Commercial real estate investing can be a lucrative venture, but it requires careful planning and analysis to ensure success. One of the most important tools in a commercial real estate investor's arsenal is a proforma template. A proforma template is a financial model that helps investors forecast the potential income and expenses of a commercial property, allowing them to make informed decisions about whether to invest.

In this article, we will explore the world of commercial real estate proforma templates, including what they are, why they are important, and how to create one. We will also provide tips and tricks for using a proforma template to analyze commercial real estate investments.

What is a Commercial Real Estate Proforma Template?

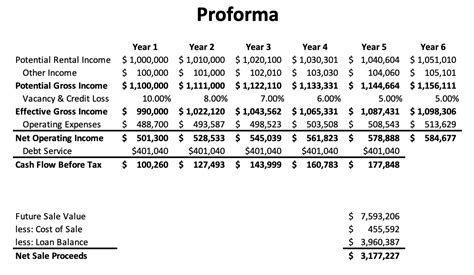

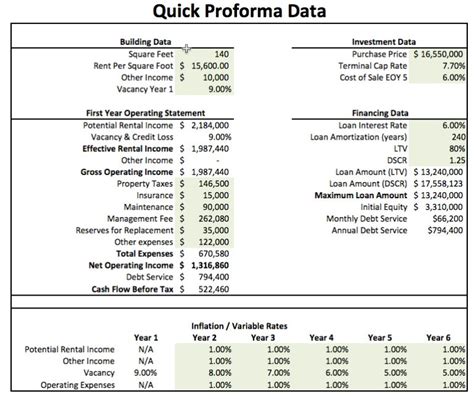

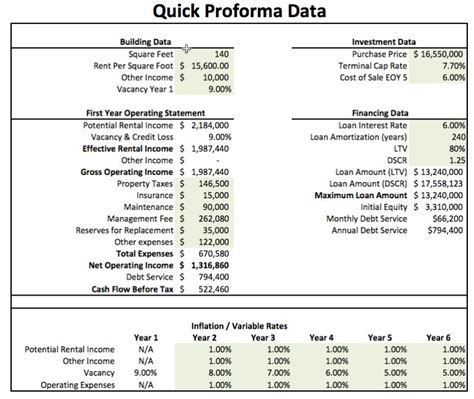

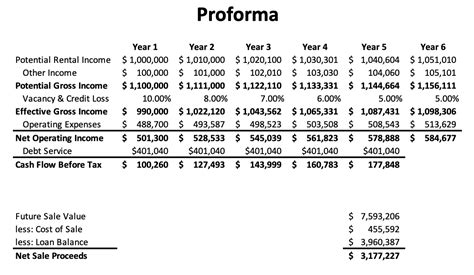

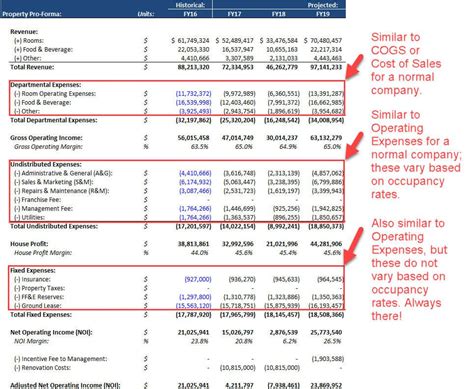

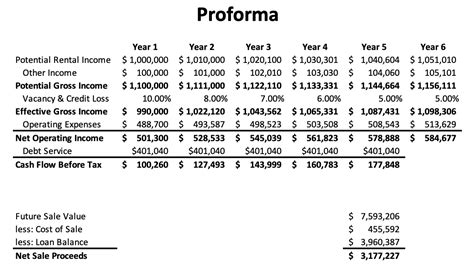

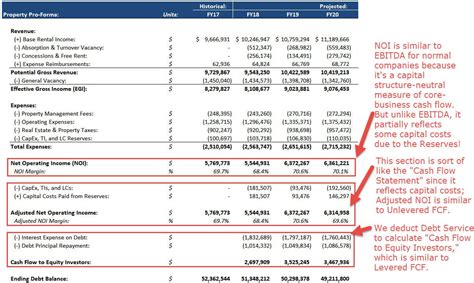

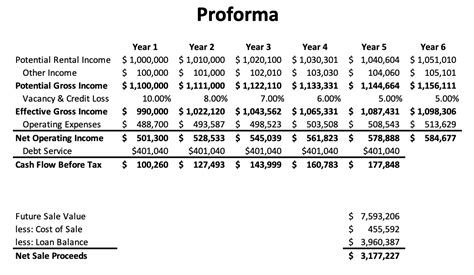

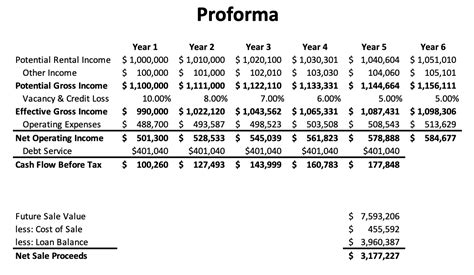

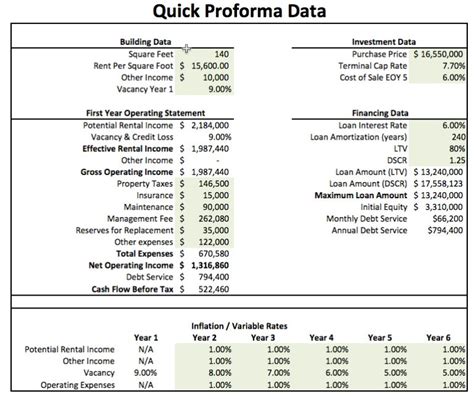

A commercial real estate proforma template is a financial model that is used to forecast the potential income and expenses of a commercial property. It is typically a spreadsheet that outlines the property's projected income, expenses, and cash flow over a specific period of time, usually 5-10 years. The proforma template takes into account various factors such as rental income, operating expenses, debt service, and capital expenditures to provide a comprehensive picture of the property's financial performance.

Why is a Proforma Template Important?

A proforma template is essential for commercial real estate investors because it allows them to evaluate the potential financial performance of a property before making a purchase. By using a proforma template, investors can:

- Forecast potential income and expenses

- Evaluate the property's cash flow and return on investment

- Identify potential risks and opportunities

- Compare different investment scenarios

- Make informed decisions about whether to invest

How to Create a Commercial Real Estate Proforma Template

Creating a commercial real estate proforma template can be a complex task, but it can be broken down into several steps. Here's a step-by-step guide to creating a proforma template:

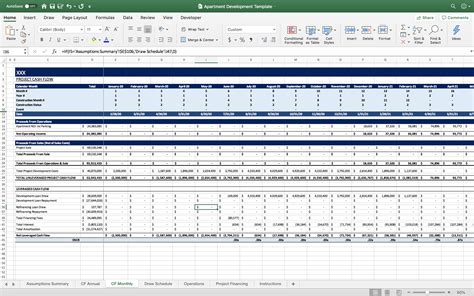

- Define the Property's Assumptions: Start by defining the property's assumptions, including the property type, location, size, and age. You should also define the investment goals and objectives.

- Gather Data: Gather data on the property's income and expenses, including rental income, operating expenses, debt service, and capital expenditures.

- Create a Spreadsheet: Create a spreadsheet that outlines the property's projected income and expenses over a specific period of time. Use formulas to calculate the property's cash flow and return on investment.

- Include Scenarios: Include different scenarios to evaluate the property's financial performance under different assumptions. For example, you may want to evaluate the property's performance under different interest rates or rental income scenarios.

- Review and Refine: Review and refine the proforma template to ensure that it accurately reflects the property's financial performance.

Tips and Tricks for Using a Proforma Template

Here are some tips and tricks for using a proforma template to analyze commercial real estate investments:

- Use Historical Data: Use historical data to estimate the property's income and expenses.

- Be Conservative: Be conservative when estimating the property's income and expenses.

- Evaluate Different Scenarios: Evaluate different scenarios to understand the property's financial performance under different assumptions.

- Review and Refine: Review and refine the proforma template regularly to ensure that it accurately reflects the property's financial performance.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using a proforma template:

- Overestimating Income: Overestimating income can lead to unrealistic expectations and poor investment decisions.

- Underestimating Expenses: Underestimating expenses can lead to poor investment decisions and financial losses.

- Not Evaluating Different Scenarios: Not evaluating different scenarios can lead to a lack of understanding of the property's financial performance under different assumptions.

Conclusion

A commercial real estate proforma template is a powerful tool for evaluating commercial real estate investments. By following the steps outlined in this article, you can create a comprehensive proforma template that helps you make informed investment decisions. Remember to use historical data, be conservative, evaluate different scenarios, and review and refine the proforma template regularly.

Commercial Real Estate Proforma Template Gallery

We hope this article has provided you with a comprehensive understanding of commercial real estate proforma templates and how to use them to analyze commercial real estate investments. If you have any questions or need further clarification, please don't hesitate to ask.