil and gas extraction

- Ferrous metal mining

- Non-ferrous metal mining

- Non-metallic mineral mining

- Agricultural products

- Food processing

- Textile production

- Wood processing

- Paper and paper products

- Chemical production

Each category is assigned a weight based on its importance in the Chinese economy, and the prices of goods and services within each category are collected from a sample of manufacturers and producers.

What are the Key Components of the China PPI?

The China PPI is composed of several key components, including:

- Raw materials: This category includes prices of raw materials, such as coal, iron ore, and crude oil.

- Intermediate goods: This category includes prices of intermediate goods, such as steel, cement, and chemicals.

- Final goods: This category includes prices of final goods, such as machinery, electronics, and textiles.

- Energy commodities: This category includes prices of energy commodities, such as gasoline, diesel, and electricity.

Each component is weighted based on its importance in the Chinese economy, and the overall PPI is calculated as a weighted average of the price changes of each component.

What is the Economic Impact of the China PPI?

The China PPI has significant economic implications for China and the global economy. Here are some of the key economic impacts of the China PPI:

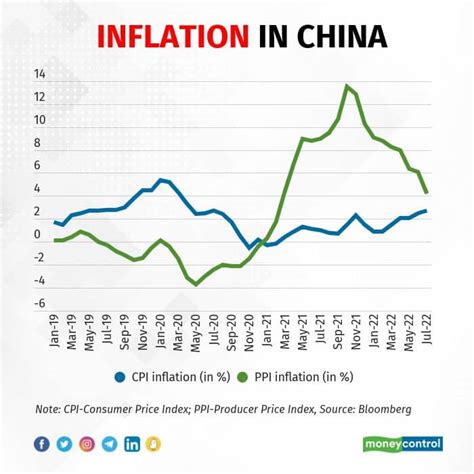

- Inflation expectations: The China PPI is considered a leading indicator of inflation, as it measures the prices of goods at the production level. An increase in the PPI can indicate rising inflation expectations, which can impact monetary policy decisions.

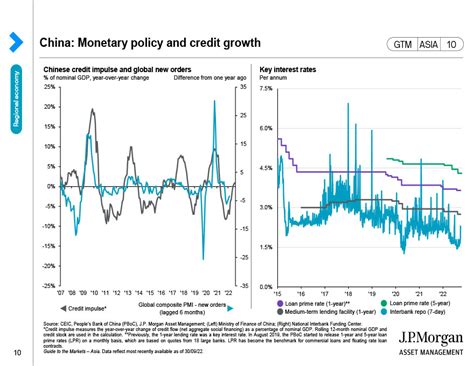

- Monetary policy: The People's Bank of China (PBOC) uses the PPI as one of the key indicators to determine monetary policy decisions. An increase in the PPI can lead to tighter monetary policy, while a decrease can lead to looser monetary policy.

- Currency market: The China PPI can impact the value of the Chinese yuan (RMB) against other currencies. An increase in the PPI can lead to a stronger RMB, while a decrease can lead to a weaker RMB.

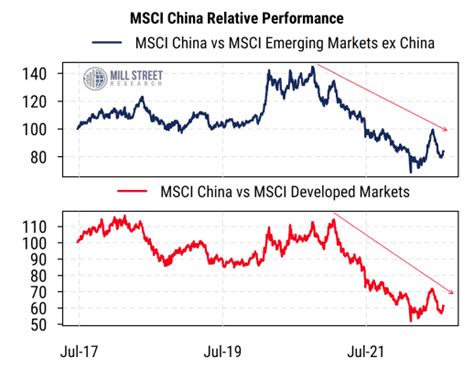

- Stock market: The China PPI can impact the Chinese stock market, as an increase in the PPI can lead to higher production costs and lower profit margins for companies.

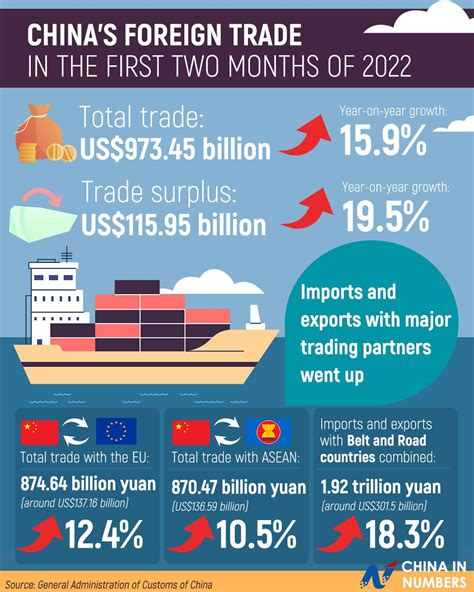

- Global trade: The China PPI can impact global trade, as an increase in the PPI can lead to higher prices of Chinese exports, making them less competitive in the global market.

How Does the China PPI Impact the Global Economy?

The China PPI has significant implications for the global economy, as China is the world's second-largest economy and a major trading partner for many countries. Here are some of the key ways in which the China PPI can impact the global economy:

- Global inflation: An increase in the China PPI can lead to higher global inflation, as Chinese exports become more expensive for other countries.

- Global trade: An increase in the China PPI can lead to higher prices of Chinese exports, making them less competitive in the global market.

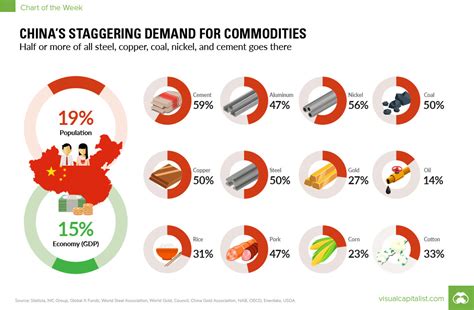

- Commodity prices: The China PPI can impact global commodity prices, as China is a major consumer of commodities such as copper, iron ore, and crude oil.

- Emerging markets: The China PPI can impact emerging markets, as many emerging market economies are heavily dependent on Chinese trade and investment.

Conclusion

The China Producer Price Index is a crucial economic indicator that measures the average change in prices of goods and services produced by Chinese manufacturers and producers. The PPI has significant economic implications for China and the global economy, including inflation expectations, monetary policy, currency market, stock market, and global trade. Understanding the China PPI is essential for policymakers, economists, and investors to make informed decisions about the Chinese economy and its impact on the global economy.

China Producer Price Index Image Gallery

We hope this article has provided you with a comprehensive understanding of the China Producer Price Index and its economic impact. If you have any questions or comments, please feel free to share them with us.