Intro

Explore the alarming signs of a potential US dollar collapse. Is the end near? Learn about the impending economic crisis, dollar devaluation, inflation, and the impact of global trade wars on the US currency. Discover the expert predictions, causes, and consequences of a dollar collapse and how to protect your assets.

The US dollar has been the global reserve currency for decades, and its collapse has been predicted by many economists and financial experts. However, the question remains: is the end near? In this article, we will explore the factors that contribute to the potential collapse of the US dollar, its impact on the global economy, and what it means for investors and individuals.

What Causes a Currency to Collapse?

A currency collapse occurs when a country's currency loses a significant portion of its value in a short period. This can happen due to various factors, including:

- Hyperinflation: When a country experiences extremely high inflation rates, the value of its currency can drop significantly.

- Economic Instability: Economic instability, such as a recession or a significant decline in a country's GDP, can lead to a loss of confidence in its currency.

- Debt Crisis: When a country's debt levels become unsustainable, it can lead to a currency crisis.

- Loss of Confidence: When investors and citizens lose confidence in a country's currency, it can lead to a collapse.

Factors Contributing to the Potential Collapse of the US Dollar

Several factors contribute to the potential collapse of the US dollar, including:

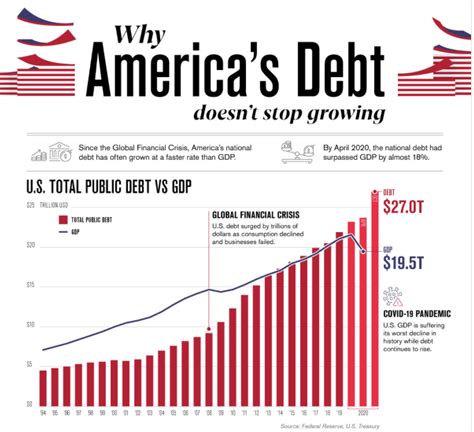

- Increasing National Debt: The US national debt has been increasing rapidly over the years, and it is now over $28 trillion. This has led to concerns about the country's ability to pay its debts.

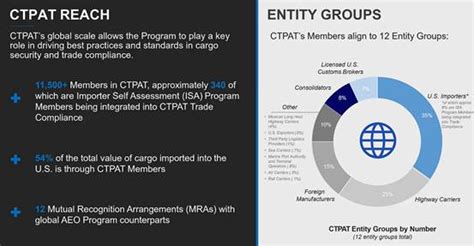

- Trade Deficits: The US has been experiencing significant trade deficits, which can lead to a decline in the value of its currency.

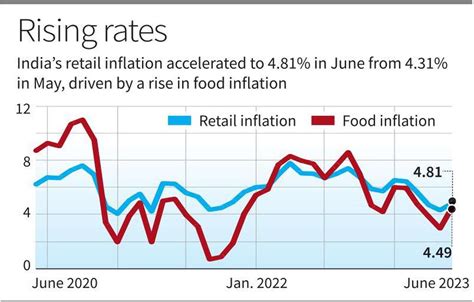

- Inflation: The US has experienced low inflation rates in recent years, but there are concerns that inflation could rise in the future, which could lead to a decline in the value of the dollar.

- Global Economic Trends: The global economy is becoming increasingly multipolar, with countries like China and the EU gaining more economic influence. This could lead to a decline in the value of the US dollar.

Impact of a US Dollar Collapse on the Global Economy

A US dollar collapse would have significant implications for the global economy, including:

- Global Trade: A decline in the value of the US dollar would make US exports more competitive, but it could also lead to trade wars and protectionism.

- Commodity Prices: A decline in the value of the US dollar could lead to an increase in commodity prices, as many commodities are priced in US dollars.

- Global Financial Markets: A US dollar collapse could lead to a decline in global financial markets, as many assets are priced in US dollars.

What Does a US Dollar Collapse Mean for Investors and Individuals?

A US dollar collapse would have significant implications for investors and individuals, including:

- Investment Strategies: Investors may need to adjust their investment strategies to take into account the potential collapse of the US dollar.

- Asset Protection: Individuals may need to take steps to protect their assets, such as diversifying their investments and holding assets in other currencies.

- Inflation Protection: Individuals may need to take steps to protect themselves from inflation, such as investing in assets that historically perform well during periods of inflation.

Is the End Near?

While there are factors that contribute to the potential collapse of the US dollar, it is impossible to predict with certainty when or if it will happen. However, by understanding the factors that contribute to a currency collapse and taking steps to protect oneself, individuals and investors can be prepared for any eventuality.

US Dollar Collapse Image Gallery

The potential collapse of the US dollar is a complex and multifaceted issue that requires careful consideration. By understanding the factors that contribute to a currency collapse and taking steps to protect oneself, individuals and investors can be prepared for any eventuality.