The concept of compound interest has been a cornerstone of personal finance and investing for centuries. It's a powerful force that can help your savings grow exponentially over time, but it can be daunting to understand and calculate. Luckily, with the help of Excel sheets, mastering compound interest has never been easier. In this article, we'll explore five ways to harness the power of compound interest using Excel sheets.

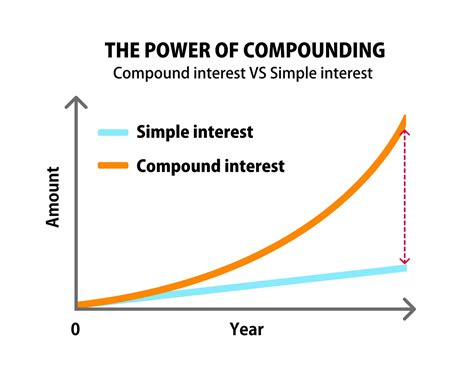

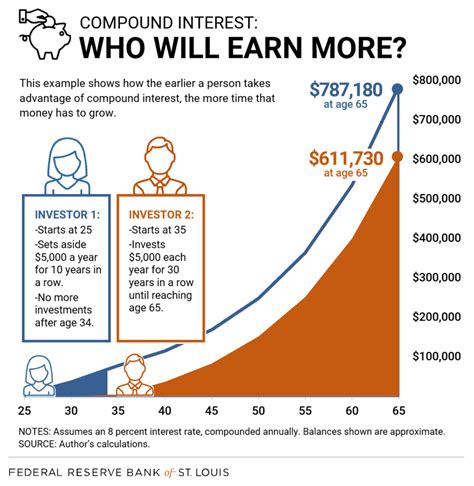

The Magic of Compound Interest

Compound interest is the process of earning interest on both the principal amount and any accrued interest over time. It's a snowball effect that can help your savings grow at an incredible rate. For example, if you deposit $1,000 into a savings account with a 5% annual interest rate, you'll earn $50 in interest in the first year. In the second year, you'll earn 5% interest on the new balance of $1,050, earning $52.50 in interest. As you can see, the interest earned in the second year is greater than the first year, even though the interest rate remains the same.

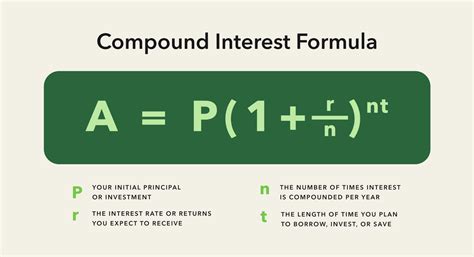

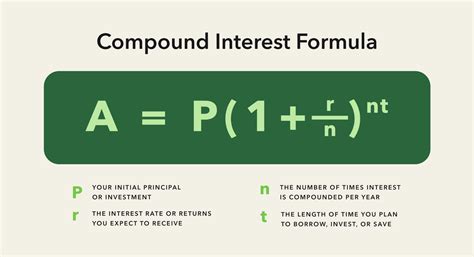

1. Understanding the Formula

Before we dive into the world of Excel sheets, it's essential to understand the formula behind compound interest. The formula is:

A = P x (1 + r/n)^(n*t)

Where:

- A = the future value of the investment

- P = the principal amount (the initial deposit)

- r = the annual interest rate (in decimal form)

- n = the number of times interest is compounded per year

- t = the number of years the money is invested

Using Excel to Calculate Compound Interest

Now that we have the formula, let's create an Excel sheet to calculate compound interest. Create a new Excel sheet and enter the following values:

| Cell | Value |

|---|---|

| A1 | Principal Amount |

| A2 | 1000 |

| A3 | Annual Interest Rate |

| A4 | 0.05 |

| A5 | Number of Times Interest is Compounded per Year |

| A6 | 1 |

| A7 | Number of Years |

| A8 | 10 |

In cell A9, enter the formula:

=A2 x (1 + A4/A6)^(A6*A8)

This will calculate the future value of the investment based on the inputs.

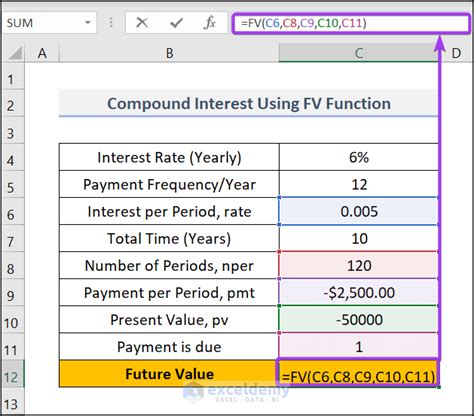

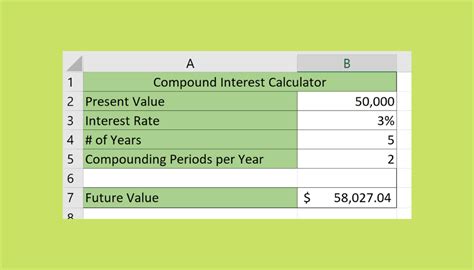

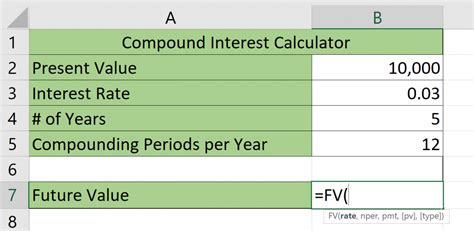

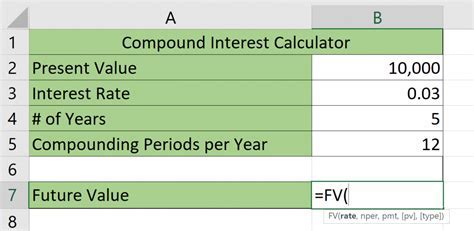

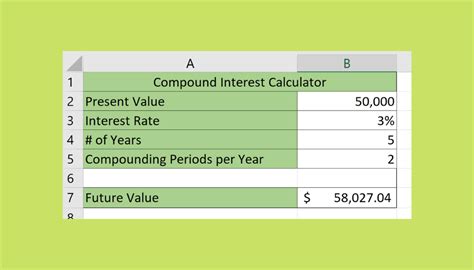

2. Creating a Compound Interest Calculator

While the formula is useful, it's not very user-friendly. Let's create a compound interest calculator using Excel's built-in functions.

Create a new Excel sheet and enter the following values:

| Cell | Value |

|---|---|

| A1 | Principal Amount |

| A2 | 1000 |

| A3 | Annual Interest Rate |

| A4 | 0.05 |

| A5 | Number of Times Interest is Compounded per Year |

| A6 | 1 |

| A7 | Number of Years |

In cell A8, enter the formula:

=FV(A4,A6,A7,-A2,0)

This will calculate the future value of the investment using the FV function.

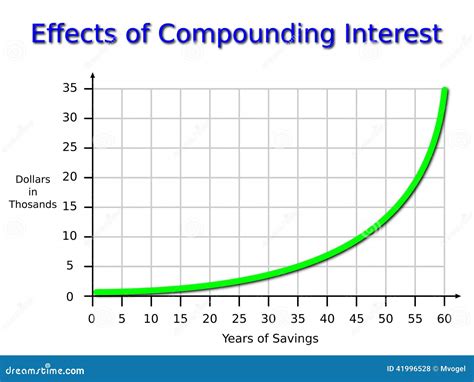

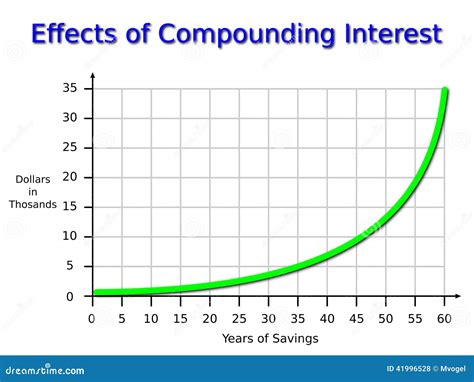

3. Visualizing Compound Interest with Charts

Compound interest can be difficult to understand, but visualizing it can help. Let's create a chart to illustrate the power of compound interest.

Create a new Excel sheet and enter the following values:

| Cell | Value |

|---|---|

| A1 | Year |

| A2 | 1 |

| A3 | 2 |

| A4 | 3 |

| ... | ... |

| A10 | 10 |

| B1 | Balance |

| B2 | =A2 x (1 + 0.05/1)^(1*1) |

| B3 | =A3 x (1 + 0.05/1)^(1*2) |

| B4 | =A4 x (1 + 0.05/1)^(1*3) |

| ... | ... |

| B10 | =A10 x (1 + 0.05/1)^(1*10) |

Select the data range A1:B10 and create a line chart to visualize the growth of the investment.

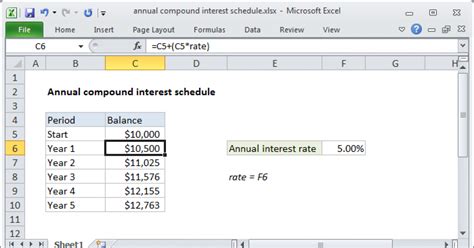

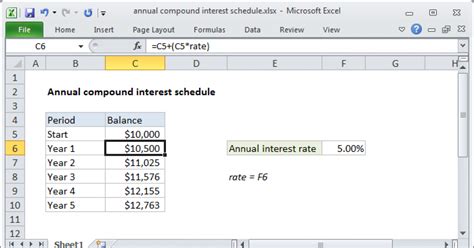

4. Creating a Compound Interest Schedule

A compound interest schedule can help you understand how your investment will grow over time. Let's create a schedule using Excel.

Create a new Excel sheet and enter the following values:

| Cell | Value |

|---|---|

| A1 | Year |

| A2 | 1 |

| A3 | 2 |

| A4 | 3 |

| ... | ... |

| A10 | 10 |

| B1 | Balance |

| B2 | =A2 x (1 + 0.05/1)^(1*1) |

| B3 | =A3 x (1 + 0.05/1)^(1*2) |

| B4 | =A4 x (1 + 0.05/1)^(1*3) |

| ... | ... |

| B10 | =A10 x (1 + 0.05/1)^(1*10) |

| C1 | Interest Earned |

| C2 | =B2 - A2 |

| C3 | =B3 - A3 |

| C4 | =B4 - A4 |

| ... | ... |

| C10 | =B10 - A10 |

Select the data range A1:C10 and create a table to visualize the schedule.

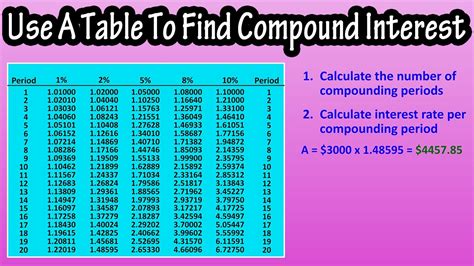

5. Automating Compound Interest Calculations

While the above methods are useful, they require manual input. Let's automate the compound interest calculations using Excel's built-in functions.

Create a new Excel sheet and enter the following values:

| Cell | Value |

|---|---|

| A1 | Principal Amount |

| A2 | 1000 |

| A3 | Annual Interest Rate |

| A4 | 0.05 |

| A5 | Number of Times Interest is Compounded per Year |

| A6 | 1 |

| A7 | Number of Years |

In cell A8, enter the formula:

=FV(A4,A6,A7,-A2,0)

This will calculate the future value of the investment using the FV function. You can then use the formula to automate the calculations for different scenarios.

Gallery of Compound Interest

Compound Interest Image Gallery

Take the Next Step

Mastering compound interest with Excel sheets can help you make informed decisions about your investments and savings. By following the five methods outlined above, you'll be able to calculate compound interest, create a compound interest calculator, visualize compound interest with charts, create a compound interest schedule, and automate compound interest calculations. Take the next step and start using Excel to harness the power of compound interest today!