Intro

Discover expert 5 Cit Bank Mortgage Tips for a smooth loan process, including mortgage rates, loan options, and refinancing, to help you make informed decisions and secure the best mortgage deals with competitive interest rates and flexible repayment terms.

Purchasing a home can be a daunting experience, especially when it comes to navigating the mortgage process. With so many options available, it's essential to find a lender that meets your needs and provides competitive rates. CIT Bank is a popular choice among homebuyers, offering a range of mortgage products with attractive terms. In this article, we'll delve into the world of CIT Bank mortgages, exploring five valuable tips to help you make the most of your home financing experience.

For those who are new to the mortgage market, CIT Bank is a reputable online lender that offers a variety of loan options, including conventional, jumbo, and FHA loans. With a strong focus on customer service and a user-friendly online platform, CIT Bank has become a go-to destination for homebuyers seeking a hassle-free mortgage experience. Whether you're a first-time buyer or a seasoned homeowner, understanding the ins and outs of CIT Bank's mortgage products is crucial to securing the best deal possible.

As you begin your mortgage journey, it's essential to consider the various factors that can impact your loan terms. From credit scores to debt-to-income ratios, numerous elements can influence the interest rate you qualify for and the overall cost of your loan. By taking the time to educate yourself on the mortgage process and CIT Bank's specific requirements, you can avoid common pitfalls and ensure a smooth transaction. In the following sections, we'll explore five expert tips to help you navigate the CIT Bank mortgage process with confidence.

Understanding CIT Bank Mortgage Options

Conventional Loans

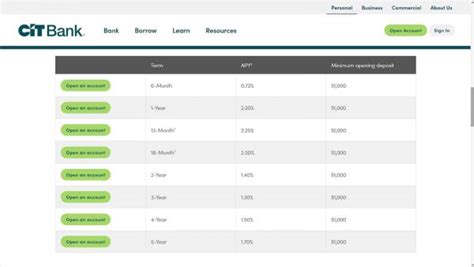

Conventional loans are one of the most popular mortgage options offered by CIT Bank. These loans are not insured by the government and typically require a higher credit score and larger down payment. However, they often come with more flexible terms and lower mortgage insurance premiums. CIT Bank's conventional loans are available in 15- or 30-year fixed-rate terms, as well as 5/1 and 7/1 adjustable-rate terms.FHA Loans

FHA loans, on the other hand, are insured by the Federal Housing Administration and are designed for borrowers with lower credit scores or limited down payment funds. These loans offer more lenient credit requirements and lower down payment options, making them an attractive choice for first-time homebuyers. CIT Bank's FHA loans are available in 15- or 30-year fixed-rate terms, with down payment requirements as low as 3.5%.Checking Your Credit Score

Improving Your Credit Score

If your credit score is less than ideal, there are several steps you can take to improve it. Paying your bills on time, reducing debt, and avoiding new credit inquiries can all help to boost your credit score over time. Additionally, CIT Bank offers a range of resources and tools to help borrowers improve their credit and qualify for better loan terms.Getting Pre-Approved

Pre-Approval Process

The pre-approval process typically takes several days to a week, depending on the complexity of your financial situation. Once you've submitted your application, CIT Bank will review your credit report, verify your income and assets, and provide you with a pre-approval letter stating the approved loan amount and interest rate. This letter is usually valid for 30 to 60 days, giving you ample time to find your dream home.Comparing Rates and Terms

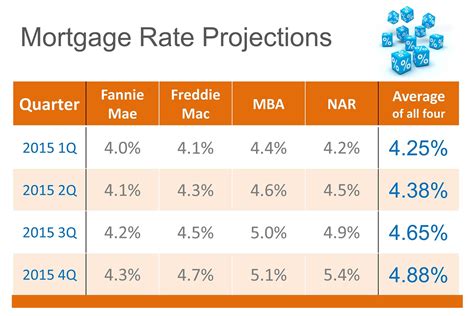

Rate Lock Options

CIT Bank also offers rate lock options, which allow you to secure a specific interest rate for a predetermined period. This can provide peace of mind and protect you from rising interest rates. Rate locks are usually available for 30, 45, or 60 days, and may require a fee to extend the lock period.Working with a Mortgage Expert

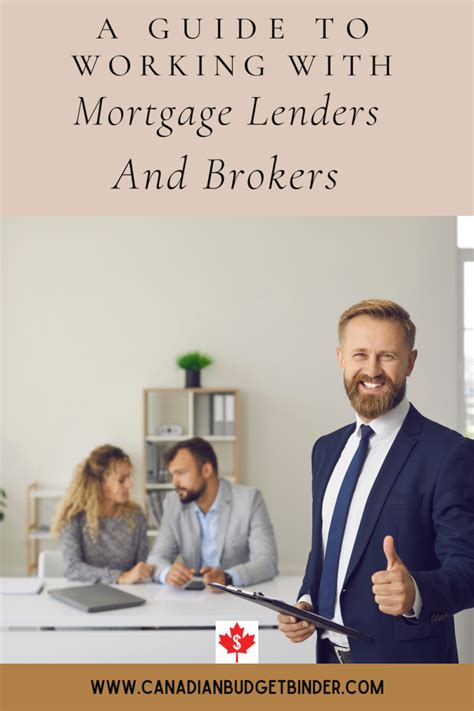

Mortgage Expert Benefits

Some of the benefits of working with a mortgage expert include: * Personalized loan recommendations * Expert guidance on the application process * Assistance with credit score improvement * Access to exclusive loan products and rates * Ongoing support throughout the loan termCIT Bank Mortgage Image Gallery

In conclusion, navigating the CIT Bank mortgage process requires careful consideration and planning. By understanding the various loan options, checking your credit score, getting pre-approved, comparing rates and terms, and working with a mortgage expert, you can ensure a smooth and successful homebuying experience. Remember to stay informed, ask questions, and seek guidance when needed. With the right approach and support, you can find the perfect CIT Bank mortgage to suit your needs and achieve your dream of homeownership. We invite you to share your thoughts and experiences with CIT Bank mortgages in the comments below, and don't forget to share this article with friends and family who may be embarking on their own homebuying journey.