Intro

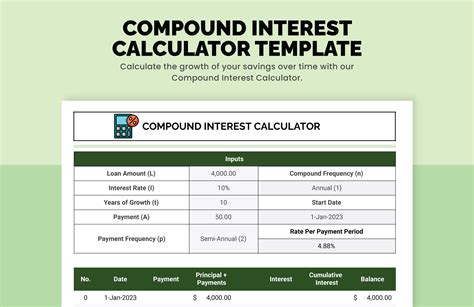

Unlock the power of compound interest with our easy-to-use Excel template. Learn how to calculate compound interest with our simple and effective spreadsheet solution. Discover the benefits of compound interest, how to use our template, and optimize your savings with our expert guide to Excel compound interest calculators.

Calculating compound interest can be a complex and time-consuming process, but with an Excel compound interest calculator template, you can simplify the process and get accurate results quickly. In this article, we will explore the importance of compound interest, how it works, and provide a step-by-step guide on creating an Excel compound interest calculator template.

Compound interest is a powerful financial tool that can help you grow your savings and investments over time. It is the interest earned on both the principal amount and any accrued interest over time. Compound interest can be applied to various financial products, including savings accounts, certificates of deposit (CDs), and investments. Understanding how compound interest works is essential to making informed financial decisions.

How Compound Interest Works

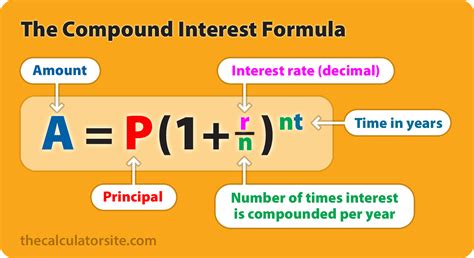

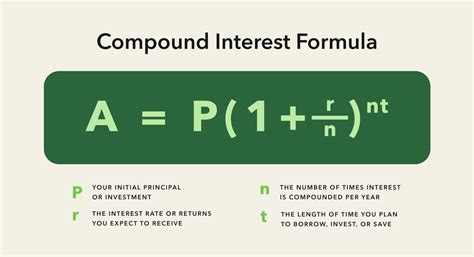

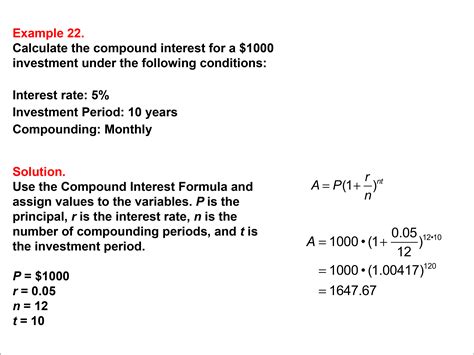

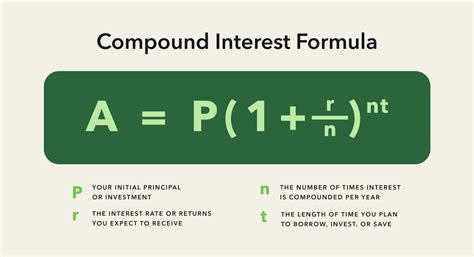

Compound interest is calculated using the following formula:

A = P (1 + r/n)^(nt)

Where: A = the future value of the investment/loan, including interest P = principal investment amount (the initial deposit or loan amount) r = annual interest rate (in decimal form - e.g. 4% = 0.04) n = number of times that interest is compounded per year t = time the money is invested or borrowed for, in years

For example, if you deposit $1,000 into a savings account with a 4% annual interest rate compounded monthly, the interest rate per period would be 0.04/12 = 0.003333. After one year, the total amount in the account would be:

A = $1,000 (1 + 0.003333)^12 ≈ $1,043.04

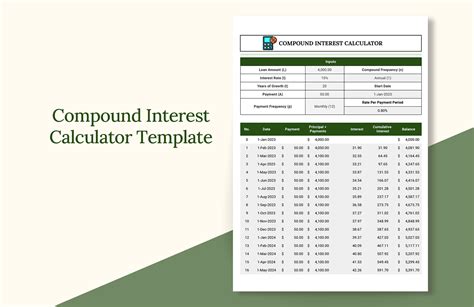

Benefits of Using an Excel Compound Interest Calculator Template

Using an Excel compound interest calculator template offers several benefits, including:

- Easy to use: Simply input the principal amount, interest rate, compounding frequency, and time, and the template will calculate the compound interest for you.

- Accurate results: The template eliminates the risk of human error, ensuring accurate calculations.

- Time-saving: The template saves you time and effort, allowing you to focus on other important tasks.

- Flexibility: You can customize the template to suit your specific needs and scenarios.

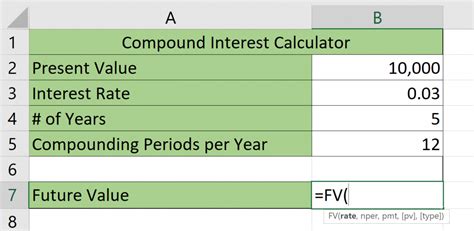

Creating an Excel Compound Interest Calculator Template

To create an Excel compound interest calculator template, follow these steps:

- Open a new Excel workbook and create a table with the following columns:

- Principal Amount

- Interest Rate

- Compounding Frequency

- Time

- Compound Interest

- Enter the formula for compound interest in the Compound Interest column:

=A2*(1+B2/C2)^(C2*D2)- A2 is the principal amount

- B2 is the interest rate

- C2 is the compounding frequency

- D2 is the time

- Format the cells to display the results in a clear and readable format.

- Test the template by inputting sample values and verifying the results.

Example Use Cases for an Excel Compound Interest Calculator Template

Here are some example use cases for an Excel compound interest calculator template:

- Savings account: Calculate the compound interest earned on a savings account over a specified period.

- Investment: Determine the compound interest earned on an investment over a specified period.

- Loan: Calculate the compound interest paid on a loan over a specified period.

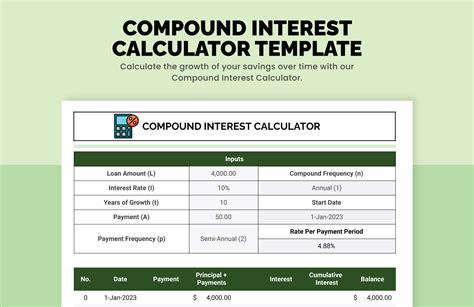

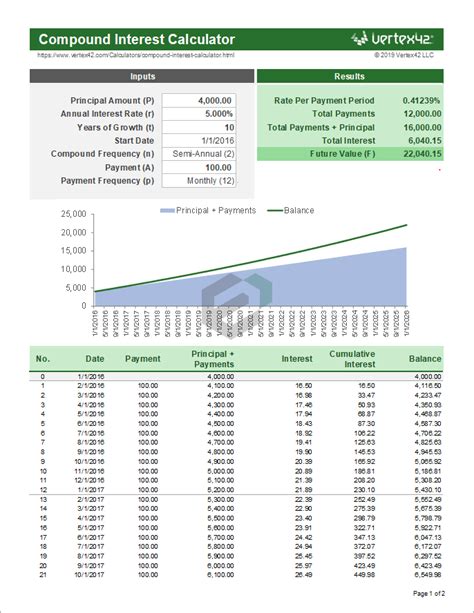

Gallery of Compound Interest Templates

Compound Interest Calculator Template Gallery

In conclusion, creating an Excel compound interest calculator template is a simple and effective way to simplify complex financial calculations. By following the steps outlined in this article, you can create a template that suits your specific needs and scenarios. Whether you're a student, a financial analyst, or simply someone looking to manage your finances effectively, an Excel compound interest calculator template is a valuable tool to have in your toolkit.

We hope this article has provided you with a comprehensive understanding of compound interest and how to create an Excel compound interest calculator template. If you have any questions or comments, please feel free to share them in the section below.