Intro

Master the power of compound interest with Excel! Learn 5 ways to calculate compound interest daily, effortlessly tracking investments and savings. Discover formulas, functions, and spreadsheet hacks for calculating daily compound interest rates, future values, and more. Boost your financial planning with Excels compound interest calculator.

As an individual or business owner, understanding how to calculate compound interest is crucial for managing your finances effectively. Compound interest can help your savings grow exponentially over time, but it can also work against you if you're not careful. In this article, we'll explore five ways to calculate compound interest in Excel daily, helping you make the most of your financial planning.

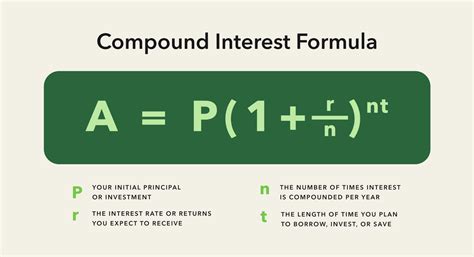

Understanding Compound Interest

Compound interest is the interest earned on both the principal amount and any accrued interest over time. It's a powerful tool for growing your savings, but it can also increase your debt if not managed properly. To calculate compound interest, you'll need to know the principal amount, interest rate, time period, and compounding frequency.

Key Components of Compound Interest

- Principal amount (P): The initial amount of money deposited or borrowed.

- Interest rate (r): The percentage rate at which interest is earned or charged.

- Time period (t): The length of time the money is invested or borrowed for.

- Compounding frequency (n): The number of times interest is compounded per year.

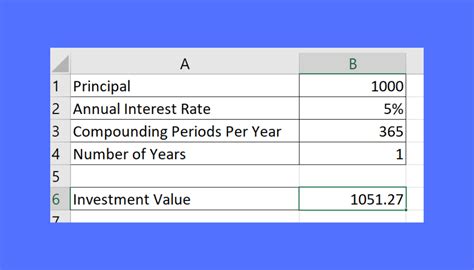

Method 1: Using the Compound Interest Formula

The compound interest formula is:

A = P (1 + r/n)^(nt)

Where: A = the future value of the investment/loan P = the principal amount r = the interest rate n = the compounding frequency t = the time period

To calculate compound interest in Excel using this formula, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Principal, Interest Rate, Time Period, Compounding Frequency, and Future Value.

- Enter the values for the principal amount, interest rate, time period, and compounding frequency.

- Use the formula =P*(1+r/n)^(n*t) to calculate the future value.

Example

| Principal | Interest Rate | Time Period | Compounding Frequency | Future Value |

|---|---|---|---|---|

| 1000 | 5% | 5 years | 12 | =1000*(1+0.05/12)^(12*5) |

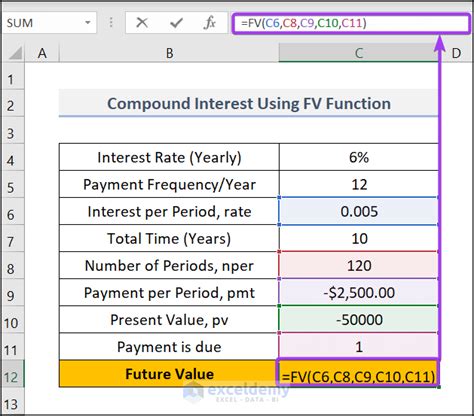

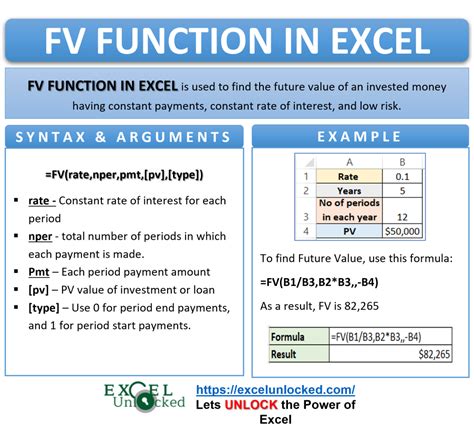

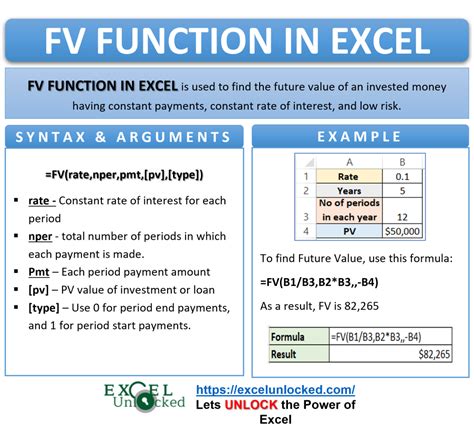

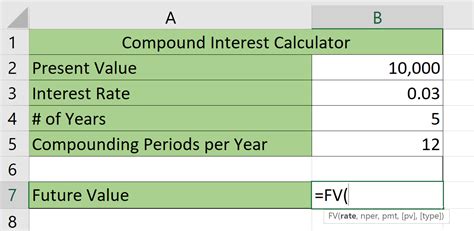

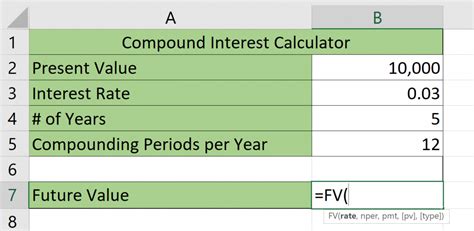

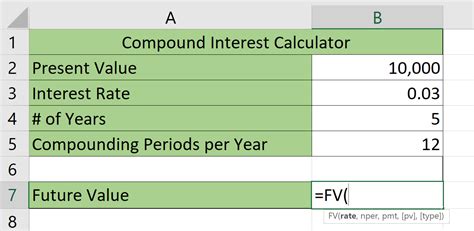

Method 2: Using the FV Function

The FV function in Excel calculates the future value of an investment based on a constant interest rate. To use the FV function, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Principal, Interest Rate, Time Period, and Future Value.

- Enter the values for the principal amount, interest rate, and time period.

- Use the formula =FV(r,n,P) to calculate the future value.

Example

| Principal | Interest Rate | Time Period | Future Value |

|---|---|---|---|

| 1000 | 5% | 5 years | =FV(0.05,5,-1000) |

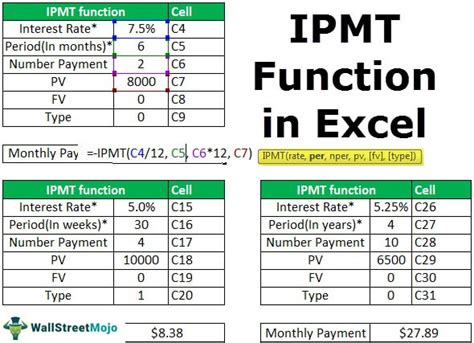

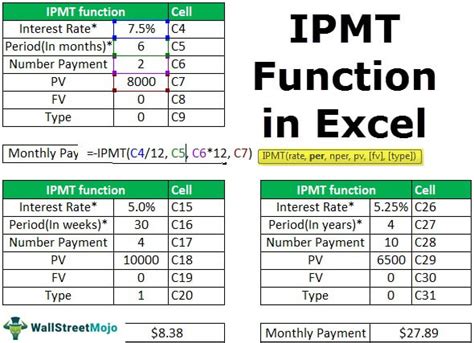

Method 3: Using the IPMT Function

The IPMT function in Excel calculates the interest portion of a loan payment based on a constant interest rate. To use the IPMT function, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Principal, Interest Rate, Time Period, and Interest Payment.

- Enter the values for the principal amount, interest rate, and time period.

- Use the formula =IPMT(r,n,P) to calculate the interest payment.

Example

| Principal | Interest Rate | Time Period | Interest Payment |

|---|---|---|---|

| 1000 | 5% | 5 years | =IPMT(0.05,5,1000) |

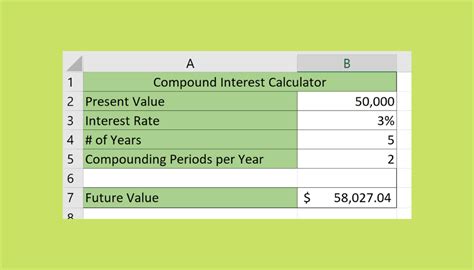

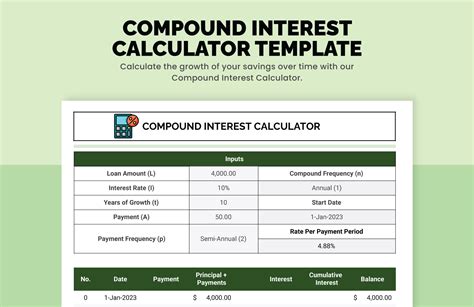

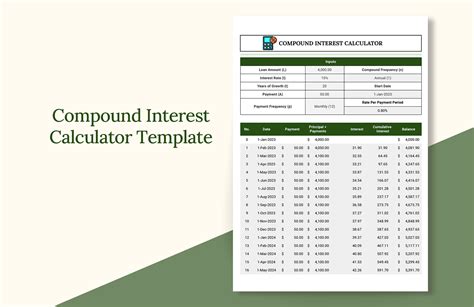

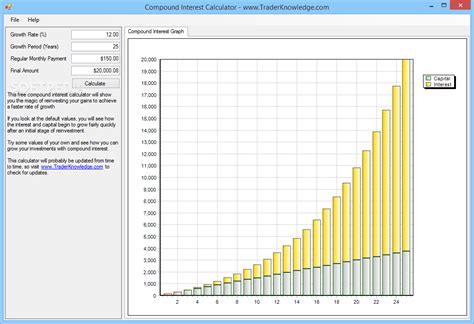

Method 4: Using a Compound Interest Calculator Template

You can use a pre-designed compound interest calculator template to simplify the calculation process. To use a template, follow these steps:

- Download a compound interest calculator template from a reputable source.

- Enter the values for the principal amount, interest rate, time period, and compounding frequency.

- The template will automatically calculate the future value.

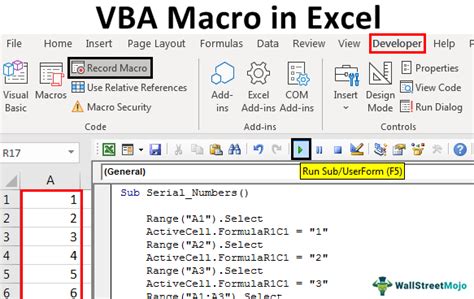

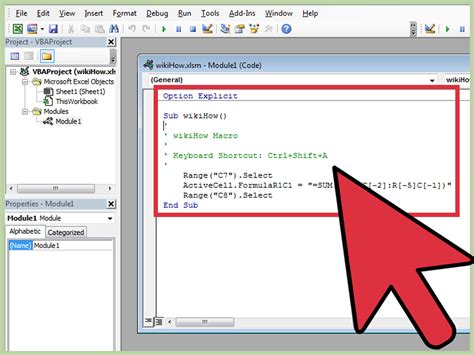

Method 5: Using a Macro

You can create a macro in Excel to automate the compound interest calculation process. To create a macro, follow these steps:

- Open a new Excel spreadsheet and create a table with the following columns: Principal, Interest Rate, Time Period, and Future Value.

- Enter the values for the principal amount, interest rate, and time period.

- Go to the Developer tab and click on the Macro button.

- Create a new macro and enter the formula =P*(1+r/n)^(n*t) to calculate the future value.

- Save the macro and run it to calculate the future value.

Gallery of Compound Interest Calculators

Compound Interest Calculators

We hope this article has provided you with a comprehensive understanding of how to calculate compound interest in Excel daily. Whether you're using the compound interest formula, FV function, IPMT function, a compound interest calculator template, or a macro, you can now make informed decisions about your financial planning. Remember to share this article with your friends and family to help them grow their savings and avoid debt.

If you have any questions or comments, please feel free to ask in the section below. We'd be happy to hear from you!