Intro

Discover high-yield Cit online savings account rates, featuring competitive APYs, low fees, and flexible banking options, ideal for savers seeking secure, high-interest savings accounts with easy online management.

The world of online banking has revolutionized the way we manage our finances, and one of the most significant advantages is the ability to earn higher interest rates on our savings. CIT Bank, a leading online bank, offers a range of savings account options with competitive rates that can help you grow your savings over time. In this article, we will delve into the world of CIT online savings account rates, exploring the benefits, features, and steps to open an account.

Saving money is an essential aspect of personal finance, and it's crucial to find a savings account that meets your needs. With so many options available, it can be overwhelming to choose the right one. However, CIT Bank's online savings accounts have gained popularity due to their high-yield rates, low fees, and user-friendly online platform. Whether you're a seasoned saver or just starting to build your emergency fund, CIT Bank's online savings account rates are definitely worth considering.

The importance of saving money cannot be overstated. Having a cushion of savings can provide peace of mind, help you weather financial storms, and achieve long-term goals such as buying a house, funding your children's education, or retiring comfortably. With CIT Bank's online savings accounts, you can earn higher interest rates than traditional brick-and-mortar banks, which means your money can grow faster over time. In the following sections, we will explore the benefits, features, and rates of CIT Bank's online savings accounts in more detail.

Benefits of CIT Online Savings Account Rates

Features of CIT Online Savings Accounts

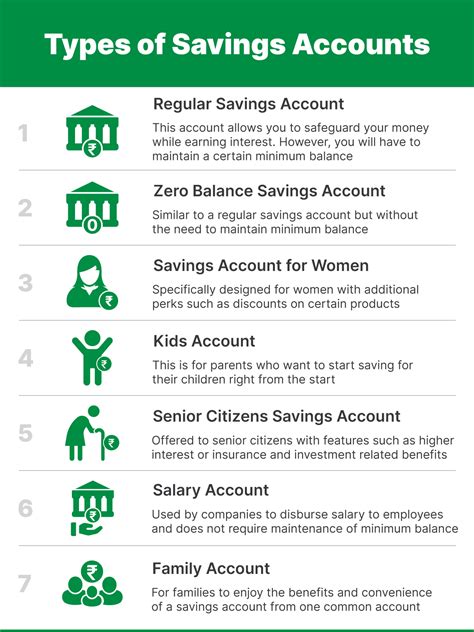

CIT Bank's online savings accounts come with a range of features that make it easy to manage your money. Some of the key features include: * Online account management * Mobile banking app * Bill pay * Transfer funds * Account alerts * FDIC insuranceTypes of CIT Online Savings Accounts

How to Open a CIT Online Savings Account

Opening a CIT online savings account is a straightforward process that can be completed online or by phone. To get started, you will need to: 1. Visit the CIT Bank website 2. Click on the "Open an Account" button 3. Choose the type of account you want to open 4. Fill out the online application form 5. Fund your account with an initial depositCIT Online Savings Account Rates Comparison

Tips for Maximizing Your CIT Online Savings Account Rates

To maximize your CIT online savings account rates, consider the following tips: * Keep a high balance: The higher your balance, the more interest you will earn. * Avoid fees: Try to avoid fees by maintaining a minimum balance and avoiding overdrafts. * Use the mobile banking app: The mobile banking app makes it easy to manage your account and transfer funds. * Consider a savings challenge: Consider a savings challenge to help you save more and earn more interest.CIT Online Savings Account Security

Common Questions About CIT Online Savings Account Rates

Here are some common questions about CIT online savings account rates: * What is the interest rate on a CIT online savings account? * How do I open a CIT online savings account? * What are the fees associated with a CIT online savings account? * Is my money safe with CIT Bank?CIT Online Savings Account Image Gallery

In conclusion, CIT online savings account rates offer a range of benefits, including high-yield interest rates, low fees, and a user-friendly online platform. By considering the different types of CIT online savings accounts, comparing rates, and following tips for maximizing your earnings, you can make the most of your savings and achieve your long-term financial goals. We invite you to share your experiences with CIT online savings account rates, ask questions, or provide feedback in the comments section below.