Intro

Unlock efficient commercial real estate underwriting with our comprehensive Excel template. Streamline your analysis with a standardized framework, covering key metrics such as debt service coverage ratio, loan-to-value ratio, and net operating income. Download our customizable template to simplify your underwriting process and make informed investment decisions.

Commercial real estate (CRE) underwriting is a critical process for lenders, investors, and other stakeholders to evaluate the potential risks and returns of a commercial property investment. An Excel template can be a valuable tool to streamline the underwriting process, ensuring consistency and accuracy. In this article, we'll explore the key components of a CRE underwriting template in Excel and provide a comprehensive guide to creating one.

Why Use a CRE Underwriting Template in Excel?

A CRE underwriting template in Excel offers several benefits, including:

- Standardization: A template ensures that all relevant data is collected and analyzed consistently, reducing errors and improving comparability across different properties.

- Efficiency: An Excel template automates many calculations, saving time and increasing productivity.

- Flexibility: A well-designed template can be easily modified to accommodate different property types, locations, and investment strategies.

- Transparency: A clear and organized template facilitates communication among stakeholders, promoting a deeper understanding of the investment's potential risks and rewards.

Key Components of a CRE Underwriting Template in Excel

A comprehensive CRE underwriting template in Excel should include the following sections:

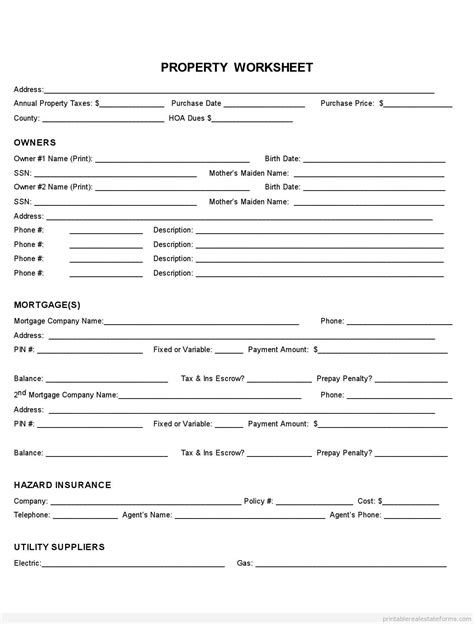

Property Information

- Property type (e.g., office, retail, multifamily, industrial)

- Location (city, state, zip code)

- Property size (square footage, number of units)

- Age and condition of the property

- Parking and amenities information

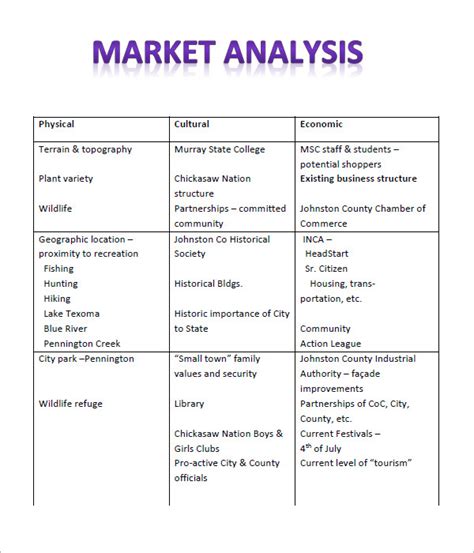

Market Analysis

- Overview of the local market conditions (supply, demand, rental rates)

- Competitive property analysis (comparable sales, leases)

- Market trends and forecasts

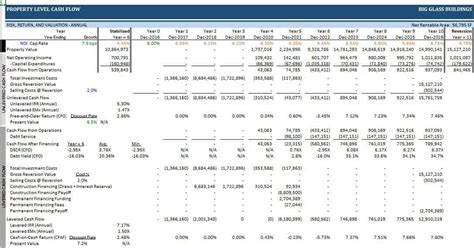

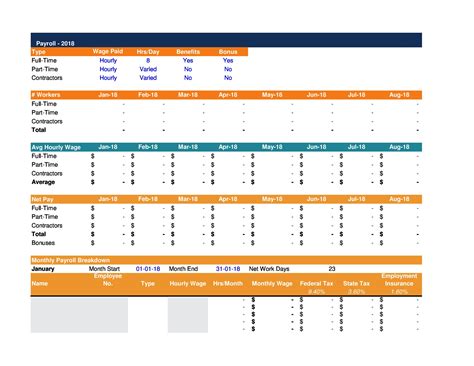

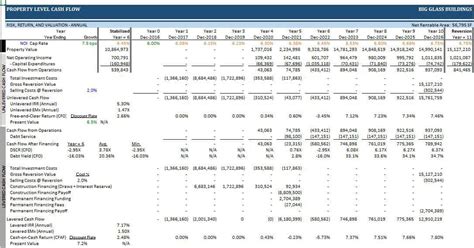

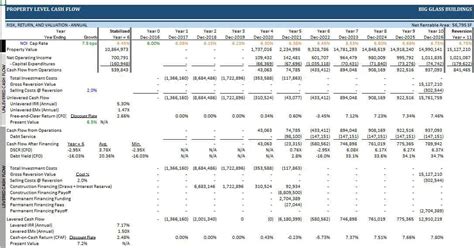

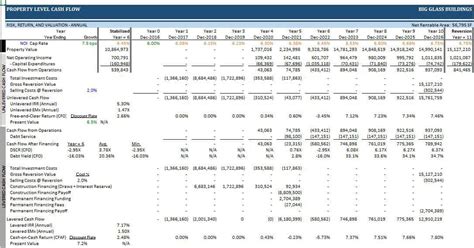

Financial Projections

- Income statement (rental income, expenses, net operating income)

- Cash flow statement (capital expenditures, debt service, net cash flow)

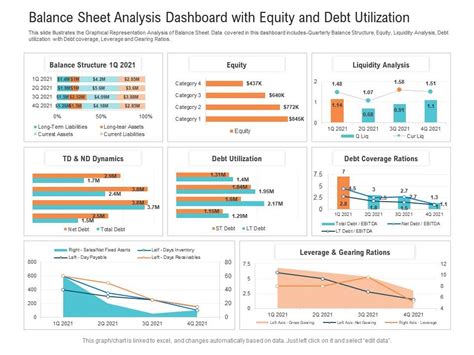

- Balance sheet (asset value, liabilities, equity)

Debt and Equity Analysis

- Loan terms (interest rate, amortization, maturity)

- Debt coverage ratio (DCR) and loan-to-value (LTV) analysis

- Equity requirements and returns (cash-on-cash, internal rate of return)

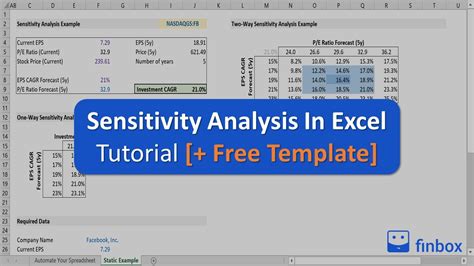

Sensitivity Analysis

- Sensitivity of net operating income (NOI) to changes in rental rates, expenses, and occupancy

- Sensitivity of cash flow to changes in capital expenditures, debt service, and interest rates

Conclusion and Recommendations

- Summary of key findings and investment highlights

- Recommendations for further analysis or due diligence

Creating a CRE Underwriting Template in Excel

To create a comprehensive CRE underwriting template in Excel, follow these steps:

- Set up a new Excel workbook with separate sheets for each section (Property Information, Market Analysis, Financial Projections, etc.).

- Create tables and formulas to collect and analyze data, using headers and footers to facilitate navigation.

- Use Excel functions (e.g., VLOOKUP, INDEX/MATCH) to automate calculations and reduce errors.

- Format cells and charts to enhance readability and visualization.

- Use conditional formatting to highlight key findings and trends.

- Create charts and graphs to illustrate market trends, financial performance, and sensitivity analysis.

- Use Excel's built-in functions (e.g., Scenario Manager, Goal Seek) to perform sensitivity analysis and what-if scenarios.

- Test and refine the template to ensure accuracy and consistency.

Gallery of CRE Underwriting Template Images

CRE Underwriting Template Image Gallery

Conclusion

A CRE underwriting template in Excel is a powerful tool for lenders, investors, and other stakeholders to evaluate the potential risks and returns of a commercial property investment. By following the steps outlined in this article, you can create a comprehensive template that streamlines the underwriting process, ensuring consistency and accuracy. Remember to test and refine your template to ensure it meets your specific needs and requirements.