Intro

Learn how to calculate your Coast Guard pay accurately with our comprehensive guide. Discover the top 5 methods to determine your military compensation, including Base Pay, Allowances, Special Pays, and more. Get insider tips on how to maximize your earnings, navigate the pay chart, and understand the impact of time-in-grade and time-in-service.

The United States Coast Guard is a unique branch of the military that operates under the Department of Homeland Security during peacetime, but can be transferred to the Department of the Navy during wartime. As a result, Coast Guard pay is calculated similarly to other military branches, but with some differences. Here are five ways to calculate Coast Guard pay:

Understanding Coast Guard Pay Grades

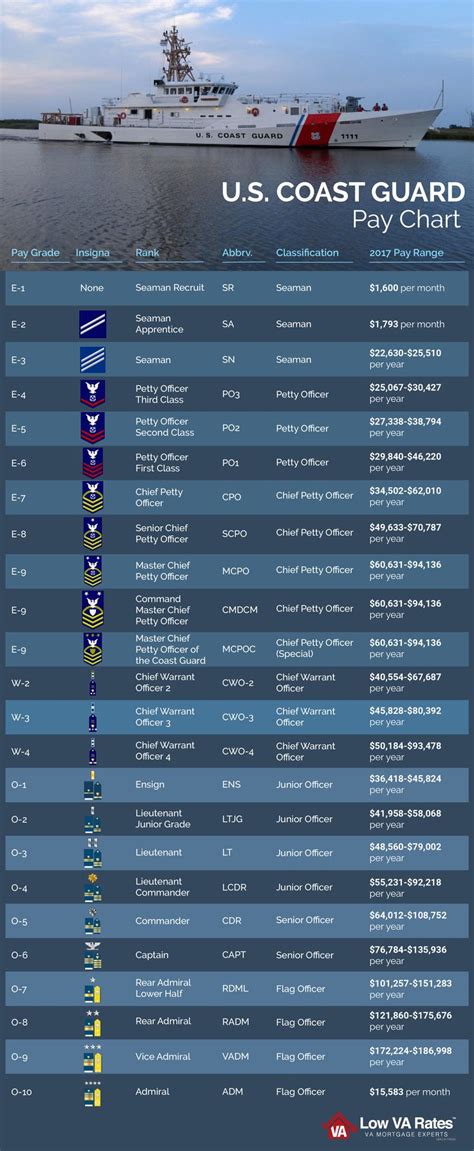

Coast Guard pay is based on a combination of factors, including the member's pay grade, time in service, and time in pay grade. The Coast Guard uses a pay grade system similar to the other military branches, with nine enlisted pay grades (E-1 to E-9) and eleven officer pay grades (O-1 to O-10).

Enlisted Pay Grades

- E-1: Seaman Recruit (SR)

- E-2: Seaman Apprentice (SA)

- E-3: Seaman (SN)

- E-4: Petty Officer Third Class (PO3)

- E-5: Petty Officer Second Class (PO2)

- E-6: Petty Officer First Class (PO1)

- E-7: Chief Petty Officer (CPO)

- E-8: Senior Chief Petty Officer (SCPO)

- E-9: Master Chief Petty Officer (MCPO)

Officer Pay Grades

- O-1: Ensign (ENS)

- O-2: Lieutenant Junior Grade (LTJG)

- O-3: Lieutenant (LT)

- O-4: Lieutenant Commander (LCDR)

- O-5: Commander (CDR)

- O-6: Captain (CAPT)

- O-7: Rear Admiral Lower Half (RDML)

- O-8: Rear Admiral Upper Half (RADM)

- O-9: Vice Admiral (VA)

- O-10: Admiral (ADM)

Calculating Coast Guard Base Pay

Coast Guard base pay is calculated based on the member's pay grade and time in service. The Coast Guard uses a pay chart to determine base pay, which is updated annually. To calculate base pay, follow these steps:

- Determine the member's pay grade and time in service.

- Find the corresponding pay grade and time in service on the Coast Guard pay chart.

- Read the monthly base pay amount from the chart.

For example, a Petty Officer Second Class (E-5) with 6 years of service would have a monthly base pay of $2,714.10, according to the 2022 Coast Guard pay chart.

Calculating Coast Guard Allowances

In addition to base pay, Coast Guard members may receive allowances to help cover the cost of living expenses. The two main allowances are Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH).

- BAS: This allowance is intended to help cover the cost of food and is paid to all members, regardless of their marital status or dependency status. The monthly BAS rate is $369.39 for enlisted members and $254.39 for officers.

- BAH: This allowance is intended to help cover the cost of housing and is paid to members who do not live in government-provided housing. The monthly BAH rate varies depending on the member's location, pay grade, and dependency status.

To calculate allowances, follow these steps:

- Determine the member's pay grade and marital status.

- Find the corresponding BAS and BAH rates for the member's location and pay grade.

- Add the BAS and BAH rates to the member's base pay.

For example, a Petty Officer Second Class (E-5) with 6 years of service, living in San Diego, CA, with dependents, would have a monthly BAS rate of $369.39 and a monthly BAH rate of $1,743.00. Their total monthly pay would be:

$2,714.10 (base pay) + $369.39 (BAS) + $1,743.00 (BAH) = $4,826.49

Calculating Coast Guard Special Pays

Coast Guard members may be eligible for special pays, which are designed to compensate members for hazardous duty, special skills, or other unique circumstances. Some examples of special pays include:

- Hazardous Duty Pay (HDP): Paid to members who perform hazardous duties, such as aviation or diving.

- Dive Pay: Paid to members who are qualified divers.

- Flight Pay: Paid to members who are qualified aviators.

- Submarine Duty Pay: Paid to members who serve on submarines.

To calculate special pays, follow these steps:

- Determine the member's pay grade and special pay eligibility.

- Find the corresponding special pay rate for the member's pay grade and special pay type.

- Add the special pay rate to the member's base pay and allowances.

For example, a Petty Officer Second Class (E-5) with 6 years of service, serving on a submarine, would be eligible for Submarine Duty Pay. The monthly Submarine Duty Pay rate is $500.00. Their total monthly pay would be:

$2,714.10 (base pay) + $369.39 (BAS) + $1,743.00 (BAH) + $500.00 (Submarine Duty Pay) = $5,326.49

Calculating Coast Guard Bonuses

Coast Guard members may be eligible for bonuses, which are designed to incentivize members to serve in certain specialties or to reenlist. Some examples of bonuses include:

- Enlistment Bonus: Paid to new recruits who enlist in a critical skill or specialty.

- Reenlistment Bonus: Paid to members who reenlist in a critical skill or specialty.

- Special Duty Pay Bonus: Paid to members who serve in a special duty pay eligible position.

To calculate bonuses, follow these steps:

- Determine the member's pay grade and bonus eligibility.

- Find the corresponding bonus rate for the member's pay grade and bonus type.

- Add the bonus rate to the member's base pay and allowances.

For example, a Petty Officer Second Class (E-5) with 6 years of service, reenlisting in a critical skill, would be eligible for a Reenlistment Bonus. The bonus rate is $10,000.00. Their total monthly pay would be:

$2,714.10 (base pay) + $369.39 (BAS) + $1,743.00 (BAH) + $500.00 (Submarine Duty Pay) + $10,000.00 (Reenlistment Bonus) = $13,326.49

Coast Guard Pay Image Gallery

We hope this article has helped you understand how to calculate Coast Guard pay. Remember to consider all the factors that affect pay, including pay grade, time in service, allowances, special pays, and bonuses. If you have any further questions or would like to discuss your specific situation, please leave a comment below.