Intro

Chinas economic house of cards is on the brink of collapse. Rising debt, declining growth, and decreasing exports are warning signs of a looming economic crisis. Explore the factors contributing to Chinas economic instability, including a slowing property market, faltering manufacturing sector, and the impact of the US-China trade war.

China's rapid economic growth over the past few decades has been nothing short of remarkable. The country has transformed itself from a relatively poor and isolated nation to the world's second-largest economy, with a GDP of over $14 trillion. However, beneath the surface of this impressive growth lies a complex web of economic vulnerabilities that threaten to topple the entire house of cards.

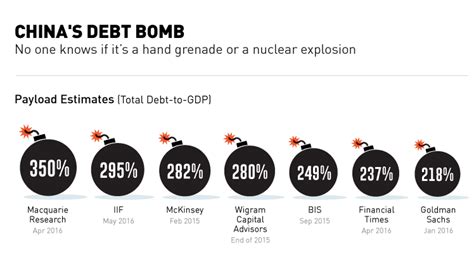

China's economic miracle has been fueled by a combination of factors, including large-scale investment in infrastructure, a massive and cheap labor force, and a favorable business environment. However, this growth has come at a cost. China's economy is now heavily reliant on debt, with total debt levels exceeding 300% of GDP. This is significantly higher than the debt levels of other major economies, and it poses a significant risk to the stability of the entire financial system.

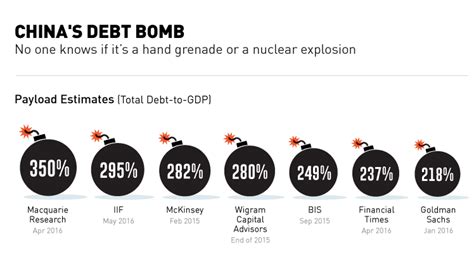

China's Debt Bomb

China's debt problem is a ticking time bomb, waiting to go off and cause widespread devastation to the global economy. The country's debt-to-GDP ratio has increased dramatically over the past decade, from around 150% in 2008 to over 300% today. This is a staggering increase, and it is unsustainable in the long term.

The main driver of China's debt problem is the country's addiction to credit. China's banking system is dominated by state-owned banks, which are often forced to lend to inefficient and unprofitable state-owned enterprises (SOEs). These SOEs are often unable to repay their debts, which means that the banks are left holding large amounts of bad debt.

Shadow Banking

China's shadow banking sector is another major contributor to the country's debt problem. Shadow banking refers to the practice of providing loans and other financial services outside of the traditional banking system. In China, the shadow banking sector is massive, with estimates suggesting that it is worth over $8 trillion.

The shadow banking sector is a major risk to China's financial stability because it is largely unregulated. This means that there is little oversight of the sector, and it is difficult to know the true extent of the risks involved. The shadow banking sector is also heavily interconnected with the traditional banking system, which means that if it were to collapse, it could take the entire financial system down with it.

China's Housing Bubble

China's housing market is another area of concern. The country's housing bubble is one of the largest in the world, with prices having increased by over 50% in the past year alone. This is unsustainable, and it is only a matter of time before the bubble bursts.

The housing bubble is being fueled by speculation and easy credit. Many people are buying homes in the hope of making a quick profit, rather than to live in them. This is creating a huge amount of demand for housing, which is driving up prices.

Ghost Cities

China's ghost cities are another symptom of the country's housing bubble. Ghost cities are cities that have been built but are largely uninhabited. They are a result of the government's efforts to stimulate economic growth through infrastructure development.

Ghost cities are a major waste of resources and are a sign of the government's failed economic policies. They are also a risk to the financial system, as many of the banks that have lent money to the developers of these cities may not get their money back.

China's Economic Reforms

China's economic reforms are a major concern for investors and policymakers around the world. The government has announced a number of reforms aimed at reducing the country's reliance on debt and stimulating economic growth.

However, many of these reforms have been slow to implement, and it is unclear whether they will be enough to address the country's deep-seated economic problems. The government has also been reluctant to allow the market to play a greater role in the economy, which has limited the effectiveness of the reforms.

Xi Jinping's Power Grab

Xi Jinping's power grab is another major concern for investors and policymakers. Xi has consolidated power in his own hands, which has limited the ability of other policymakers to implement reforms.

Xi's power grab has also limited the ability of the government to respond to economic crises. This has increased the risk of a major economic collapse, as the government may not be able to take the necessary steps to prevent it.

China's Global Impact

China's economic collapse would have a major impact on the global economy. China is the world's second-largest economy, and it is a major trading partner for many countries.

A Chinese economic collapse would lead to a sharp decline in global trade, which would have a major impact on economic growth around the world. It would also lead to a decline in commodity prices, which would have a major impact on countries that rely heavily on commodity exports.

Global Market Volatility

A Chinese economic collapse would also lead to a significant increase in global market volatility. This would make it more difficult for investors to make informed decisions, which could lead to a decline in investor confidence.

The global market volatility would also lead to a decline in the value of the yuan, which would make it more difficult for Chinese companies to repay their debts.

China's Economic Collapse Image Gallery

In conclusion, China's economic collapse is a major risk to the global economy. The country's debt problem, housing bubble, and lack of economic reforms are all major concerns. The global impact of a Chinese economic collapse would be significant, leading to a decline in global trade, commodity prices, and investor confidence. It is essential for policymakers and investors to be aware of these risks and to take steps to mitigate them.

We would love to hear your thoughts on this topic. Please leave a comment below and let us know what you think about China's economic collapse and its potential impact on the global economy.