Intro

Boost your finances with High Cit Rates Savings, offering competitive interest rates, secure investments, and high-yield returns, maximizing your savings potential.

High cit rates savings accounts have become increasingly popular among individuals looking to maximize their savings. With the rise of online banking and financial technology, it's now easier than ever to find and open a high-yield savings account that offers competitive interest rates. In this article, we'll delve into the world of high cit rates savings, exploring the benefits, types of accounts, and strategies for getting the most out of your savings.

The importance of saving cannot be overstated. Having a cushion of savings can provide peace of mind, financial security, and the freedom to pursue long-term goals. However, with inflation and economic uncertainty, it's essential to find ways to make your savings work harder for you. High cit rates savings accounts offer a solution, providing a safe and low-risk way to grow your savings over time. Whether you're looking to build an emergency fund, save for a specific goal, or simply earn a higher return on your cash, high cit rates savings accounts are definitely worth considering.

For those who are new to high cit rates savings, it's essential to understand how these accounts work. Essentially, high-yield savings accounts are a type of deposit account that earns a higher interest rate than a traditional savings account. These accounts are typically offered by online banks, credit unions, and financial institutions that operate primarily online. By cutting out the costs associated with physical branches, these institutions can pass the savings on to customers in the form of higher interest rates. As a result, high cit rates savings accounts can offer significantly higher returns than traditional savings accounts, making them an attractive option for savers.

Benefits of High Cit Rates Savings Accounts

Some of the key benefits of high cit rates savings accounts include:

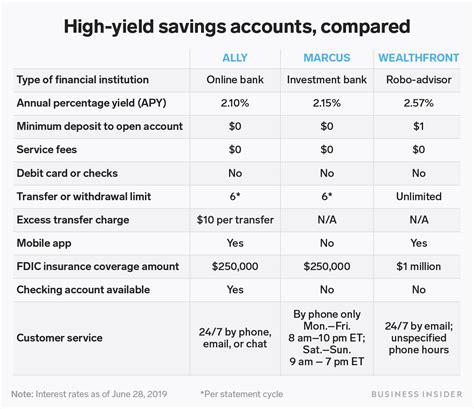

- Higher interest rates: High-yield savings accounts offer significantly higher interest rates than traditional savings accounts, which means you can earn more money on your deposits over time.

- Low risk: High cit rates savings accounts are typically insured by the FDIC or NCUA, which means your deposits are protected up to $250,000.

- Liquidity: High-yield savings accounts are highly liquid, meaning you can access your money when you need it.

- Flexibility: Many high cit rates savings accounts offer flexible terms and conditions, allowing you to withdraw your money or add to your account as needed.

Types of High Cit Rates Savings Accounts

How to Choose the Right High Cit Rates Savings Account

When it comes to choosing the right high cit rates savings account, there are several factors to consider. Some of the key things to look for include: * Interest rate: Look for accounts that offer competitive interest rates, and consider the APY (annual percentage yield) to ensure you're getting the best return on your money. * Fees: Check for any fees associated with the account, such as maintenance fees, overdraft fees, or ATM fees. * Minimum balance requirements: Some high cit rates savings accounts come with minimum balance requirements, which can affect your ability to earn interest or avoid fees. * Liquidity: Consider the liquidity of the account, and whether you can access your money when you need it.Strategies for Getting the Most Out of Your High Cit Rates Savings Account

Common Mistakes to Avoid

When it comes to high cit rates savings accounts, there are several common mistakes to avoid. Some of the most common mistakes include: * Not reading the fine print: Be sure to read the terms and conditions of your account carefully, and understand any fees or restrictions that may apply. * Not monitoring your account: Failing to monitor your account can lead to missed opportunities or unforeseen fees. * Not taking advantage of compounding interest: Compounding interest can help your savings grow faster over time, so be sure to take advantage of this feature.High Cit Rates Savings Accounts and Inflation

High Cit Rates Savings Accounts and Taxes

High cit rates savings accounts can also have tax implications, which should be considered when evaluating these accounts. Some of the key tax implications to consider include: * Interest income: The interest earned on your high-yield savings account is considered taxable income, and will be reported on your tax return. * Tax deductions: Depending on your tax situation, you may be able to deduct certain expenses related to your high-yield savings account, such as fees or interest payments.Gallery of High Cit Rates Savings Accounts

High Cit Rates Savings Accounts Image Gallery

In conclusion, high cit rates savings accounts offer a safe and low-risk way to grow your savings over time. By understanding the benefits, types of accounts, and strategies for getting the most out of your high-yield savings account, you can make informed decisions about your financial future. Whether you're looking to build an emergency fund, save for a specific goal, or simply earn a higher return on your cash, high cit rates savings accounts are definitely worth considering. We invite you to share your thoughts and experiences with high cit rates savings accounts in the comments below, and to explore other articles on our site for more information on personal finance and savings strategies.